FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Finance Co lent $9.8 million to Corbin Construction on January 1, 2021, to construct a playground. Corbin signed a three-year, 5%

installment note to be paid in three equal payments at the end of each year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and

PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1. Prepare the journal entry for FinanceCo's lending the funds on January 1, 2021.

2. Prepare an amortization schedule for the three-year term of the installment note.

3. Prepare the journal entry for the first installment payment on December 31, 2021.

4. Prepare the journal entry for the third installment payment on December 31, 2023.

Complete this question by entering your answers in the tabs below.

Req 2 Req 1 3 and 4

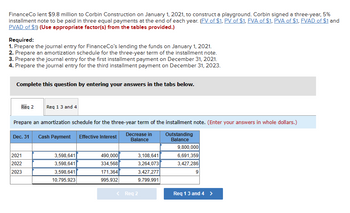

Prepare an amortization schedule for the three-year term of the installment note. (Enter your answers in whole dollars.)

Decrease in

Balance

Outstanding

Balance

Dec. 31 Cash Payment Effective Interest

2021

2022

2023

3,598,641

3,598,641

3,598,641

10,795,923

490,000

334,568

171,364

995,932

3,108,641

3,264,073

3,427,277

9,799,991

< Req 2

9,800,000

6,691,359

3,427,286

9

Req 1 3 and 4 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Thornton Industries began construction of a warehouse on July 1, 2021. The project was completed on March 31, 2022. No new loans were required to fund construction. Thonton does have the following two interest-bearing liabilities that were outstanding throughout the construction perlod: $3,000, 000, 12% note $7,000, 000, 7X bonds Construction expenditures Incurred were as follows: July 1, 2021 Septenber 30, 2021 November 30, 2021 January 30, 2022 $ 700,000 990,000 990, 000 930,000 The company's fiscal year-end is December 31. Required: Calculate the amount of interest capitallized for 2021 and 2022. Complete this question by entering your answers in the tabs below. 2021 2022arrow_forwardOn January 1, 2021, the Highlands Company began construction on a new manufacturing facility for its own use. The building was completed in 2022. The company borrowed $1,500,000 at 8% on January 1 to help finance the construction. In addition to the construction loan, Highlands had the following debt outstanding throughout 2021: $5,000,000, 12% bonds $3,000,000, 8% long-term note Construction expenditures incurred during 2021 were as follows:January 1 $ 600,000March 31 1,200,000June 30 800,000September 30 600,000December 31 400,000Required:Calculate the amount of interest capitalized for 2021 using the specific interest method.arrow_forwardOn December 31, 2024, Windsor Inc. borrowed $3,480,000 at 12% payable annually to finance the construction of a new building. In 2025, the company made the following expenditures related to this building: March 1, $417,600; June 1, $696,000; July 1, $1,740,000; December 1, $1,740,000. The building was completed in February 2026. Additional information is provided as follows. 1. 2. 3. (a) Other debt outstanding: 10-year, 13% bond, December 31, 2018, interest payable annually 6-year, 10% note, dated December 31, 2022, interest payable annually March 1, 2025, expenditure included land costs of $174,000. Interest revenue of $56,840 earned in 2025. Your answer is correct. Determine the amount of interest to be capitalized in 2025 in relation to the construction of the building. The amount of interest $ $4,640,000 1,856,000 212280arrow_forward

- On January 1, 2021, the Montgomery Company agreed to purchase a building by making six payments. The first three are to be $26,000 each, and will be paid on December 31, 2021, 2022, and 2023. The last three are to be $41,000 each and will be paid on December 31, 2024, 2025, and 2026. Montgomery borrowed other money at a 12% annual rate. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required:1. At what amount should Montgomery record the note payable and corresponding cost of the building on January 1, 2021?2. How much interest expense on this note will Montgomery recognize in 2021?arrow_forwardOn January 1, 2021, the company obtained a $3 million loan with a 10% interest rate. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 $ 1,080,000 March 1, 2021 900,000 June 30, 2021 320,000 October 1, 2021 700,000 January 31, 2022 720,000 April 30, 2022 1,035,000 August 31, 2022 1,800,000 On January 1, 2021, the company obtained a $3 million construction loan with a 10% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2021 and 2022. The company’s other interest-bearing debt included two long-term notes of $5,000,000 and $7,000,000 with interest rates of 5% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company’s fiscal year-end is December 31. Required: Calculate the amount of interest that Mason should…arrow_forwardOn January 1, 2021, the company obtained a $3 million loan with a 11% interest rate. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 March 1, 2021 June 30, 2021 October 1, 2021 January 31, 2022 April 30, 2022 August 31, 2022 On January 1, 2021, the company obtained a $3 million construction loan with a 11% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2021 and 2022. The company's other interest-bearing debt included two long-term notes of $5,100,000 and $7,100,000 with interest rates of 7% and 9%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company's fiscal year-end is December 31. Required: 1. Calculate the amount of interest that Mason should capitalize in 2021 and 2022 using the weighted-average method. 2. What is the total cost of the building? 3. Calculate the…arrow_forward

