FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

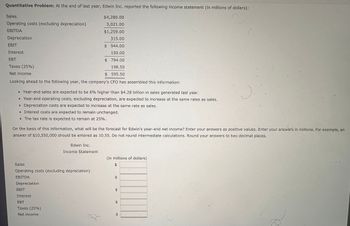

Transcribed Image Text:Quantitative Problem: At the end of last year, Edwin Inc. reported the following income statement (in millions of dollars):

Sales

Operating costs (excluding depreciation)

EBITDA

Depreciation

$4,280.00

3,021.00

$1,259.00

315.00

$944.00

150.00

$ 794.00

198.50

595.50

Looking ahead to the following year, the company's CFO has assembled this information:

EBIT

Interest

EBT

Taxes (25%).

Net income

Year-end sales are expected to be 6% higher than $4.28 billion in sales generated last year.

▪ Year-end operating costs, excluding depreciation, are expected to increase at the same rates as sales.

Depreciation costs are expected to increase at the same rate as sales.

Interest costs are expected to remain unchanged.

▪ The tax rate is expected to remain at 25%.

On the basis of this information, what will be the forecast for Edwin's year-end net income? Enter your answers as positive values. Enter your answers in millions. For example, an

answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places.

Edwin Inc.

Income Statement

Sales

Operating costs (excluding depreciation)

EBITDA

Depreciation

EBIT

Interest

EBT

Taxes (25%)

Net income

$

1

(in millions of dollars)

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ast year Triangular Resources earned $5.4 million in net operating income and had an operating profit margin of 19.3 percent. If the firm's total asset turnover ratio was 1.59, what was the firm's investment in total assets?arrow_forwardSix Measures of Solvency or Profitability The following data were taken from the financial statements of Loveseth Inc. for the current fiscal year. Property, plant, and equipment (net) $1,239,600 Liabilities: Current liabilities $206,000 Note payable, 6%, due in 15 years 1,033,000 Total liabilities $1,239,000 Stockholders' equity: Preferred $4 stock, $100 par (no change during year) $929,250 Common stock, $10 par (no change during year) 929,250 Retained earnings: Balance, beginning of year $992,000 Net income 396,000 $1,388,000 Preferred dividends $37,170 Common dividends 111,830 149,000 Balance, end of year 1,239,000 Total stockholders' equity $3,097,500 Sales $28,329,275 Interest expense $61,980arrow_forwardYour company has net sales revenue of $43 million during the year. At the beginning of the year, fixed assets are $15 million. At the end of the year, fixed assets are $17 million. What the fixed asset turnover ratio? Multiple Choice 2.87 1.34 2.53 269arrow_forward

- Swiss Group reports net income of $39,000 for the year. At the beginning of the year, Swiss Group had $195,000 in assets. By the end of the year, assets had grown to $245,000. What is Swiss Group's return on assets for the current year? Did Swiss Group perform better or worse than its competitors if competitors average an 13% return on assets? Complete this question by entering your answers in the tabs below. Return on Assets Group Perform What is Swiss Group's return on assets for the current year? Numerator: Denominator:arrow_forwardAMT. Inc.'s net income for this quarter is $500,000. The publicized return on assets (ROA) is 34.5 % . Estimate the firm's total asset to the closet possible. a. $1,500,000 c. $2,450,000 b. $ 1,450,000 d. $2,005,500arrow_forwardA. Income StatementAt the end of the last year, King Power Company achieved $6 million in income (EBITDA). Depreciation expense was $1.2 million, interest expense was $800,000 and the corporate tax rate was 35%. At the end of the fiscal year the company had current assets totaling $12 million, $4 million in accounts payable, $1.5 million in accrued liabilities, $1.3 million in other payables, and $8 million in property, plant, and equipment. Assume that King Power has no excess cash, uses debt and equity to finance its operations, has no current liabilities, and recognizes depreciation periodically. Determine the company's net income or loss. Explain how this result can help the manager in making decisions in the company.2. Calculate net and operating working capital. Explain the difference between the two results.3. If the company had $6 million in property, plant, and equipment in the previous year and net operating working capital remained constant, what is the company's available…arrow_forward

- Solve this practice problemarrow_forward14. Briggs Company has operating income of $33,516, invested assets of $133,000, and sales of $478,800. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin ____ % b. Investment turnover ____ c. Return on investment ____ %arrow_forwardplease provide answer with calculatinoarrow_forward

- Help sir fasttarrow_forwardGibson Corporation’s balance sheet indicates that the company has $580,000 invested in operating assets. During the year, Gibson earned operating income of $67,280 on $1,160,000 of sales. Required Compute Gibson’s profit margin for the year. Compute Gibson’s turnover for the year. Compute Gibson’s return on investment for the year. Recompute Gibson’s ROI under each of the following independent assumptions:(1) Sales increase from $1,160,000 to $1,392,000, thereby resulting in an increase in operating income from $67,280 to $76,560.(2) Sales remain constant, but Gibson reduces expenses, resulting in an increase in operating income from $67,280 to $69,600.(3) Gibson is able to reduce its invested capital from $580,000 to $464,000 without affecting operating income.arrow_forwardProvide Answer for this Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education