FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:55

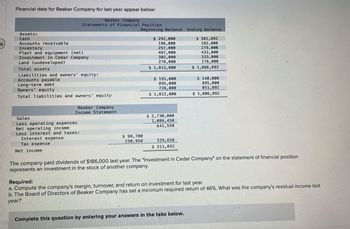

Financial data for Beaker Company for last year appear below:

Beaker Company

Statements of Financial Position

Beginning Balance

Assets:

Cash

Accounts receivable

Inventory

Plant and equipment (net)

Investment in Cedar Company

Land (undeveloped)

Total assets

Liabilities and owners' equity:

Accounts payable

Long-term debt

Owners equity

Total liabilities and owners' equity

Beaker Company

Income Statement

Sales

Less operating expenses

Net operating income

Less interest and taxes:

Interest expense

Tax expense

Net income

$ 98,700

230,958

$ 292,000

196,000

257,000

487,000

302,000

278,000

$1,812,000

$191,000

895,000

726,000

$ 1,812,000

$ 2,730,000

2,088,450

641,550

329,658

$ 311,892

Ending Balance

$ 381,892

182,000

279,000

433,000

333,000

278,000

$1,886,892

Complete this question by entering your answers in the tabs below.

$ 140,000

895,000

851,892

$ 1,886,892

The company paid dividends of $186,000 last year. The "Investment in Cedar Company" on the statement of financial position

represents an investment in the stock of another company.

Required:

a. Compute the company's margin, turnover, and return on investment for last year.

b. The Board of Directors of Beaker Company has set a minimum required return of 46%. What was the company's residual income last

year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 448,600 297,150 151,450 98,600 5,000 47,850 19,276 $ 28,574 Cost of goods sold Gross profit Operating expenses Interest expense Profit before taxes Income tax expense Net profit Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Property, plant and equipment, net Total assets Req 1 and 2 Req 3 Req 4 CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity Req 5 8,000 Accounts payable 8,800 Accrued wages payable 32,400 Income taxes payable 2,750 Share capital 150,300 Retained earnings $ 238,400 Total liabilities and equity Complete this question by entering your answers in the tabs below. Compute the current ratio and acid-test ratio. 36,150 Long-term note payable, secured by mortgage on property, plant and equipment Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days'…arrow_forwardWhat is the current assets for each company? What are the short term investments for each company? What is the average account receivable for each company? What is the average inventory for each company?arrow_forwardEdison Company reported the following for the current year: $ 84,000 59,000 21,080 63,000 77,080 Net sales Cost of goods sold Net income Beginning balance of total assets Ending balance of total assets Compute (a) profit margin and (b) return on total assets. Complete this question by entering your answers in the tabs below. Profit Margin Ratio Compute the return on total assets. Return On Total Assets Numerator: 7 7 7 Return On Total Assets Denominator: = Return On Total Assets Return on total assets II =arrow_forward

- Thunder Corporation's balance sheet and income statement appear below: Assets: Cash and cash equivalents Accounts receivable Inventory Property, plant, and equipment Less accumulated depreciation Total assets Liabilities and stockholders' equity: Accounts payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income Income taxes Net income Operating activities: Comparative Balance Sheet Income Statement @ 550 D RSA $ 891 Required: Prepare a statement of cash flows in good form using the indirect method. Note: List any deduction in cash and cash outflows as negative amounts. Thunder Corporation Statement of Cash Flows For This Year Ended December 31 334 $ 116 Santa Ending Balance 72 53 466 206 $ 425 53 $ 425 SER SIS The company did not dispose of any property, plant, and equipment, issue any bonds payable, or repurchase a stock during the year. The company…arrow_forwardCan you show me how this problem supposed to be worked outarrow_forwardLydex Company’s financial statements for the last two years are as follows: Lydex Company Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,020,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,940,000 2,040,000 Inventory 3,660,000 2,100,000 Prepaid expenses 270,000 210,000 Total current assets 7,890,000 5,910,000 Plant and equipment, net 9,640,000 9,110,000 Total assets $ 17,530,000 $ 15,020,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,070,000 $ 3,100,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,770,000 6,200,000 Stockholders' equity: Common stock, $75 par value 7,500,000 7,500,000 Retained earnings 2,260,000 1,320,000 Total stockholders' equity 9,760,000 8,820,000 Total liabilities and stockholders' equity $ 17,530,000 $ 15,020,000 Lydex Company Comparative Income Statement and Reconciliation This…arrow_forward

- Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes. Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets Sin Comparative Income Statements For Years Ended December 31 2021 $ 420,027 252,856 167,171 59,644 37,802 97,446 69,725 12,969 $ 56,756 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity Assets Current assets Long-term investments Plant assets, net. Total assets Liabilities and Equity Current liabaties Common stock Other paid-in capital Retained earnings Total liabilities and equity 2020 $ 321,775 202,718 KORBIN COMPANY Comparative Balance Sheets December 31 2021 119,057 44,405 28,316 72,721 46,336 9,499 $ 36,837 $ 55,286 0 102,674 $ 157,960 2020 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as answers to 2 decimal places.) 111.77 % 0.00 $ 37,003 700…arrow_forwardLydex Company’s financial statements for the last two years are as follows: Lydex Company Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,020,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,940,000 2,040,000 Inventory 3,660,000 2,100,000 Prepaid expenses 270,000 210,000 Total current assets 7,890,000 5,910,000 Plant and equipment, net 9,640,000 9,110,000 Total assets $ 17,530,000 $ 15,020,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,070,000 $ 3,100,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,770,000 6,200,000 Stockholders' equity: Common stock, $75 par value 7,500,000 7,500,000 Retained earnings 2,260,000 1,320,000 Total stockholders' equity 9,760,000 8,820,000 Total liabilities and stockholders' equity $ 17,530,000 $ 15,020,000 Lydex Company Comparative Income Statement and Reconciliation This…arrow_forwardCreate a comparative financial statement from the following:arrow_forward

- Comparative financial statement data for Carmono Company follow: Assets Cash and cash equivalents Accounts receivable Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Total assets Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity For this year, the company reported net income as follows: Sales Cost of goods sold Gross margin Selling and administrative expenses Net income This Year $ 11.00 64.00 110.00 185.00 252.00 51.20 200.80 $385.80 $ 66.00 146.00 173.80 $385.80 $ 1,200.00 720.00 480.00 460.00 $ 20.00 Last Year $ 21.00 57.00 97.40 175.40 208.00 38 40 169.60 $345.00 $ 53.00 112.00 180.00 $345.00 This year Carmono paid a cash dividend but it did not sell any property, plant, and equipment or repurchase any of its own stock. Required: 1. Using the indirect method, prepare a statement of cash flows for this year. 2. Compute Carmono's…arrow_forwardPortions of the financial statements for Parnell Company are provided below. PARNELL COMPANY Income Statement For the Year Ended December 31, 2021 ($ in thousands) Revenues and gains: Sales $ 750 Gain on sale of building 11 $ 761 Expenses and loss: Cost of goods sold $ 275 Salaries 115 Insurance 35 Depreciation 118 Interest expense 45 Loss on sale of equipment 13 601 Income before tax 160 Income tax expense 80 Net income $ 80 PARNELL COMPANY Selected Accounts from Comparative Balance Sheets December 31, 2021 and 2020 ($ in thousands) Year 2021 2020 Change Cash $ 129 $ 105 $ 24 Accounts receivable 319 221 98 Inventory 326 420 (94 ) Prepaid insurance 71 83 (12 ) Accounts payable 205 122 83 Salaries payable 112 98 14…arrow_forwardLong-Term Solvency Ratios Summary data from year-end financial statements of Palm Springs Company for the current year follow. Summary Income Statement Data Sales $10, 500, 600 Cost of goods sold 6, 050,000 Selling expenses 685,000 Administrative expenses 945,000 Interest expense 783, 500 Income tax expense 427,791 8,891,291 Net income $1,609,309 Summary Balance Sheet Data Cash $84, 700 Total liabilities $749,700 Noncash assets 885,500 Stockholders' equity 220, 500 Total assets $970, 200 Total liabilities and equity $970, 200 Round answers to one decimal place. a. Compute the ratio of times - interest - earned. Answer times b. Compute the debt-to-equity ratio. Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education