FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

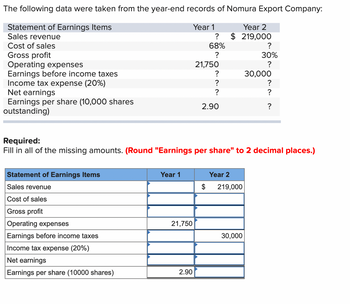

Transcribed Image Text:The following data were taken from the year-end records of Nomura Export Company:

Statement of Earnings Items

Year 1

Sales revenue

Cost of sales

Gross profit

Operating expenses

Earnings before income taxes

Income tax expense (20%)

Net earnings

Earnings per share (10,000 shares

outstanding)

Statement of Earnings Items

Sales revenue

Cost of sales

Gross profit

Operating expenses

Earnings before income taxes

Income tax expense (20%)

Net earnings

Earnings per share (10000 shares)

Required:

Fill in all of the missing amounts. (Round "Earnings per share" to 2 decimal places.)

Year 1

21,750

?

68%

?

21,750

?

?

?

2.90

2.90

$

Year 2

$ 219,000

Year 2

219,000

?

30%

?

30,000

?

?

?

30,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps with 1 images

Knowledge Booster

Similar questions

- Benson Company’s net income was $225,000 for Year 1, $243,750 for Year 2, and $293,160 for Year 3. Assume trend percentages for net income over the three-year period are computed, with Year 1 serving as the base year.The trend percentage for Year 3’s net income is: Select one: A. 117.30% B. 86.36% C. 120.92% D. 130.29%arrow_forwardSnelling Company does business in two regional segments: North and South. The following annual revenue information was determined from the accounting system's invoice data: Segment Current Year Prior Year North $ 75,000 $100,000 South 260,000 220,000 Total revenues $335,000 $320,000 Using horizontal analysis, determine the percentage change in revenues for the South region. Round to one decimal place. Oa. (18.2)% Ob. 84.6% Oc. 15.4% Od. 18.2%arrow_forwardAssume the following sales data for a company: Current year $778,795 Preceding year 600,257 What is the percentage increase in sales from the preceding year to the current year?arrow_forward

- Selected information from the annual financial statements of Delicata Industries is shown below. ($ in thousands) Revenue Operating income Net other income(expense) Net income 240,000 5,600 196,480 Average operating assets 4,200,000 Average operating liabilities 1,800,000 Current Financials $1,500,000 Delicata has an income tax rate of 20%. a. What is Delicata's net operating profit after taxes (NOPAT) for the year? $0 b. Calculate Delicata's net operating profit margin (NOPM) for the year. Result Numerator + Denominator = 0 + $ 0 = NOPM $ c. Calculate Delicata's return on net operating assets (RNOA) for the year. Numerator + Denominator = Result 0 + $ 0 = RNOA $ 96arrow_forwardGiven the following information for Blue Bell Company for last year: Net sales (all on account) $5,200,000 Cost of goods sold 2,080,000 Interest expense 240,000 Income tax expense 280,000 Net income 420,000 Income tax rate 40% Total assets: January 1 $1,800,000 December 31 2,400,000 Shareholders' equity (all common): January 1 1,500,000 December 31 1,600,000 Current assets, December 31 700,000 Quick assets, December 31 400,000 Current liabilities, December 31 300,000 Net accounts receivable: January 1 200,000 December 31 180,000 Inventory: January 1 210,000 December 31 250,000 Refer to Exhibit 4-1. Blue Bell's debt to assets ratio December 31 was A16.7% B26.2% C42.8% D33.3%arrow_forwardUse the info below to answer the following questions: A company reports the following information as of December 31, Year 1: Sales revenue $ 900,000 Cost of goods sold 600,000 Operating Expenses 150,000 Unrealized Holding Gain on Trading securities 70,000 Unrealized Holding Gain on AFS securities 60,000What amount should the company report as net income as of December 31, Year 1? What amount should the company report as comprehensive income as of December 31, Year 1?arrow_forward

