FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

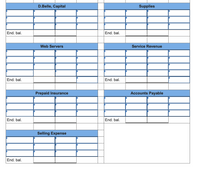

Transcribed Image Text:Fill in each of following T-accounts for Belle Co's seven transactions listed here. The T-accounts represent Belle Co's general ledger.

Code each entry with transaction number 1 through 7 (in order) for reference.

1. D. Belle created a new business and invested $6,700 cash, $7,600 of equipment, and $10,800 in web servers.

2. The company paid $4,000 cash in advance for prepaid insurance coverage.

3. The company purchased $700 of supplies on account.

4. The company paid $600 cash for selling expenses.

5. The company received $4,500 cash for services provided.

6. The company paid $700 cash toward accounts payable.

7. The company paid $2,900 cash for equipment.

Cash

Equipment

End. bal.

End. bal.

D.Belle, Capital

Supplies

End. bal.

End. bal.

Transcribed Image Text:D.Belle, Capital

Supplies

End. bal.

End. bal.

Web Servers

Service Revenue

End. bal.

End. bal.

Prepaid Insurance

Accounts Payable

End. bal.

End. bal.

Selling Expense

End. bal.

Expert Solution

arrow_forward

Step 1

As per double entry system of accounting, for every transaction atleast two accounts should be effected. Atleast one account should be debited and atleast one account should be credited.

Accounting equation that is:

Assets = Liabilities + Equity, should be equal after every transaction recording.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use below information to prepare general journal entries for Belle Co.'s 1 through 7 transactions. 1. D. Belle created a new business and invested $5,900 cash, $6,900 of equipment, and $12,900 in web servers. 2. The company paid $6,000 cash in advance for prepaid insurance coverage. 3. The company purchased $800 of supplies on account. 4. The company paid $600 cash for selling expenses. 5. The company received $6,000 cash for services provided. 6. The company paid $800 cash toward accounts payable. 7. The company paid $4,000 cash for equipment. View transaction list Journal entry worksheet A B C D E F G Record the cash payment for purchase of equipment. Note: Enter debits before credits. Transaction General Journal Debit Credit 7.arrow_forwardLes Stanley established an insurance agency on July 1, 20Y5, and completed the following transactions during July: Opened a business bank account in the name of Stanley Insurance Inc., with a deposit of $65,000 in exchange for common stock. Borrowed $120,000 by issuing a note payable. Received cash from fees earned, $40,000. Paid rent on office and equipment for the month, $5,000. Provided service to customers on account, $ 20,000. Paid automobile expense for the month, $3,500, and miscellaneous expense, $1,000. Paid office salaries, $6,500. Paid interest on the note payable, $500. Purchased land as a future building site, paying cash of $100,000. Paid dividends, $3,000. Instructions Indicate the effect of each transaction and the balances after each transaction, using the integrated financial statement frameworkarrow_forwardPrepare general journal entries for the following transactions of a new company called Pose-for-Pics. Use the following partial chart of accounts: Cash; Supplies; Prepaid Insurance; Equipment; M. Harris, Capital; Services Revenue; and Utilities Expense. Aug. 1 M. Harris, the owner, invested $6,500 cash and $33,500 of photography equipment in the company. The company paid $2,100 cash for an insurance policy covering the next 24 months. The company purchased supplies for $880 cash. ots ofant The company received $3,331 cash from taking photos for customers. 31 The company paid $675 cash for August utilities. 2 5 20 mot Rost goneral iournal entries that impact casharrow_forward

