College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Assume that social security taxes provide answer general accounting

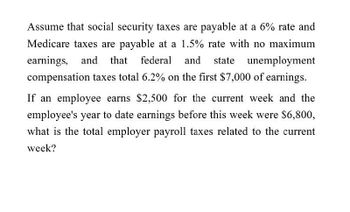

Transcribed Image Text:Assume that social security taxes are payable at a 6% rate and

Medicare taxes are payable at a 1.5% rate with no maximum

earnings, and that federal and state unemployment

compensation taxes total 6.2% on the first $7,000 of earnings.

If an employee earns $2,500 for the current week and the

employee's year to date earnings before this week were $6,800,

what is the total employer payroll taxes related to the current

week?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lemur Corp. is going to pay three employees a year-end bonus. The amount of the year-end bonus and the amount of federal income tax withholding are as follows. Lemurs payroll deductions include FICA Social Security at 6.2%, FICA Medicare at 1.45%, FUTA at 0.6%, SUTA at 5.4%, federal income tax as previously shown, state income tax at 5% of gross pay, and 401(k) employee contributions at 2% of gross pay. Record the entry for the employee payroll on December 31.arrow_forwardPayrex Co. has six employees. All are paid on a weekly basis. For the payroll period ending January 7, total employee earnings were 12,500, all of which were subject to SUTA, FUTA, Social Security, and Medicare taxes. The SUTA tax rate in Payrexs state is 5.4%, but Payrex qualifies for a rate of 2.0% because of its good record of providing regular employment to its employees. Other employer payroll taxes are at the rates described in the chapter. REQUIRED 1. Calculate Payrexs FUTA, SUTA, Social Security, and Medicare taxes for the week ended January 7. 2. Prepare the journal entry for Payrexs payroll taxes for the week ended January 7. 3. What amount of payroll taxes did Payrex save because of its good employment record?arrow_forwardWallace Corporation summarizes the following information from its weekly payroll records during April. Prepare the two journal entries to record the payment of the payroll and the accrual of its payroll taxes for April. Assume an 8% FICA rate for both employees and the employer. Also assume a 5.4% state unemployment tax rate, a 0.6% federal unemployment tax rate, and that all wages are subject to all payroll taxes. Round to the nearest dollar.arrow_forward

- _____1. Johnson Industries, a semiweekly depositor, pays its employees every Friday. When should the company deposit the employment taxes for each weekly payday? _____2. What rule should Bartlett Repair, a new company, follow in making its deposits for accumulated employment taxes? _____3. Quail Hollow Motors (a semiweekly depositor) accumulates taxes of 105,000 on Monday and must deposit this amount on Tuesday, the next banking day. On Tuesday, the company accumulates additional taxes of 20,000. What deposit rule should Quail Hollow Motors follow for depositing the additional 20,000?arrow_forwardAssume that social security taxes are payable at a 6% rate and Medicare taxes are payable at a 1.5% rate with no maximum earnings, and that federal and state unemployment compensation taxes total 6.2% on the first $7,000 of earnings. If an employee earns $2,500 for the current week and the employee's year-to-date earnings before this week were $6,800, what is the total employer payroll taxes related to the current week? a.$187.50 b.$199.90 c.$342.50 d.$12.40arrow_forwardCompute the net pay for each employee using the federal income tax withholding table included. Assume that FICA Social Security tax is 6.2% on a wage base limit of $142,800, Medicare is 1.45% on all earnings, the payroll is paid biweekly, and no state income tax applies. (Round each computation to the nearest cent as needed.) View the employee information. Compute the net pay for each employee. View the biweekly payroll period percentage method withholding chart. Li Kan Isabel Poland Gross earnings for the current pay period Deductions for employee withholding taxes - BIWEEKLY Payroll Period Percentage Method Withholding Chart STANDARD Withholding Rate Schedules Single or Married Filing Separately of the amount The tentative amount to Plus this withhold is: percentage-exceeds— that the Adjusted Wage Total deductions Net pay Adjusted wage amount is at least $0, but less than $483 $ 0.00 0% $ Adjusted wage amount is at least $483, but less than $865 $ 0.00 10% $ 483 Adjusted wage amount…arrow_forward

- The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both taxes are applied to the first $7,000 of an employee's pay. Assume that an employee earned total wages of $9,900. What is the amount of total unemployment taxes the employer must pay on this employee's wages?arrow_forwardThe current Federal Unemployment Taxes (FUTA) tax rate is 0.6%, and the State Unemployment Taxes (SUTA) tax rate is 5.4%. Both taxes are applied to the first $7,000 of an employee's pay. Assume that an employee earned total wages of $3,060 in the current period and had cumulative pay for prior periods of $6,120. What is the amount of unemployment taxes the employer must pay on this employee's wages for the current period? Multiple Choice $420.00. $367.20. $52.80. O $183.60. $0.00.arrow_forwardAn employee earned $62,500 during the year working for an employer. The FICA tax rate for Social Security is 6.2% and the FICA tax rate for Medicare is 1.45%. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount of total unemployment taxes the employee must pay? $0.00 $56.00 O $434.00 O $378.00 $101.50arrow_forward

- Davis and Thompson have earnings of $913 each. The social security tax rate is 6.0%, and the Medicare tax rate is 1.5%. Assuming that the payroll will be paid on December 29, what will be the employer's total FICA tax for this payroll period?arrow_forwardJason's gross pay for the week is $1,800. His year−to−date pay is under the limit for OASDI. Assume that the rate for state and federal unemployment compensation taxes is 6% and that Jason's year−to−date pay has not yet exceeded the $7,000 cap. What is the total amount of payroll taxes that his employer must record as payroll tax expenses? (Do not round your intermediate calculations. Assume a FICA—OASDI Tax of 6.2% and FICA—Medicare Tax of 1.45%.)arrow_forwardthe current FUTA rate is 0.6% and the SUTA taxt rate is 5.4%. both taxes are applied to the first 7,000 of an employees pay. assume that an employee earned total eages of 11,900. what is the amount of total unemployment taxes the employer must pay on this employees wages?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,