- Computing Earnings per Share The income statement, statement of retained earnings, and balance sheet for Jeanette Company are as follows: Jeanette CompanyIncome StatementFor the Year Ended December 31, 20X2 Amount Percent Net sales $8,281,989 100.0% Less: Cost of goods sold (5,383,293) 65.0 Gross margin $2,898,696 35.0 Less: Operating expenses (1,323,368) 16.0 Operating income $1,575,328 19.0 Less: Interest expense (50,000) 0.6 Income before taxes $1,525,328 18.4 Less: Income taxes (40%)* (610,131) 7.4 Net income $915,197 11.0 * Includes both state and federal taxes. Jeanette CompanyStatement of Retained EarningsFor the Year Ended December 31, 20X2 Balance, beginning of period $1,979,155 Net income 915,197 Total $2,894,352 Preferred dividends (80,000) Dividends to common stockholders (201,887) Balance, end of period $2,612,465 Jeanette CompanyComparative Balance SheetsAt December 31,…arrow_forwardThe most recent financial statements for Bradley, Inc., are shown here (assuming no income taxes): Sales Costs Income Statement. Net income Assets: Total EFN $6,800 -4,080 $2,720 Balance Sheet. $20,400 Debt $20,400 Equity Total $10,600 9,800 $20,400 Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $7,752. What is the external financing needed? (A negative value should be indicated by a minus si Do not round intermediate calculations. Round your answer to the nearest whole number.)arrow_forwardPreparing a Single-Step Income Statement The following items are from the adjusted trial balance of Bailey Corp. on December 31, the end of its annual accounting period. Assume an average 25% income tax on all items. Weighted average shares of common stock outstanding for the year were 10,000. Sales revenue Depreciation for the period Rent revenue Gain on sale of investment Cost of goods sold Selling expenses General and administrative expenses Interest revenue Interest expense Loss on sale of investment $645,200 6,000 2,400 2,000 330,000 136,000 110,000 900 1,500 22,000 Prepare a single-step income statement for the 12 months ended December 31, including the earnings per share disclosures. Report income taxes in its own section. Note: Enter the answer for earnings per share in dollars and cents, rounded to the nearest penny. Note: Do not enter any negative signs with your answers.arrow_forward

- Selected data from the financial statements of Rags to Riches are provided below: Current Year Prior Year Accounts Receivable $120,000 $ 76,000 Inventory 24,000 32,000 Total Assets 900,000 760,000 Net Sales 760,000 540,000 Cost of Goods Sold 320,000 420,000 Which of the following would result from vertical analysis of the company's income statement? a. The accounts receivable turnover ratio is 7.76 in the current year. b. Gross profit is 57.9% of net sales for the current year. c. Net sales are 84.4% of total assets for the current year. d. Cost of goods sold decreased by $50,000 or 23.8% duringarrow_forwardConsider the following financial statement data for Hi-Tech Instruments: For the Year Ended December 31 (Thousands of Dollars, except Earnings per Share) Sales revenue $218,000 Cost of goods sold 133,000 Net income 16,300 Dividends 10,600 Earnings per share $4.15 HI-TECH INSTRUMENTS, INC. Balance Sheets (Thousands of Dollars) Current Year Prior Year Assets Cash $26,300 $26,000 Accounts receivable (net) 54,000 49,000 Inventory 47,500 51,700 Total Current Assets 127,800 126,700 Plant assets (net) 60,600 58,500 Other assets 23,600 21,800 Total Assets $212,000 $207,000 Liabilities and Stockholders’ Equity Notes payable—banks $14,000 $14,000 Accounts payable 30,500 26,700 Accrued liabilities 24,500 29,000 Total Current Liabilities 69,000 69,700 9% Bonds payable 48,000 48,000 Total Liabilities 117,000 117,700 Common stock 50,000 50,000 Retained earnings 45,000 39,300 Total Stockholders’ Equity 95,000 89,300…arrow_forwardCommon-Size Income StatementsConsider the following income statement data from the Ross Company: Current Year Previous Year Sales revenue $529,000 $454,000 Cost of goods sold 336,000 279,000 Selling expenses 109,000 103,000 Administrative expenses 64,000 58,000 Income tax expense 7,800 5,400 Prepare common-size income statements for each year. Note: Round answers to one decimal place (ex: 0.2345 = 23.5%). Note: Compute percentages for each "Total" (do not add prior percentage amounts to arrive at Totals). ROSS COMPANYCommon-Size Income Statements(Percent of Sales Revenue) Current Year Previous Year Sales Revenue Answer Answer Cost of Goods Sold Answer Answer Answer Answer Answer Answer Selling Expenses Answer Answer Administrative Expenses Answer Answer Total Answer Answer Income before Income Taxes Answer Answer Answer Answer Answer Answer Answer Answer PreviousSave AnswersNextarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education