FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

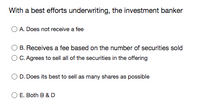

Transcribed Image Text:With a best efforts underwriting, the investment banker

O A. Does not receive a fee

B. Receives a fee based on the number of securities sold

O C. Agrees to sell all of the securities in the offering

D. Does its best to sell as many shares as possible

E. Both B & D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3. Consider the following two statements concerning share issues: Statement (1): Retained profits are a free source of finance to a business. Statement (2): Investors normally view loan notes as being riskier than preference shares. Which one of the following combinations (true/false) relating to the above statements is correct? a. Both of the statements are true. b. Both of the statements are false. c. Statement (1) is true, Statement (2) is false. d. Statement (1) is false, Statement (2) is true.arrow_forwardGive typing answer with explanation and conclusion What is the benefit to a company from a securities underwriter? A) They generate demand for a company’s securities by giving them a strong credit rating B) They help companies to receive a premium on the sale of their securities C) They study the market and advise companies on where to set their IPO share price D) They help companies to reduce the risk associated with an IPOarrow_forwardWhich of the following statement is true? a. In brokered markets, buyers and sellers confront each other directly and bargain over price. b. Primary market is the market for trading outstanding securities. c. Preference shareholders have a higher priority claim on company’s assets than ordinary shareholders in the event of insolvency. d. Ordinary shareholders receive fixed dividend payments.arrow_forward

- To the extent that shares sold during an IPO are discounted from their appropriate price, the proceeds that the issuing firm receives from the IPO are lower than it deserves. Question 21 options: True Falsearrow_forwardWith firm commitment underwriting, the investment banker O A. purchases all of the shares of stock from the company and then sells them to the investing public O B. does it best to sell as many securities as possible O C. receives a fee for each security sold O D. All things being equal, the issuing company (going public) would prefer the firm commitment basis since this assures from the that all of the shares are sold. O E. Both A & Darrow_forwardA benefit of issuing corporate bonds instead of common stock is: Group of answer choices they do not need to be repaid interest must be paid periodically no cash will be raised there is no loss of ownershiparrow_forward

- help - only answer is okarrow_forwardIn the primary market, the initial time given offers to be public, in financial exchange is considered as? A. Initial Public Offering B. Trade C. Share D. Issuance Offering Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardA best efforts underwriting is a situation where: Question 31Answer a. An underwriter buys securities from an issuer and reoffers them to the public at a higher price. b. An underwriter commits to securing 100% market acceptance of a securities issue. c. The issuer receives all the proceeds from a market issue. d. The underwriter act as an agent of the issuer in marketing the securities to investorsarrow_forward

- 2. Which of the following is a characteristic of preferred stock?A. Give voting rights to its owner.B. It is like annuity.C. Investors cannot force the payment of the dividend.D. Dividends are tax-deductible for the firm as opposed to interest payment.arrow_forwardWhich of the following is INCORRECT description for private equity transactions? Group of answer choices a. There are liquid public markets for privately held securities such as NASDAQ. b. The process of creating value in private equity, whether building a brand-new company or turning around an established one requires significant time and means a long-term relationship. c. The general partner participates actively in the governance of the investment d. Private equity investing is a lot of work as gaining access to better opportunities requires active sourcing and negotiationarrow_forwardF1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education