FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

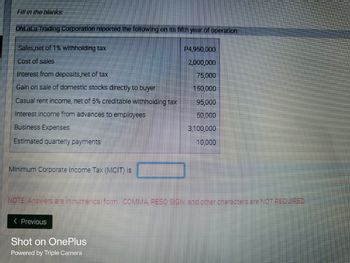

Transcribed Image Text:Fill in the blanks:

OhLaLa Trading Corporation reported the following on its fifth year of operation:

Sales,net of 1% withholding tax

P4,950,000

Cost of sales

2,000,000

Interest from deposits,net of tax

75,000

Gain on sale of domestic stocks directly to buyer

150,000

Casual rent income, net of 5% creditable withholding tax

95,000

Interest income from advances to employees

50,000

Business Expenses

3,100,000

Estimated quarterly payments

10,000

Minimum Corporate Income Tax (MCIT) is

NOTE: Answers are in numerical form. COMMA PESO SIGN and other characters are NOT REQUIRED.

< Previous

Shot on OnePlus

Powered by Triple Camera

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Consider the following simplified financial statements for the Wims Corporation (assuming no income taxes): Income Statement Sales Costs Net income $46,900 41,140 $ 5,760 Balance Sheet Assets $22,700 Debt $ 6,700 Equity 16,000 Sales Costs Net income Total $22,700 Total $22,700 The company has predicted a sales increase of 18 percent. Assume the company pays out half of net income in the form of a cash dividend. Costs and assets vary with sales, ship but debt and equity do not. Prepare the pro forma statements. (Input all amounts as positive values. Do not round intermediate calculations and round your answers to the nearest whole dollar amount.) Pro forma income statement $ 55,342 Assets Total $ $ GA Pro forma balance sheet 26,786 Debt Equity 26,786 Totalarrow_forwardThe trial balance of Plano Company included the following accounts as of December 31, 2024: Sales revenue Interest revenue Gain on sale of investments Debits Credits $ 612,000 77,000 127,000 Cost of goods sold Selling expense Interest expense General and administrative expenses $ 455,000 133,000 23,000 86,000 Plano had 50,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 25%. Required: Prepare a single-step income statement with earnings per share disclosure. Note: Round earnings per share answer to 2 decimal places. PLANO COMPANY Income Statement For the Year Ended December 31, 2024 Revenues and gains: Total revenues and gains Expenses: Total expenses Income before income taxes Eamings per sharearrow_forwardThe Jacks corporation reported the following:i. Net income $ 840,000.00ii. Accounts payable and accruals $1,270,650.00iii. Interest expense $ 305,000.00iv. Return on asset 16%v. Tax rate 30%As the company’s business analyst, you know that Jacks finances only with debt and equity. 45%of its total invested capital is debt. Calculate and interpret the basic earnings power ratio, thereturn on equity, and the return on invested capital. Please show workarrow_forward

- Brown Office Supplies recently reported $4422 in Net Income. It had $9,000 of bonds outstanding that carry a 7.0% interest rate, and its federal-plus-state income tax rate was 40%. How much was EBIT?. O $8,918 O $5,49 O $8,033 O $8000 O $7,223arrow_forwardIn tax year 1, an electronics-packaging firm had a gross income of $33,000,000, $5,000,000 in salaries, $6,000,000 in wages, $1,000,000 in depreciation expenses, a loan principal payment of $250,000, and a loan interest payment of $200,000. Determine the net income of the company in tax year 1. The corporate tax rate is 21%. The net income of the company in tax year 1 is $ (Round to the nearest dollar.)arrow_forwardplease helparrow_forward

- How do I find the missing valuesarrow_forwardThe following data were taken from the year-end records of Nomura Export Company: Statement of Earnings Items Year 1 Sales revenue Cost of sales Gross profit Operating expenses Earnings before income taxes Income tax expense (20%) Net earnings Earnings per share (10,000 shares outstanding) Statement of Earnings Items Sales revenue Cost of sales Gross profit Operating expenses Earnings before income taxes Income tax expense (20%) Net earnings Earnings per share (10000 shares) Required: Fill in all of the missing amounts. (Round "Earnings per share" to 2 decimal places.) Year 1 21,750 ? 68% ? 21,750 ? ? ? 2.90 2.90 $ Year 2 $ 219,000 Year 2 219,000 ? 30% ? 30,000 ? ? ? 30,000arrow_forwardThe most recent financial statements for Mandy Company are shown below: Income Statement Balance Sheet $ 38,000 Debt 96,800 Equity $ 134,800 Total Sales Costs Taxable income Tax (23%) Net Income $ 98,400 Current assets 69,750 Fixed assets. Total Internal growth rate $ 28,650 6,590 $ 22,060 $ 49,200 85,600 $134,800 Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 35 percent dividend payout ratio. No external financing is possible. What is the internal growth rate? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forward

- I just need number 2, thanks!arrow_forwardNonearrow_forwardA corporation earns $8.30 per share before taxes. The corporate tax rate is 39%, the personal tax rate on dividends is 15%, and the personal tax rate on non-dividend income is 36%. What is the total amount of taxes paid per share if the company has a payout ratio of 45%? Answer to two decimals (dollars and cents)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education