FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

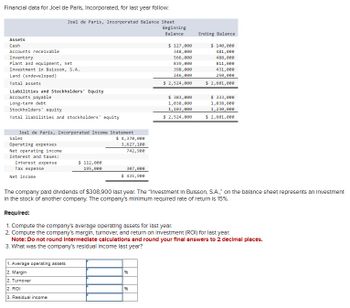

Transcribed Image Text:Financial data for Joel de Paris, Incorporated, for last year follow.

Joel de Paris, Incorporated Balance Sheet

Assets

Cash

Accounts receivable

Beginning

Balance

$ 127,000

348,000

Ending Balance

$ 140,000

481,000

Inventory

Plant and equipment, net

Investment in Buisson, S.A.

Land (undeveloped)

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Long-term debt

Stockholders' equity

Total liabilities and stockholders' equity

566,000

839,000

398,000

246,000

$ 2,524,000

488,000

811,000

431,000

250,000

$ 383,000

1,038,000

1,103,000

$ 2,524,000

$ 2,601,000

$ 333,000

1,038,000

1,230,000

$ 2,601,000

Joel de Paris, Incorporated Income Statement

$ 4,370,000

Sales

Operating expenses

Net operating income

Interest and taxes:

Interest expense

Tax expense

Net income

$ 112,000

195,000

3,627,100

742,900

307,000

$ 435,900

The company paid dividends of $308,900 last year. The "Investment In Buisson, S.A.," on the balance sheet represents an Investment

In the stock of another company. The company's minimum required rate of return is 15%.

Required:

1. Compute the company's average operating assets for last year.

2. Compute the company's margin, turnover, and return on Investment (ROI) for last year.

Note: Do not round Intermediate calculations and round your final answers to 2 decimal places.

3. What was the company's residual Income last year?

1. Average operating assets

2. Margin

2. Turnover

2. ROI

3. Residual income

%

96

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please answer all requirementsarrow_forwardCategory Accounts payable Accounts receivable Accruals Additional paid in capital Cash Common Stock COGS Current portion long-term debt Depreciation expense Interest expense Inventories Long-term debt Net fixed assets Notes payable Operating expenses (excl. depr.) Retained earnings Sales Taxes Prior Year Current Year ??? ??? 320,715 397,400 40,500 33,750 500,000 541,650 17,500 47,500 94,000 105,000 328,500 431,876.00 33,750 35,000 54,000 54,402.00 40,500 42,823.00 279,000 288,000 339,660.00 398,369.00 946,535 999,000 148,500 162,000 126,000 162,881.00 306,000 342,000 639,000 847,928.00 24,750 47,224.00 What is the current year's return on assets (ROA)? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))arrow_forwardCategory Accounts payable Accounts receivable Accruals Additional paid in capital Cash Common Stock COGS Current portion long-term debt Depreciation expense Interest expense Inventories Long-term debt Net fixed assets Notes payable Operating expenses (excl. depr.) Retained earnings Sales Taxes Prior Year Current Year 3,106.00 5,972.00 6,919.00 8,940.00 5,691.00 6,099.00 20,212.00 13,343.00 ??? ??? 2,850 18,751.00 500 2,850 22,826.00 500 965.00 1,016.00 1,259.00 1,123.00 3,086.00 6,750.00 16,982.00 22,296.00 75,731.00 73,844.00 4,053.00 6,596.00 19,950 20,000 35,937.00 34,762.00 46,360 45,530.00 350 920 What is the firm's cash flow from operations? Submit Answer format: Number: Round to: 0 decimal places.arrow_forward