- Acruni Co. had the following loans in place at the beginning of 2019. 1 January 2019 GHC m 10% Bank loan repayable 2020 9.5% Bank loan repayable 2021 8.9% debenture repayable 2024 120 80 100 On 1 January 2019, Acruni Co began construction of a qualifying asset, a piece of machinery for a hydroelectric plant, using existing borrowings. Expenditure drawn down for the construction was GHC30 million on 1 January 2019, and GHC20 million on 1 October 2019. Surplus funds were invested temporarily at a rate of 2%. Required a) Calculate the borrowing costs that can be capitalized for the piece of machinery. b) Compute the cost of the machinery that will be reported in the statement of financial position as at December, 2019 ATES)arrow_forwardRequired information [The following information applies to the questions displayed below.) On January 1, 2024, Monster Corporation borrowed $19 million from a local bank to construct a new highway over the next four years. The loan will be paid back in four equal installments of $5,609,334 on December 31 of each year. The payments include interest at a rate of 7%. 2. Prepare an amortization schedule over the four-year life of the installment note. (Round your final answers to the nearest dollar amount. Enter your answer in dollars, not millions. (i.e., $5.5 million should be entered as 5,500,000.).) Date 12/31/2024 12/31/2025 12/31/2026 12/31/2026 Cash Paid Interest Expense Decrease in Carrying Value Carrying Valuearrow_forwardIn 2018, SM Residences entered into a 3-year agreement in to construct a condominium project for a contract price of P10,000,000. SM recognizes construction contract under the percentage of completion method. For the year ended 2018, the following balances were found in SM's books: Progress Billings P2,000,000; Accounts Receivable P1,000,000; Construction in Progress P3,500,000, Costs incurred to date P2,800,000. For 2019, the balances are Progress Billings P3,000,000; Accounts Receivable P1,200,000; Construction in Progress P6,500,000, Costs incurred to date 5,500,000. What is the percentage of completion in 2019? (Answer format: 1%, 20%, 50%)arrow_forward

- [The following information applies to the questions displayed below] On January 1, 2021, Gundy Enterprises purchases an office building for $162,000, paying $42,000 down and borrowing the remaining $120,000, signing a 8%, 10-year mortgage. Installment payments of $1,455.93 are due at the end of each month, with the first payment due on January 31, 2021. Required: 1. Record the purchase of the building on January 1, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the purchase of the building.arrow_forward0 Required information [The following information applies to the questions displayed below.] On January 1, 2024, Evanston Corporation borrowed $10 million from a local bank to construct a new building over the next three years. The loan will be paid back in three equal installments of $3,880,335 on December 31 of each year. The payments include interest at a rate of 8%. 3. Use amounts from the amortization schedule to record each installment payment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions. (i.e., $5.5 million should be entered as 5,500,000.).) View transaction list Journal entry worksheet 1 2 3 Record the payment of first annual installment on the note payable. Note: Enter debits before credits. Date December 31, 2024 General Journal Debit Credit Record entry Clear entry View general journalarrow_forwardDuring 2021, Colorado Company constructed a 3-storey building. The weighted average expenditures for capitalization of interest during 2021 amounted to P 23,600,000. The existin debt of Colorado are the following: • From Union Bank (specific borrowing), P 3,600,000, 10% • From Land Bank (general borrowing), P 6,000,000, 20% • From Security Bank (general borrowing), P 10,000,000, 18% QUESTION 1: What is the capitalized borrowing costs for the year ended December 31, 2021? [Select ] | Select] P3,750,000 P 3,788,000 P 3,360,000 P 4,110,000 QUESTION 2: What is the interest expense for the year ended December 31 , 2021? [ Select ]arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education