Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with accounting questions

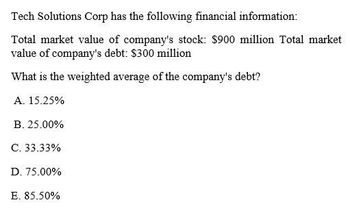

Transcribed Image Text:Tech Solutions Corp has the following financial information:

Total market value of company's stock: $900 million Total market

value of company's debt: $300 million

What is the weighted average of the company's debt?

A. 15.25%

B. 25.00%

C. 33.33%

D. 75.00%

E. 85.50%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Klynveld Companys balance sheet shows total liabilities of 94,000,000, total stockholders equity of 75,000,000, and total assets of 169,000,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.arrow_forwardFood shoppe galore had the following information solve this questionarrow_forwardABC Corporation has the following balance sheet. How much net operating working capital does the firm have? Cash Short-term investments Accounts receivable Inventory Current assets Net fixed assets Total assets O a. $285.00 O b. $15.00 O c. $68.00 O d. $82.00 Oe. $232.00 $10 Accounts payable Accruals 84 Notes payable 56 Current liabilities $150 Long-term debt 100 Common equity Retained earnings Total liab. & equity $250 $22 60 53 $135 30 30 55 $250arrow_forward

- please show your answer with workings and explanation.arrow_forwardThe following data pertains to Xena Corp. Xena Corp. Total Assets $23,610 Interest-Bearing Debt (market value) $11,070 Average borrowing rate for debt 10.2% Common Equity: Book Value $6,150 Market Value $25,830 Marginal Income Tax Rate 37% Market Beta 1.73 Using the information from the table, calculate Xena's cost of debt capitalarrow_forwardJordan Manufacturing reports the following capital structure: Current liabilities P100,000 ; Long-term debt 400,000 ; Deferred income taxes 10,000 ; Preferred stock 80,000 ; Common stock 100,000 ; Premium on common stock 180,000 ; Retained earnings 170,000. What is the debt ratio? A. 0.48 B. 0.49 C. 0.93 D. 0.96arrow_forward

- The Jacks corporation reported the following:i. Net income $ 840,000.00ii. Accounts payable and accruals $1,270,650.00iii. Interest expense $ 305,000.00iv. Return on asset 16%v. Tax rate 30%As the company’s business analyst, you know that Jacks finances only with debt and equity. 45%of its total invested capital is debt. Calculate and interpret the basic earnings power ratio, thereturn on equity, and the return on invested capital. Please show workarrow_forwardCurrent assets Long-term assets Total Locust Farming Balance Sheet ($ in millions) $ 42,524 46,832 Current liabilities Long-term debt Other liabilities Equity $ 89,356 Total $ 29,755 27,752 14,317 17,532 $ 89,356 Locust has 657 million shares outstanding with a market price of $83 a share. a. Calculate the company's market value added. b. Calculate the market-to-book ratio. c. How much value has the company created for its shareholders as a percent of shareholders' equity, that is, as a percent of the net capital contributed by shareholders?arrow_forwardWhat is the company's Debt to equity ratio on these general accounting question?arrow_forward

- What is the company's debt to equity ratio on these general accounting question?arrow_forwardXitin Inc. has the following balance sheet. How much total operating capital does the firm have? Cash $ 63.00 Accounts payable $ 515.00 Short-term investments 117.00 Accruals 281.00 Accounts receivable 246.00 Notes payable 122.00 Inventory 392.00 Current liabilities $918.00 Current assets $818.00 Long-term debt 246.00 Gross fixed assets $647.00 Common stock 56.00 Accumulated depreciation 77.00 Retained earnings Net fixed assets Total assets $475 O $470 $552 $665 O $670 168.00 $570.00 Total common equity $224.00 $1,388.00 Total liab. & equity $1,388.00arrow_forwardIf a company’s debt-to-value ratio is 40% calculate its debt-to-equity ratio. If the dollar value of the company’s debt is $200 million calculate its market value of equity and its market value of assets. Show all calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning