FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

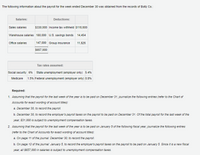

Transcribed Image Text:The following information about the payroll for the week ended December 30 was obtained from the records of Boltz Co.:

**Salaries:**

- Sales salaries: $330,000

- Warehouse salaries: $180,000

- Office salaries: $147,000

**Total Salaries:** $657,000

**Deductions:**

- Income tax withheld: $116,600

- U.S. savings bonds: $14,454

- Group insurance: $11,826

**Tax rates assumed:**

- Social security: 6%

- Medicare: 1.5%

- State unemployment (employer only): 5.4%

- Federal unemployment (employer only): 0.8%

**Required:**

1. **Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries:**

(refer to the Chart of Accounts for exact wording of account titles):

a. December 30, to record the payroll.

b. December 30, to record the employer’s payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $31,000 is subject to unemployment compensation taxes.

2. **Assuming that the payroll for the last week of the year is to be paid on January 5 of the following fiscal year, journalize the following entries:**

(refer to the Chart of Accounts for exact wording of account titles):

a. On page 11 of the journal: December 30, to record the payroll.

b. On page 12 of the journal: January 5, to record the employer’s payroll taxes on the payroll to be paid on January 5. Since it is a new fiscal year, all $657,000 in salaries is subject to unemployment compensation taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information about the payroll for the week ended December 30 was obtained from the records of Boltz Co.: Salaries: Deductions: Sales salaries $325,000 Income tax withheld $119,000 Warehouse salaries 196,000 U.S. savings bonds 14,344 Office salaries 131,000 Group insurance 11,736 $652,000 Tax rates assumed: Social security 6% State unemployment (employer only) 5.4% Medicare 1.5% Federal unemployment (employer only) 0.8% Required: 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles): a. December 30, to record the payroll. b. December 30, to record the employer’s payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $44,000 is subject to unemployment compensation taxes. 2. Assuming that the payroll for the last…arrow_forwardThe following information about the payroll for the week ended December 30 was obtained from the records of Saine Co.: Salaries: Deductions: Sales salaries $199,000 Income tax withheld $71,984 Warehouse salaries 109,000 U.S. savings bonds 8,998 Office salaries 101,000 Group insurance 7,362 $409,000 Tax rates assumed: Social security, 6% Medicare, 1.5% State unemployment (employer only), 5.4% Federal unemployment (employer only), 0.8% Required: If an amount box does not require an entry, leave it blank. 1a. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the entry on December 30, to record the payroll. first picture, for all green boxes the headers are the same: Date, account, debit ,credit 2a. Assuming that the payroll for the last week of the year is to be paid on January 4 of the following fiscal year, journalize the entry on December 30, to record the payroll.…arrow_forwardJournalize Payroll Tax The payroll register of Chen Engineering Co. indicates $1,956 of social security withheld and $489.00 of Medicare tax withheld on total salaries of $32,600 for the period. Earnings of $10,100 are subject to state and federal unemployment compensation taxes at the federal rate of 0.6% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank. Round to two decimal places.arrow_forward

- Entries for Payroll and Payroll Taxes The following information about the payroll for the week ended December 30 was obtained from the records of Boltz Co.: Salaries: Deductions: Sales salaries $171,000 Income tax withheld $61,952 Warehouse salaries 94,000 U.S. savings bonds 7,744 Office salaries 87,000 Group insurance 6,336 $352,000 Tax rates assumed: Social security, 6% Medicare, 1.5% State unemployment (employer only), 5.4% Federal unemployment (employer only), 0.8% Required: If an amount box does not require an entry, leave it blank. 2b. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following fiscal year, journalize the entry to record the employer's payroll taxes on the payroll to be paid on January 5. Because it is a new fiscal year, all $352,000 in salaries is subject to unemployment compensation taxes. Date Account Debit Credit…arrow_forwardAssume that the social security tax rate is 6% and the Medicare tax rate is 1.5%. In the following summary of data for a payroll period, some amounts have been intentionally omitted: Earnings: 1. At regular rate ? 2. At overtime rate $64,000 3. Total earnings ? Deductions: 4. Social security tax 30,240 5. Medicare tax 7,560 6. Federal income tax withheld 128,000 7. Medical insurance 17,640 8. Union dues ? 9. Total deductions 190,190 10. Net amount paid 313,810 Accounts debited: 11. Factory Wages 264,000 12. Sales Salaries ? 13. Office Salaries 110,000 Required: a. Determine the amounts omitted in lines (1), (3), (8), and (12). b. On December 19, journalize the entry to record the payroll accrual.* c. On December 20, journalize the entry to record the payment of the payroll.*arrow_forwardJournalize payroll taxThe payroll register of Heritage Co. indicates $4,200 of social security withheld and $1,050 of Medicare tax withheld on total salaries of $70,000 for the period. Earnings of $12,000 are subject to state and federal unemployment compensation taxes at the federal rate of 0.8% andthe state rate of 5.4%. Journalize the entry to record the payroll tax expense for the period.arrow_forward

- A28arrow_forwardProblem 10-55 (LO 10-4) CFG Company has the following employees: Edwardo Melanie Navach Wages Paid $ 12,000 6,000 22,000 CFG receives the maximum credit for state unemployment taxes. Required: What is the FUTA tax that CFG Company would owe for the year? FUTA tax for the yeararrow_forwardA7arrow_forward

- Recording Payroll and Payroll Taxes The following data are taken from Fremont Wholesale Company's May payroll Administrative salaries $47,600 Sales salaries 65,800 Custodial salaries 9,800 Total payroll $123,200 Salaries subject to 1. 45 percent Medicare tax $123,200 Salaries subject to 6.2 percent Social Security tax 103,600 Salaries subject to federal unemployment taxes 19,600 Salaries subject to state unemployment taxes 28,000 Federal income taxes withheld from all salaries 24,920 Assume that the company is subject to a two percent state unemployment tax (due to a favorable experience rating) and a 0.6 percent federal unemployment tax. Required Record the following in general journal form on May 31: a. Accrual of the monthly payroll. b. Payment of the net payroll. c. Accrual of employer's payroll taxes. ( Assume that the FICA matches the amount withheld.) d. Payment of these payroll-related liabilities. (Assume that all are settled at the same time.) Round your answers to the…arrow_forwardNonearrow_forwardThe following information about the payroll for the week ended December 30 was obtained from the records of Boltz Co.: Salaries: Deductions: Sales salaries $350,000 Income tax withheld $117,000 Warehouse salaries 182,000 U.S. savings bonds 14,696 Office salaries 136,000 Group insurance 12,024 $668,000 Tax rates assumed: Social security 6% State unemployment (employer only) 5.4% Medicare 1.5% Federal unemployment (employer only) 0.8% Required:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education