FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

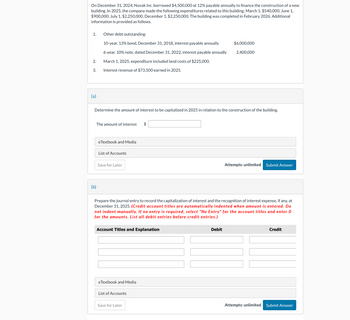

Transcribed Image Text:On December 31, 2024, Novak Inc. borrowed $4,500,000 at 12% payable annually to finance the construction of a new

building. In 2025, the company made the following expenditures related to this building: March 1, $540,000; June 1,

$900,000; July 1, $2,250,000; December 1, $2,250,000. The building was completed in February 2026. Additional

information is provided as follows.

1. Other debt outstanding:

10-year, 13% bond, December 31, 2018, interest payable annually

6-year, 10% note, dated December 31, 2022, interest payable annually

$6,000,000

2,400,000

2.

March 1, 2025, expenditure included land costs of $225,000.

3.

Interest revenue of $73,500 earned in 2025.

(a)

Determine the amount of interest to be capitalized in 2025 in relation to the construction of the building.

The amount of interest

$

eTextbook and Media

List of Accounts

Save for Later

Attempts: unlimited

Submit Answer

(b)

Prepare the journal entry to record the capitalization of interest and the recognition of interest expense, if any, at

December 31, 2025. (Credit account titles are automatically indented when amount is entered. Do

not indent manually. If no entry is required, select "No Entry" for the account titles and enter O

for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

eTextbook and Media

List of Accounts

Save for Later

Debit

Credit

Attempts: unlimited

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 March 1, 2024 June 30, 2024 October 1, 2024 January 31, 2025 April 30, 2025 August 31, 2025 On January 1, 2024, the company obtained a $3 million construction loan with a 12% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2024 and 2025. The company's other interest-bearing debt included two long-term notes of $5,500,000 and $7,500,000 with interest rates of 7% and 9%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company's fiscal year-end is December 31. $ 1,200,000 690,000 450,000 660,000 945,000 1,260,000 2,250,000 Required: Using the weighted-average interest method, answer the following questions: 1.…arrow_forwardOn December 31, 2024, Windsor Inc. borrowed $3,480,000 at 12% payable annually to finance the construction of a new building. In 2025, the company made the following expenditures related to this building: March 1, $417,600; June 1, $696,000; July 1, $1,740,000; December 1, $1,740,000. The building was completed in February 2026. Additional information is provided as follows. 1. 2. 3. (a) Other debt outstanding: 10-year, 13% bond, December 31, 2018, interest payable annually 6-year, 10% note, dated December 31, 2022, interest payable annually March 1, 2025, expenditure included land costs of $174,000. Interest revenue of $56,840 earned in 2025. Your answer is correct. Determine the amount of interest to be capitalized in 2025 in relation to the construction of the building. The amount of interest $ $4,640,000 1,856,000 212280arrow_forwardOn December 31, 2016, Headland Inc. borrowed $840,000 at 12% payable annually to finance the construction of a new building. In 2017, the company made the following expenditures related to this building: June 1, $336,000; July 1, $504,000; September 1, $1,008,000; December 1, $504,000. The building was completed in April 2018. Additional information is provided as follows. 1. Other debt outstanding 10-year, 10% bond, dated December 31, 2010, interest payable annually $8,400,000 15-year, 12% note, dated December 31, 2004, interest payable annually $2,100,000 2. Interest revenue earned in 2017 $5,040 Prepare the journal entry to record the capitalization of interest and the recognition of interest expense, if any, at December 31, 2017arrow_forward

