ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

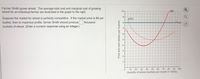

Transcribed Image Text:Farmer Smith grows wheat. The average total cost and marginal cost of growing

wheat for an individual farmer are illustrated in the graph to the right.

10-

MC

9-

ATC

Suppose the market for wheat is perfectly competitive. If the market price is $8 per

bushel, then to maximize profits, farmer Smith should produce thousand

8-

Price

bushels of wheat. (Enter a numeric response using an integer.)

4-

3-

2-

10 20 30 40

Quantity of wheat (bushels per month in 1000s)

50

60

70

80

90 100

Price and cost (dollars per bushel)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- you've been learning about what makes a market perfectly competitive, how a firm in a perfectly competitive market makes profit-maximizing decisions, and how a perfectly competitive market moves towards equilibirium. But how applicable is this to real life? For this discussion, try to think of a market (for a product or service) that is perfectly competitive or very close to it. What characteristics of the market make it like perfect competition? Are there factors that keep it from being perfectly competitive? If so, what are they? How close do you think the firms in this market are to perfectly competitive firms in choosing equilibrium price and quantity?arrow_forwardSuppose the market for peaches is perfectly competitive. The short-run average total cost and marginal cost of growing peaches for an individual grower are illustrated in the figure to the right. Assume that the market price for peaches is $30.00 per box. What is the profit-maximizing quantity for peach growers to produce? boxes. (Enter your response as an integer.) At this level of output, profit will be $. (Enter your response rounded to the nearest dollar.) Peach growers will earn positive economic profit in the short run at any market price above $ per box. (Enter your response rounded to one decimal place.) Price (dollars per box) 40- 36- 32- 28- 24 20 16- 12- 8 4- 10 MC 20 30 40 50 60 70 80 Output (boxes of peaches per day) ▬▬ ATC 90 100 Qarrow_forwardThe accompanying graph depicts the cost curves of an individual firm in a perfectly (or purely) competitive industry.arrow_forward

- Brody's firm produces trumpets in a perfectly competitive market. The table below shows Brody's total variable cost. He has a fixed cost of $240, and the price per trumpet is $60.-Calculate the average total cost of producing 6 trumpets. Show your work. -Calculate the marginal cost of producing the 11th trumpet. -What is Brody's profit-maximizing quantity? Use marginal analysis to explain your answer. -At the profit-maximizing quantity you determined in part (c), calculate Brody's profit or loss. Show your work. -Brody also produces saxophones at a loss in a perfectly competitive market. Draw a correctly labeled graph for Brody's firm showing the following at a market price of $200. -Brody's profit-maximizing quantity of saxophones -Brody's loss, completely shaded Quantity Total Variable cost 6 $120 7 $145 8 $165 9 $220 10 $290 11 $390arrow_forwardPlease give a detailed answer to the question below and make sure it is 100% correct.arrow_forward$11.00 MC| $10.00 $9.00 ATC $8.00 $7.00 TRAVCI $6.00 $5.00 $4.00 $3.00 2 3 7 9 10 Quantity of Output (q) Pierre is a photographer in a perfectly competitive market. The graph shown above gives his MC, ATC and AVC curves. Suppose the market price is $10.50. How much profit does Pierre make? 22.5 24 20 O18 S per unitarrow_forward

- Sarge's Lawn Mowing Service is a small business a perfectly competitive market. The prevailing market price of lawn mowing is $20 per acre. Sarge's costs are given by total cost = 0.1q² + 10q + 50, where q = the number of acres Sarge chooses to cut a day. How many acres should Sarge choose to cut to maximize profit? values without any comma, or decimal places.) How much is Sarge's maximum daily profit? your answer in numerical values without any dollar sign, comma or decimal place (please put your answer in numerical (please putarrow_forwardConsider the perfectly competitive market for sports jackets. The following graph shows the marginal cost ( MCMC ), average total cost ( ATCATC ), and average variable cost ( AVCAVC ) curves for a typical firm in the industry.arrow_forwardV4arrow_forward

- The Invisible Hand Principle states that individuals' independent efforts to maximize their gains will generally be beneficial for society and result in the socially optimal allocation of resources (Need help? Read chapter 4.6 of the textbook, here: https://playconomics.com/textbooks/view/playconomics4-2019t3/part2/ch4/s6) in any type of market. particularly in the short run. if the market is perfectly competitive. if firms are free to enter but not to exit the market. None of these.arrow_forwardThe following graph shows the demand curve, as well as the AVC, ATC and MC curves of a company selling rolled oats in a perfectly competitive market. Use the graph to answer the questions. The goal of the company is to maximize its profit. How many boxes of rolled oats should it sell to attain this goal? What price will it charge? How much profit does this firm make per month? Will this company produce or shut down in the short run? Why? Will this firm exit the market for rolled oats in the long run or not? Why?arrow_forwardSuppose the cost of renting a snowy bus were to fall from $30 per hour to $20 per hour. What do you expect would happen in the short-run (stage 1 equilibrium) to (a) the number of cones produced by each snowy bus; (b) total production of cones in the market, and (c) economic profits of snowy bus businesses? Briefly explain (you don't need to do any calculations, just explain inwords).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education