FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

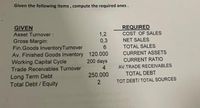

Transcribed Image Text:Given the following items , compute the required ones.

REQUIRED

COST OF SALES

GIVEN

Asset Turnover :

Gross Margin:

1,2

0,3

NET SALES

TOTAL SALES

CURRENT ASSETS

Fin.Goods InventoryTurnover

Av. Finished Goods Inventory 120.000

Working.Capital Cycle

Trade Receivables Turnover

CURRENT RATIO

200 days

4

AV.TRADE RECEIVABLES

TOTAL DEBT

Long Term Debt

Total Debt / Equity

250.000

TOT.DEBT/ TOTAL SOURCES

Expert Solution

arrow_forward

Step 1

In accounting, a ratio is used to evaluate the company's financial performance by establishing the relationship between two line items of financial statements.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sales Revenue Less: Cost of Goods Sold Gross Profits Less: Operating Expenses Operating Profits Less: Interest Expense Net Profits Before Taxes Less: Taxes (40%) Net Profits After Taxes Assets Cash Income Statement Pulp, Paper and Paperboard, Inc. For the Year Ended December 31, 2019 Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets Liabilities and stockholders' equity Current liabilities Balance Sheet Pulp, Paper and Paperboard, Inc. December 31, 2019 Accounts payable Notes payable Accruals Total current liabilities Long-term debts Total liabilities Stockholders' equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Calculate the following: NP, GP $2,080,976 1,701,000 $ 379,976 273,846 $ 106,130 19,296 S 86,834 34,810 S 52,024 Current Ratio - Quick Ratio Receivable days - Payable days $ 95,000 237,000 243.000 $ 575,000 500,000 75.000 $ 425,000…arrow_forwardThe comparative statements of Lily Company are presented here. Net sales Lily Company Income Statements For the Years Ended December 31 Cost of goods sold Gross profit Selling and administrative expenses Income from operations Other expenses and losses Interest expense Income before income taxes Income tax expense Net income Assets Current assets Cash Debt investments (short-term) Accounts receivable (net) Inventory Total current assets Plant assets (net) Total assets Lily Company Balance Sheets December 31 Liabilities and Stockholders' Equity Current liabilities Accounts payable Stockholders' equity Common stock ($5 par) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 282,200 265,700 547,900 $971,800 $1,815,100 1,011,300 2022 803,800 517,400 286,400 2022 267,600 80,016 $ 187,584 $60,100 68,100 18,800 304,000 161,700 465,700 $852,700 116,200 123,100 367,500 604.300 $971,800 $160,300 2021 $64,600 50,200 102,900 114,500 332,200 520,500 $852,700…arrow_forwardRequired:a) Compute the times-interest earned and give the interpretation.b) Compute the fixed charge coverage and give the interpretation.arrow_forward

- Sales Depreciation COGS Interest Cash Accts Receivables Notes Payable L ong-term debt Net fixed assets Accounts Payable Inventory Dividend payout Tax rate 2020 21. What is the ROE for 2021? $5,300 $5,900 750 850 2400 180 200 200 800 1500 3000 250 700 2021 2900 196 500 22. What is the Inventory period in 2021? 400 550 1950 3500 400 900 30% 35% 30% 20. What is the cash flow from operating activities?arrow_forwardCoparrow_forwardVery important please be correct thank you need all 11 requiredarrow_forward

- EAST COAST YACHTS 2020 Income Statement Sales Cost of goods sold Selling, general, and administrative Depreciation EBIT Interest expense EBT Taxes (25%) Net income Dividends Retained earnings $550,424,000 397,185,000 65,778,000 17,963,000 $ 69,498,000 9,900,000 $ 59,598,000 14,899,500 $ 44,698,500 $ 19,374,500 25,324,000 Current assets Cash and equivalents Accounts receivable Inventory Other Total current assets Fixed assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Intangible assets and others Total fixed assets Total assets EAST COAST YACHTS 2020 Balance Sheet $ 10,107,000 16,813,300 18,135,700 1,054,900 $ 46,110,900 $412,032,000 (102,452,000) $309,580,000 6,772,000 $316,352,000 $362,462,900 Current liabilities Accounts payable Accrued expenses Total current liabilities Long-term debt Total long-term liabilities Stockholders' equity Preferred stock Common stock Capital surplus Accumulated retained earnings Less treasury stock…arrow_forwardusing the following table (image attached) calculate the financial leverage multiplier used in the BMC systemarrow_forwardNeed the answers in that formats thank youarrow_forward

- Need help calculating: A. Economic value added and B. Return on Capitalarrow_forwardConsider the following financial statement information for the Newk Corporation: Beginning $10,382 Ending $ 11,180 6,181 6,293 Item Inventory Accounts receivable Accounts payable Net sales. Cost of goods sold 5,651 5,952 Operating cycle Cash cycle $ 139,303 87,113 Assume all sales are on credit. Calculate the operating and cash cycles. Note: Do not round intermediate calculations and round your answers to 2 decimal pla 2.19 days daysarrow_forwardReceivable turnover Average collection period Inventory turnover Fixed asset turnover Total asset turnover Current ratio Quick ratio Assets Utilization Ratios c. Liquidity ratios. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Liquidity Ratios times times times days times times timesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education