FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

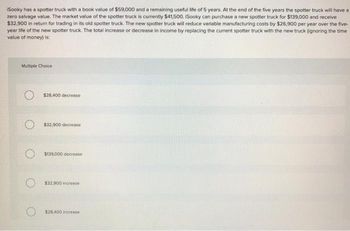

Transcribed Image Text:iSooky has a spotter truck with a book value of $59,000 and a remaining useful life of 5 years. At the end of the five years the spotter truck will have a

zero salvage value. The market value of the spotter truck is currently $41,500. iSooky can purchase a new spotter truck for $139,000 and receive

$32,900 in return for trading in its old spotter truck. The new spotter truck will reduce variable manufacturing costs by $26,900 per year over the five-

year life of the new spotter truck. The total increase or decrease in income by replacing the current spotter truck with the new truck (ignoring the time

value of money) is:

Multiple Choice

$28,400 decrease

$32,900 decrease

$139,000 decrease

$32.900 increase

$28,400 increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Roadrunner Freight Company owns a truck that cost $42,000. Currently, the truck’s book value is $24,000, and its expected remaining useful life is four years. Roadrunner has the opportunity to purchase for $31,200 a replacement truck that is extremely fuel efficient. Fuel cost for the old truck is expected to be $6,000 per year more than fuel cost for the new truck. The old truck is paid for but, in spite of being in good condition, can be sold for only $14,400.Calculate the total relevant costs. Should Roadrunner replace the old truck with the new fuel-efficientmodel, or should it continue to use the old truck until it wears out? Keep Old Replace with New Total Relevant Costarrow_forwardBuiltrite is considering the purchase of a new five-year machine worth $90,000. It will cost another $10,000 to install the machine and Builtrite will need to keep an extra $9,000 in inventory on hand due to the machine's efficiency. The current machine being used is 5 years old and originally cost $60,000 and is being depreciated down to zero over a 10-year period. If the current machine were sold today, it could be sold for $45,000. In five years, the new machine is estimated to have a salvage value of $36,000. Two employees will need to be trained for the new machine at a cost of $4000. The new machine is expected to produce $80,000 in annual savings. Builtrite is in the 34% tax bracket. What is the terminal cash flow for the new machine? O $23.760 O $31,800 O $32,760arrow_forwardGranfield Company has a piece of manufacturing equipment with a book value of $48,500 and a remaining useful life of four years. At the end of the four years the equipment will have a zero-salvage value. Granfield can purchase new equipment for $171,000 and receive $28,800 in return for trading in its current equipment. The current equipment has variable manufacturing costs of $56,000 per year. The new equipment will reduce variable manufacturing costs by $27,500 per year over its four-year life. The total increase or decrease in income by replacing the current equipment with the new equipment is: Multiple Choice $32,200 increase $110,000 increase $16,300 decrease $74,950 increase $32,200 decreasearrow_forward

- Memanarrow_forwardRoadrunner Freight Company owns a truck that cost $42,000. Currently, the truck’s book value is $24,000, and its expected remaining useful life is four years. Roadrunner has the opportunity to purchase for $31,200 a replacement truck that is extremely fuel efficient. Fuel cost for the old truck is expected to be $6,000 per year more than fuel cost for the new truck. The old truck is paid for but, in spite of being in good condition, can be sold for only $14,400.RequiredCalculate the total relevant costs. Should Roadrunner replace the old truck with the new fuel-efficient model, or should it continue to use the old truck until it wears out?arrow_forwardDeYoung Entertainment Enterprises is considering replacing the latex molding machine it uses to fabricate rubber chickens with a newer, more efficient model. The old machine has a book value of $450,000 and a remaining useful life of 5 years. The current machine would be worn out and worthless in 5 years, but DeYoung can sell it now to a Halloween mask manufacturer for $135,000. The old machine is being depreciated by $90,000 per year for each year of its remaining life. If DeYoung doesn't replace the old machine, it will have no salvage value at the end of its useful life. The new machine has a purchase price of $775,000, an estimated useful life and MACRS class life of 5 years, and an estimated salvage value of $105,000. The applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. Being highly efficient, it is expected to economize on electric power usage, labor, and repair costs, and, most importantly, to reduce the number of defective chickens. In total,…arrow_forward

- Builtrite is considering purchasing a new machine that would cost $60,000 and the machine would be depreciated (straight line) down to $0 over its five-year life. At the end of four years, it is believed that the machine could be sold for $30,000. The current machine being used was purchased 3 years ago at a cost of $40,000 and it is being depreciated down to zero over its 5-year life. The current machine's salvage value now is $12,000. The new machine would increase EBDT by $56,000 annuall Builtrite's marginal tax rate is 34%. What is the TCF associated with the purchase of this new machine if it is sold at the end of year 4? Ⓒ$30,000 $23,880 $20,500 $19,800arrow_forwardBenson Freight Company owns a truck that cost $47,000. Currently, the truck’s book value is $22,000, and its expected remaining useful life is five years. Benson has the opportunity to purchase for $30,300 a replacement truck that is extremely fuel efficient. Fuel cost for the old truck is expected to be $7,000 per year more than fuel cost for the new truck. The old truck is paid for but, in spite of being in good condition, can be sold for only $19,000.RequiredCalculate the total relevant costs. Should Benson replace the old truck with the new fuel-efficient model, or should it continue to use the old truck until it wears out?arrow_forwardA commercial oven with a book value of $87,000 has an estimated remaining 5-year life. A proposal is offered to sell the oven for $8,500 and replace it with a new oven costing $110,000. The new machine has a 5-year life with no residual value. The new machine would reduce annual maintenance costs by $23,000. Provide a differential analysis, in good form, on the proposal to replace the commercial oven.arrow_forward

- Calligraphy Pens is deciding when to replace its old machine. The machine's current salvage value is $3,050,000. Its current book value is $1,800,000. If not sold, the old machine will require maintenance costs of $710,000 at the end of the year for the next five years. Depreciation on the old machine is $360,000 per year. At the end of five years, it will have a salvage value of $155,000 and a book value of $0. A replacement machine costs $4,650,000 now and requires maintenance costs of $380,000 at the end of each year during its economic life of five years. At the end of the five years, the new machine will have a salvage value of $745,000. It will be fully depreciated by the straight-line method. In five years, a replacement machine will cost $3,650,000. The company will need to purchase this machine regardless of what choice it makes today. The corporate tax rate is 25 percent and the appropriate discount rate is 7 percent. The company is assumed to earn sufficient revenues to…arrow_forwardVijayarrow_forwardPayash Freight Company owns a truck that cost $31,000. Currently, the truck's book value is $23,000, and its expected remaining useful life is four years. Payash has the opportunity to purchase for $24,000 a replacement truck that is extremely fuel efficient. Fuel cost for the old truck is expected to be $5,900 per year more than fuel cost for the new truck. The old truck is paid for but, in spite of being in good condition, can be sold for only $14,000. Required Calculate the total relevant costs. Should payash replace the old truck with the new fuel-efficient model, or should it continue to use the old truck until it wears out?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education