FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ok

nces

Braxton Technologies, Incorporated, constructed a conveyor for A&G Warehousers that was completed and ready for use on January 1,

2024.

• A&G paid for the conveyor by Issuing a $150,000, four-year note that specified 8% Interest to be paid on December 31 of each

year, and the note is to be repald at the end of four years.

• The conveyor was custom-bullt for A&G, so Its cash price was unknown.

By comparison with similar transactions It was determined that a reasonable Interest rate was 12%.

.

Required:

1. Prepare the Journal entry for A&G's purchase of the conveyor on January 1, 2024.

2. Prepare an amortization schedule for the four-year term of the note

3. Prepare the Journal entry for A&G's third Interest payment on December 31, 2026.

4. If A&G's note had been an installment note to be paid in four equal payments at the end of each year beginning December 31,

2024, what would be the amount of each Installment?

5. By considering the installment payment of requirement 4, prepare an amortization schedule for the four-year term of the

Installment note.

6. Prepare the Journal entry for A&G's third Installment payment on December 31, 2026.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1. FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1)

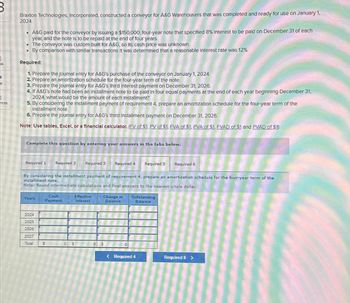

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Years

2024

2025

2026

2027

Total

By considering the installment payment of requirement 4, prepare an amortization schedule for the four-year term of the

installment note.

Note: Round intermediate calculations and final answers to the nearest whole dollar.

Cash

Payment

S

Effective

Interest

Required 4

S

Change in

Balance

Required 5

Outstanding

Balance

< Required 4

Required 6

Required 6 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Early in its fiscal year ending December 31, 2024, San Antonio Outfitters finalized plans to expand operations. The first stage was completed on March 28 with the purchase of a tract of land on the outskirts of the city. The land and existing building were purchased by paying $380,000 immediately and signing a noninterest-bearing note requiring the company to pay $780,000 on March 28, 2026. An interest rate of 8% properly reflects the time value of money for this type of loan agreement. Title search, insurance, and other closing costs totaling $38,000 were paid at closing. At the end of April, the old building was demolished at a cost of $88,000, and an additional $68,000 was paid to clear and grade the land. Construction of a new building began on May 1 and was completed on October 29. Construction expenditures were as follows: May 1 $ 3,900,000 July 30 2,400,000 September 1 1,980,000 October 1 2,880,000 San Antonio borrowed $6,300,000 at 8% on May 1 to help finance…arrow_forwardBlossom Limited purchased a machine on account on April 1, 2021, at an invoice price of $365,470. On April 2, it paid $2,170 for delivery of the machine. A one-year, $4,120 insurance policy on the machine was purchased on April 5. On April 19, Blossom paid $7,580 for installation and testing of the machine. The machine was ready for use on April 30. Blossom estimates the machine's useful life will be five years or 6,118 units with a residual value of $87,910. Assume the machine produces the following numbers of units each year: 893 units in 2021; 1,448 units in 2022; 1,426 units in 2023; 1,222 units in 2024; and 1,129 units in 2025. Blossom has a December 31 year end. (a) Your Answer Correct Answer Your answer is correct. Determine the cost of the machine. acerarrow_forwardHolly Springs, Incorporated contracted with Coldwater Corporation to have constructed a custom-made lathe. The machine was completed and ready for use on January 1, 2024. Holly Springs paid for the lathe by issuing a $330,000 note due in three years. Interest, specified at 2%, was payable annually on December 31 of each year. The cash market price of the lathe was unknown. It was determined by comparison with similar transactions for which 6% was a reasonable rate of interest. Holly Springs uses the effective interest method of amortization. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Prepare the journal entry on January 1, 2024, for Holly Springs' purchase of the lathe. 2. Prepare an amortization schedule for the three-year term of the note. 3. Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity. Complete this question by…arrow_forward

