FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

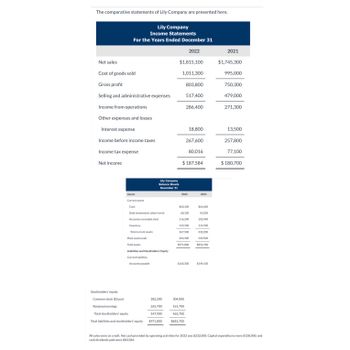

Transcribed Image Text:The comparative statements of Lily Company are presented here.

Net sales

Lily Company

Income Statements

For the Years Ended December 31

Cost of goods sold

Gross profit

Selling and administrative expenses

Income from operations

Other expenses and losses

Interest expense

Income before income taxes

Income tax expense

Net income

Assets

Current assets

Cash

Debt investments (short-term)

Accounts receivable (net)

Inventory

Total current assets

Plant assets (net)

Total assets

Lily Company

Balance Sheets

December 31

Liabilities and Stockholders' Equity

Current liabilities

Accounts payable

Stockholders' equity

Common stock ($5 par)

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity

282,200

265,700

547,900

$971,800

$1,815,100

1,011,300

2022

803,800

517,400

286,400

2022

267,600

80,016

$ 187,584

$60,100

68,100

18,800

304,000

161,700

465,700

$852,700

116,200

123,100

367,500

604.300

$971,800

$160,300

2021

$64,600

50,200

102,900

114,500

332,200

520,500

$852,700

$144,100

2021

$1,745,300

995,000

750,300

479,000

271,300

13,500

257,800

77,100

$ 180,700

All sales were on credit. Net cash provided by operating activities for 2022 was $232,000. Capital expenditures were $138,000, and

cash dividends paid were $83,584.

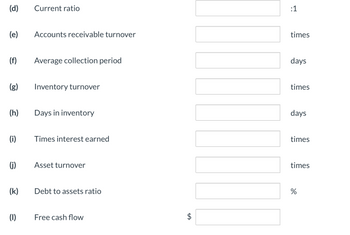

Transcribed Image Text:(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

(1)

Current ratio

Accounts receivable turnover

Average collection period

Inventory turnover

Days in inventory

Times interest earned

Asset turnover

Debt to assets ratio

Free cash flow

$

:1

times

days

times

days

times

times

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Percent of sales method At the end of the current year, Accounts Receivable has a balance of $745,000; Allowance for Doubtful Accounts has a credit balance of $6,500; and sales for the year total $3,350,000. Bad debt expense is estimated at 1/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. $ X b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $ X Allowance for Doubtful Accounts $ X Bad Debt Expense $ X c. Determine the net realizable value of accounts receivable. < $ Xarrow_forwardBased on the financial statements provided, compute the following financial ratios. Show your workings and round your figures to 2 decimal places. Ratio 2020 2019 Current Ratio Quick Ratio Debt Ratio (%)arrow_forwardPercent of Sales Method At the end of the current year, Accounts Receivable has a balance of $875,000; Allowance for Doubtful Accounts has a debit balance of $8,000; and sales for the year total $3,940,000. Bad debt expense is estimated at 1.25% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts.$ b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Adjusted BalanceDebit (Credit) Accounts Receivable $ Allowance for Doubtful Accounts $ Bad Debt Expense $ c. Determine the net realizable value of accounts receivable.$arrow_forward

- 19. The accounts receivable turnover is 8.14, and average net accounts receivable during the period is $400,000. What is the amount of net credit sales for the period? Brief Exercises Identify different types of receivables. BE8.1 (LO 1), C The following are three receivables transactions. Indicate whether these receivables are reported as accounts receivable, notes receivable, or other receivables on a balan a. Sold merchandise on account for $64,000 to a customer. b. Received a promissory note of $57,000 for services performed. c. Advanced $10,000 to an employee. Record basic accounts receivable transactions. PEO AR Rooord the following transactions on the books of Jarvis Co. (Omit cost of goods sold entries.)arrow_forwardPercent of Sales Method At the end of the current year, Accounts Receivable has a balance of $4,375,000; Allowance for Doubtful Accounts has a debit balance of $21,300; and sales for the year total $102,480,000. Bad debt expense is estimated at 1/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $4 Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable.arrow_forwardus Kimmel, tinancial Accounting, Be US eo 1 Srstom Announcements CALCATO Brief Exercise 8-10 Piet ts first vear of operations, Pronghorn Corp had credit sales of $2,714,100, of which $429,000 remained uncollected at year-end. The credit manager estimates that $16,370 of these recevahles w be Prepare the journal entry to record the estimated uncollectibles. (Assume an unadjusted balance of zero in Allowance for Doubtful Accounts.) (Credit account titles are automatically indented whee ment c indent manually.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT INTERACTIVE TUTORIAL INTERACTIVE TUTORIAL Prepare the current assets section of the balance sheet for Pronghorn Corp, assuming that in addition to the receivables it has cash of $85,320, merchandise inventory of $163,960, and supplies of $13,290. (List current a arder of liquidity) Pronghorn Corp Balance Sheet (partial) wT O secouNTSarrow_forward

- What does the accounts receivable turnover ratio measure? Multiple Choice Average balance of accounts receivables How quickly accounts receivable turn into cash How quickly inventory turns into accounts receivable How quickly the accounts receivable balance increasesarrow_forwardplease answer questions 13, 14, and 15arrow_forwardPercent of Sales Method At the end of the current year, Accounts Receivable has a balance of $870,000, Allowance for Doubtful Accounts has a debit balance of $8,000, and sales for the year total $3,920,000. Bad debt expense is estimated at 3/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense Adjusted Balance Debit (Credit) c. Determine the net realizable value of accounts receivable.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education