- Prepare general journal entries for the following transactions of a new company called Pose-for-Pics. Use the following (partial) chart of accounts: Cash; Office Supplies; Prepaid Insurance; Photography Equipment; M. Harris, Capital; Photography Fees Earned; and Utilities Expense. Aug. 1 Madison Harris, the owner, invested $6,500 cash and $33,500 of photography equipment in the company. 2 The company paid $2,100 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $880 cash. 20 The company received $3,331 cash in photography fees earned. 31 The company paid $675 cash for August utilitiesarrow_forwardSaved Help During the month, a company enters into the following transactions: 1. Borrows $3,200 of cash from the bank by signing a formal agreement to repay the loan in 2 years. 2. Buys $4,000 of new equipment on account. 3. Pays off $2,400 of accounts payable. 4. Pays off $1,200 of notes payable. Required: a. Show the effect of these transactions on the basic accounting equation. b. Prepare the journal entries that would be used to record the transactions. Complete this question by entering your answers in the tabs below. Required A Required B Show the effect of these transactions on the basic accounting equation. (Enter any decreases to account balances with a minus sign.) Transaction Analysis Liabilities + Stockholders' Equity Assets + = 1. + 2. + = 3. + 4. > Required A Required Barrow_forwardDeb Kelley opens a web consulting business called Smart Deals andcompletes the following transactions in its first month of operations.Prepare journal entries for each transaction and identify the financialstatement impact of each entry. The financial statements are automatically generated based on thejournal entries recorded.Apr. 1 Kelley invested $110,000 cash along with officeequipment valued at $31,000 in the company.Apr. 2 The company prepaid $15,000 cash for 12 months' rent foroffice space. The company's policy is record prepaidexpenses in balance sheet accounts.Apr. 3 The company made credit purchases for $9,000 in officeequipment and $4,600 in office supplies. Payment is duewithin 10 days.Apr. 6 The company completed services for a client andimmediately received $7,000 cash.Apr. 9 The company completed a $11,000 project for a client,who must pay within 30 days.Apr. 13 The company paid $13,600 cash to settle the accountpayable created on April 3.Apr. 19 The company paid $4,800…arrow_forward

- Required Informatlon [The following Information applies to the questions displayed below.] On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $83,010 in assets to launch the business. On October 31, the company's records show the following items and amounts. Cash withdrawals by owner Consulting revenue Cash $14,8980 930 Accounts receivable 12,820 12,820 Office supplies 2,290 Rent expense 2,530 Land 45,960 Salaries expense 5,780 Office equipment Accounts payable Telephone expense Miscellaneous expenses 16,900 790 7,678 610 Owner investments 83,010 Using the above Information prepare an October Income statement for the business. ERN ST CON SULTING Income Statementarrow_forwardUse below information to prepare general journal entries for Belle Co's 1 through 7 transactions. 1. D. Belle created a new business and invested $5,900 cash, $6,900 of equipment, and $12,900 in web servers 2. The company paid $6,000 cash in advance for prepaid insurance coverage. 3. The company purchased $800 of supplies on account. 4. The company paid $600 cash for selling expenses. 5. The company received $6,000 cash for services provided. 6. The company paid $800 cash toward accounts payable. 7. The company paid $4,000 cash for equipment. View transaction list Journal entry worksheet A В C D E F G > Record the cash received from customer for services provided. Note: Enter debits before credits. Transaction General Journal Debit Credit 5.arrow_forwardRequired information [The following information applies to the questions displayed below.] The transactions of Belle Company appear below. 1. D. Belle created a new business and invested $5,600 cash, $6,000 of equipment, and $11,100 in web servers in exchange for common stock. 2. The company paid $4,600 cash in advance for prepaid insurance coverage. 3. The company purchased $800 of supplies on credit. 4. The company paid $600 cash for selling expenses. 5. The company received $5,200 cash for services provided. 6. The company paid $800 cash toward accounts payable. 7. The company paid $3,300 cash for equipment. Use above information to prepare general journal entries for Belle Company's 1 through 7 transactions. View transaction list Journal entry worksheet A C D F G > Record the owner investment.arrow_forward

- Required Information View transaction list Journal entry worksheet A в . с Transaction 1. CD Record the owner Investment. Note: Enter debits before credits. Record entry DE F General Journal Clear entry G Debit Credit View general Journalarrow_forwardJOURNAL ENTRIES, LEDGERS, AND TRIAL BALANCE After opening their computer sales and service store, the Millers completed the following four transactions: 1. They invested $100,000 in cash in the business. 2. They purchased on credit $10,000 worth of goods from several suppliers. 3. They sold on a cash basis $13,000 worth of products and services. 4. They paid $3,000 for salaries. Use the above information to prepare the following: 1. Journal entries 2. Ledgers 3. Trial balancearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education