- Early in its fiscal year ending December 31, 2021, San Antonio Outfitters finalized plans to expand operations. The first stage was completed on March 28 with the purchase of a tract of land on the outskirts of the city. The land and existing building were purchased by paying $330,000 immediately and signing a noninterest-bearing note requiring the company to pay $730,000 on March 28, 2023. An interest rate of 8% properly reflects the time value of money for this type of loan agreement. Title search, insurance, and other closing costs totaling $33,000 were paid at closing. At the end of April, the old building was demolished at a cost of $83,000, and an additional $63,000 was paid to clear and grade the land. Construction of a new building began on May 1 and was completed on October 29. Construction expenditures were as follows: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) May 1 July 30 September 1 October 1…arrow_forwardAjayarrow_forwardPrecision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $40.4 million cash on October 1, 2024, to provide working capital for anticipated expansion. Precision signs a one-year, 9% promissory note to Midwest Bank under a prearranged short-term line of credit. Interest on the note is payable at maturity. Each company has a December 31 year-end. Required: 1. Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. 2. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. 3. Prepare the journal entries on September 30, 2025, to record payment of (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entries on October 1, 2024, to record (a) the…arrow_forward

- On December 31, 2024, Tamarisk Inc. borrowed $3,960,000 at 13% payable annually to finance the construction of a new building. In 2025, the company made the following expenditures related to this building: March 1, $475,200; June 1, $792,000; July 1, $1,980,000; December 1, $1,980,000. The building was completed in February 2026. Additional information is provided as follows. 1. 2. 3. (a) Other debt outstanding: 10-year, 14% bond, December 31, 2018, interest payable annually 6-year, 11% note, dated December 31, 2022, interest payable annually March 1, 2025, expenditure included land costs of $198,000. Interest revenue of $64,680 earned in 2025. Your answer is correct Determine the amount of interest to be capitalized in 2025 in relation to the construction of the building. The amount of interest $ eTextbook and Media Date Prepare the journal entry to record the capitalization of interest and the recognition of interest expense, if any, at December 31, 2025. (Credit account titles are…arrow_forwardEarly In Its fiscal year ending December 31, 2021, San Antonio Outfitters finalized plans to expand operations. The first stage was completed on March 28 with the purchase of a tract of land on the outskirts of the city. The land and existing building were purchased by paying $200,000 Immediately and signing a noninterest-bearing note requiring the company to pay $600,000 on March 28, 2023. An Interest rate of 8% properly reflects the time value of money for this type of loan agreement. Title search, Insurance, and other closing costs totaling $20,000 were paid at closing. At the end of April, the old building was demolished at a cost of $70,000, and an additional $50,000 was paid to clear and grade the land. Construction of a new building began on May 1 and was completed on October 29. Construction expenditures were as follows: (FV of $1. PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) May 1 July 30 September 1 October 1…arrow_forwardOntario Resources, a natural energy supplier, borrowed $79.6 million cash on November 1, 2024, to fund a geological survey. The loan was made by Quebec Banque under a short-term financing arrangement. Ontario Resources issued a 6-month, 12% promissory note with interest payable at maturity. Ontario Resources' fiscal period is the calendar year. Required: 1. Prepare the journal entry for the issuance of the note by Ontario Resources. 2. & 3. Prepare the appropriate adjusting entry for the note by Ontario Resources on December 31, 2024 and journal entry for the payment of the note at maturity.arrow_forward

- Holly Springs, Incorporated contracted with Coldwater Corporation to have constructed a custom-made lathe. The machine was completed and ready for use on January 1, 2024. Holly Springs paid for the lathe by issuing a $300,000 note due in three years. Interest, specified at 2%, was payable annually on December 31 of each year. The cash market price of the lathe was unknown. It was determined by comparison with similar transactions for which 6% was a reasonable rate of interest. Holly Springs uses the effective interest method of amortization. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required:1.Prepare the journal entry on January 1, 2024, for Holly Springs’ purchase of the lathe. 2.Prepare an amortization schedule for the three-year term of the note. 3.Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity.arrow_forwardAmber Mining and Milling, Inc., contracted with Truax Corporation to have constructed a custom-made lathe. The machine was completed and ready for use on January 1, 2021. Amber paid for the lathe by issuing a $600,000, three-year note that specified 4% interest, payable annually on December 31 of each year. The cash market price of the lathe was unknown. It was determined by comparison with similar transactions that 12% was a reasonable rate of interest. (FV of $1, PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Complete the table below to determine the price of the equipment. 1-b. Prepare the journal entry on January 1, 2021, for Amber Mining and Milling's purchase of the lathe. 3 2. Prepare an amortization schedule for the three-year term of the note. 3. Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity. Complete this question by…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education