- On January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 32 March 1, 2024 June 30, 2024 October 1, 2024 January 31, 2025 April 30, 2025 August 31, 2025 On January 1, 2024, the company obtained a $3 million construction loan with a 10% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2024 and 2025. The company's other interest-bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company's fiscal year-end is December 31. Required: Using the weighted-average interest method, answer the following questions: $ 1,000,000 600,000 800,000 600,000 270,000 585,000 900,000 1.…arrow_forwardOn January 1, 2021, the company obtained a $3 million loan with a 10% interest rate. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 $ 1,080,000 March 1, 2021 900,000 June 30, 2021 320,000 October 1, 2021 700,000 January 31, 2022 720,000 April 30, 2022 1,035,000 August 31, 2022 1,800,000 On January 1, 2021, the company obtained a $3 million construction loan with a 10% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2021 and 2022. The company’s other interest-bearing debt included two long-term notes of $5,000,000 and $7,000,000 with interest rates of 5% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company’s fiscal year-end is December 31. Required: Calculate the amount of interest that Mason should…arrow_forwardOn December 31, 2023, Cheyenne Inc., a public company, borrowed $3 million at 11% payable annually to finance the construction of a new building. In 2024, the company made the following expenditures related to this building structure: March 1, $519,000; June 1, $630,000; July 1, $1.5 million (of which $412,000 was for the roof); December 1, $1.5 million (of which $728,000 was for the building HVAC). Additional information follows: 1. 2. 3. Other debt outstanding: $5-million, 10-year, 12% bond, dated December 31, 2016, with interest payable annually $1.5-million, six-year, 10% note, dated December 31, 2020, with interest payable annually The March 1, 2024 expenditure included land costs of $147,000. Interest revenue earned in 2024 on the unused idle construction loan amounted to $52,400. Determine the interest amount that could be capitalized in 2024 in relation to the building construction. (Do not round intermediate calculations. Round capitalization rate to 2 decimal places, e.g.…arrow_forward

- On January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 $ 1,820,000 March 1, 2024 1,440,000 June 30, 2024 1,640,000 October 1, 2024 1,440,000 January 31, 2025 396,000 April 30, 2025 729,000 August 31, 2025 1,026,000 On January 1, 2024, the company obtained a $4,400,000 construction loan with a 14% interest rate. The loan was outstanding all of 2024 and 2025. The company’s other interest-bearing debt included two long-term notes of $2,000,000 and $8,000,000 with interest rates of 10% and 12%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company’s fiscal year-end is December 31. Required: Calculate the amount of interest that Mason should capitalize in 2024 and 2025 using the specific interest method. What is the total cost of the building?…arrow_forwardOn January 1, 2026, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2027. Expenditures on the project were as follows: During 2026: January 31 March 1 June 30 October 1 During 2027: January 31 April 30 August 31 $1,000,000 600,000 800,000 600,000 270,000 585,000 900,000 On January 1, 2026, the company obtained a $3 million construction loan with a 10% interest rate. The loan was outstanding all of 2026 and 2027. The company's other interest-bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2026 and 2027. Interest is paid annually on all debt. The company's financial year-end is December 31. Required: 1. Calculate the amount of interest that Mason should capitalize in 2026 and 2027. 2. What is the total cost of the building? 3. Calculate the amount of interest expense that will…arrow_forwardPlease help mearrow_forward

- Compute the depreciation expense for the year ended December 31, 2026. Sheridan elected to depreciate the building on a straight-line basis and determined that the asset has a useful life of 30 years and a salvage value of $360,000. (Round answer to O decimal places, e.g. 5,275.) Depreciation expense $ 360000arrow_forwardOn December 31, 2019, Riverbed Inc. borrowed $3,660,000 at 13% payable annually to finance the construction of a new building. In 2020, the company made the following expenditures related to this building: March 1, $439,200; June 1, $732,000; July 1, $1,830,000; December 1, $1,830,000. The building was completed in February 2021. Additional information is provided as follows. 1. Other debt outstanding 10-year, 14% bond, December 31, 2013, interest payable annually $4,880,000 6-year, 11% note, dated December 31, 2017, interest payable annually $1,952,000 2. March 1, 2020, expenditure included land costs of $183,000 3. Interest revenue earned in 2020 $59,780 Prepare the journal entry to record the capitalization of interest and the recognition of interest expense, if any, at December 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the…arrow_forward2. On Dec 31, 2020 Laf borrowed $3,000,000 at 12% payable annually to finance construction of a new building. In 2021 the company made the following expenditures related to this building: March 1, $360,000; June 1, $600,000; July 1, $1,500,000; Dec 1, $1,500,000. The building was completed on April 30, 2022 Other debt outstanding 10 year, $4,000,000, 13% bond, December 31, 2014, interest payable annually 6 year, 10%, $1,600,000 note dated December 31,2018, interest payable March 1, 2021 an additional expenditure was made towards construction of $150,000 Interest revenue earned in 2021 $49,000 What is the weighted average interest rate of debt other than the specific borrowing loan? (Round of interest rate to nearest whole number, so if you calculated .1412 you would write 14) The firm does not need to use the WAIR rate in calculating capitalized interest in order for it to exist Thank you Brendaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education