- ABC Industry and Trade Inc. Balance Sheet as of 31.12.2020 (TL) transactions ASSETS(Assets) I-Current Assets Ready Values Securities Commercial debts Stocks Other Current Assets Current Assets Total I-Fixed Assets Financial Fixed Assets Tangible Fixed Assets Total Fixed Assets TOTAL ASSETS 31.12.2020 Amount Vertical Percent (%) 360.000 12 45.000 1.5 870.000 29 840.000 28 255.000 8.5 2.370.000 79 390.000 13 240.000 8. 630.000 21 3.000.000 100 LIABILITIES(RESOURCES) l-Short Term Liv. resources Financial Debts Trade payables Short Term Foreign Resource Total Il-Long-Term Liabilities Financial Debts Long Term Liv. Source Ball. III-Equity Paid-in capital Profit Reserves Net profit for the period Previous Year's profit Total Equity TOTAL LIABILITIES (RESOURCES) 39.000 1.3 120.000 4 159.000 5.3 81.000 2.7 81.000 2.7 120.000 4 420.000 14 1.950.000 65 270.000 9 2.760.000 92 3.000.000 100 Requested: Calculate the vertical percentages of the Balance Sheet items of ABC Sanayi ve Ticaret A.Ş. dated…arrow_forwardI need full answers pleasearrow_forwardFinancial data for Joel de Paris, Incorporated, for last year follow: Joel de Paris, Incorporated Balance Sheet Beginning Balance Ending Balance Assets Cash Accounts receivable Plant and equipment, net Inventory Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity $ 131,000 346,000 568,000 815,000 396,000 250,000 $ 374,000 993,000 1,139,000 $ 2,506,000 $ 129,000 471,000 470,000 830,000 430,000 246,000 $ 2,576,000 $ 336,000 993,000 1,247,000 $ 2,576,000 $ 2,506,000 Joel de Paris, Incorporated Income Statement Sales Operating expenses Interest and taxes: Net operating income Interest expense Tax expense Net income $ 116,000 199,000 4,324,000 3,761,880 562,120 315,000 $ 247,120 The company paid dividends of $139,120 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an Investment in the stock of another company. The…arrow_forward

- answer in detail with introduction explanation, computation, steps answer in text formarrow_forwardThe balance sheet for Baird Corporation follows: Current assets Long-term assets (net) Total assets Current liabilities Long-term liabilities Total liabilities Common stock and retained earnings Total liabilities and stockholders' equity Required Compute the following. Note: Round "Ratios" to 1 decimal place. Working capital Current ratio Debt-to-assets ratio Debt-to-equity ratio % $ 248,000 751,000 $ 999,000 $ 142,000 456,000 598,000 401,000 $ 999,000arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- Finding operating and free cash flows Consider the balance sheets and selected data from the income statement of Keith Corporation that follow a. Calculate the firm's net operating profit after taxes (NOPAT) for this year. b. Calculate the firm's operating cash flow (OCF) for the year. c. Calculate the firm's free cash flow (FCF) for the year. d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c). a. The net operating profit after taxes is $ (Round to the nearest dollar.)arrow_forwardCalculate the following for Co. XYZ: c. Average collection period (365 days) d. Times interest earned Assets: Cash and marketable securities $400,000Accounts receivable 1,415,000Inventories 1,847,500Prepaid expenses 24,000Total current assets $3,686,500Fixed assets 2,800,000Less: accumulated depreciation 1,087,500Net fixed assets $1,712,500Total assets $5,399,000Liabilities: Accounts payable $600,000Notes payable 875,000Accrued taxes Total current liabilities $1,567,000Long-term debt 900,000Owner's equity Total liabilities and owner's equity Co. XYZ Income Statement: Net sales (all credit) $6,375,000Less: Cost of goods sold 4,375,000Selling and administrative expense 1,000,500Depreciation expense 135,000Interest expense Earnings before taxes $765,000Income taxes Net income Common stock dividends $230,000Change in retained earningsarrow_forwardCh: Analyzing Financial Statements The current year financial statement for sand and Juffair companies are presented below. Balance sheet at 31 Dec 2019 Item Cash Account receivable (net) Inventory Property & equipment (net) Other assets Total assets Current liabilities Long-term debt (interest rate: 10%) Capital stock ($10 par value) Additional paid-in capital Retained earnings Total liabilities and stockholders' equity Income statement at 31 Dec 2019 item Sales revenue (1/3 on credit) (-) Cost of goods sold (-) Operating expenses Net income Other data item Per share stock price at end of current year Average income tax rate Dividends declared and paid in current year Sand 45000 45000 95000 160000 90000 435000 95000 75000 155000 40000 70000 435000 Sand 440000 230000 159000 51000 Sand 23 30% 34000 Juffair 22000 35000 45000 415000 320000 837000 65000 65000 522000 110000 75000 837000 Juffair 800000 399000 315000 86000 Juffair 25 30% 153000 Both companies are in the fish catching and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education