Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

12-1. Operating cash flows rather than accounting income are listed in Table 12.1. Why do we focus on cash flows as opposed to net income in capital budgeting?

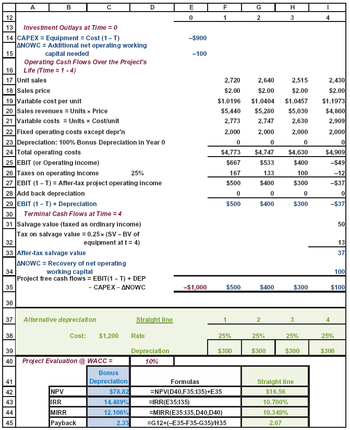

Transcribed Image Text:B

E

F

G

H

0

1

2

3

4

12

13

Investment Outlays at Time = 0

14 CAPEX Equipment = Cost (1-T)

ANOWC Additional net operating working

capital needed

Operating Cash Flows Over the Project's

15

16

Life (Time = 1-4)

17 Unit sales

-$900

-100

2,720

2,640

2,515

2,430

18 Sales price

19 Variable cost per unit

20 Sales revenues = Units x Price

$2.00

$2.00

$2.00

$2.00

$1.0196

$1.0404 $1.0457

$1.1973

$5,440

$5,280 $5,030

$4,860

21 Variable costs = Units × Cost/unit

2,773

2,747

2,630

2,909

22 Fixed operating costs except depr'n

2,000

2,000

2,000

2,000

23 Depreciation: 100% Bonus Depreciation in Year 0

0

0

0

0

24 Total operating costs

$4,773

$4,747

$4,630

$4,909

25 EBIT (or Operating income)

$667

$533

$400

-$49

26 Taxes on operating income

25%

167

133

100

-12

27 EBIT (1-T) After-tax project operating income

$500

$400

$300

-$37

28 Add back depreciation

0

0

0

0

29 EBIT (1-T)+ Depreciation

$500

$400

$300

-$37

30

Terminal Cash Flows at Time = 4

31 Salvage value (taxed as ordinary income)

32

Tax on salvage value = 0.25x (SV - BV of

equipment at t=4)

33 After-tax salvage value

34

ANOWC = Recovery of net operating

working capital

Project free cash flows = EBIT(1-T) + DEP

35

36

-

CAPEX-ANOWC

50

50

13

37

100

-$1,000

$500

$400

$300

$100

37

Alternative depreciation

Straight line

2

3

4

38

Cost: $1,200

Rate

25%

25%

25%

25%

39

40

Project Evaluation @ WACC=

Depreciation

10%

$300

$300

$300

$300

41

Bonus

Depreciation

Formulas

Straight line

42

NPV

$78.82

=NPV(D40,F35:135)+E35

$16.56

43

IRR

14.489%

=IRR(E35:135)

10.700%

44

MIRR

12.106%

=MIRR(E35:135,D40, D40)

10.349%

45

Payback

2.33

=G12+(-E35-F35-G35)/H35

2.67

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Net present value Using a cost of capital of 12%, calculate the net present value for the project shown in the following table and indicate whether it is acceptable, The net present value (NPV) of the project is $ (Round to the nearest cent.) xt Librai alculat esource Enter your answer in the answer box and then click Check Answer. Study 1 part remaining Check Answer Clear All ication Tools > Type here to searcharrow_forwardHelp pls stepwisearrow_forwardY9arrow_forward

- Engineered Supplies Inc. has over the past two years been been seriously consideing whether to expand its manufacturing line (the "project"). The company is under pressure to increase its size in order to meet the growth aspirations of its shareholders.The following information is provided: $'000s 1 Estimated start of project Immediate 2 Cost of new line, including installation - payable 50% at beginning of project and balance at end of year 1 750,000 3 Start up of production Start of Year 2 4 Esitimated EBIT of new line per year 200,000 5 Cost of feasibilty study for this new line which was paid during this past year whilst considering investment 500 Tax and accounting depreciation will be straight line over 12 years with no salvage value in the calculation 7 Estimated disposal value for this line from a potential buyer seeking it after 10 years of use. The company feels that it will most likely sell the line after 10 years of use. 90,000 8 Estimated raw material & finished goods…arrow_forwardkararrow_forwardplease answerarrow_forward

- Coffer Company is analyzing two potential investments. Cost of machine Project X $ 97,090 Net cash flow: Year 1 Year 2 Year 3 Year 4 Project Y $ 72,000 36,500 3,700 36,500 33,500 36,500 33,500 0 13,000 If the company is using the payback period method, and it requires a payback period of three years or less, which project(s) should be selected? Multiple Choice ○ Project Y. ○ Project X. Both X and Y are acceptable projects. Neither X nor Y is an acceptable project. Project Y because it has a lower Initial Investment.arrow_forwardWhat is the degree of pretax cash flow operating leverage (cash flow DOL) Revenue $250000 variable costs $162500 fixed costs $40000 EBITDA $47500arrow_forwardInitial Equipment $65,000 Project Life 3 Years Sales $55,000 Variable Costs $25,000 Fixed Costs $ 10,000 Tax rate 26% Cost of Capital 10% Ending Book Value $10,000 Sales Price at Year 3 $5,000 Net Working Capital $10,000 CALCULATE THE INITIAL COSTS, CALCULATE THE OPERATING CASH FLOW, CALCULATE THE TERMINAL NON OPERATING CASH FLOW, CALCULATE THE NPV. please show your work and formulus for the answersarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education