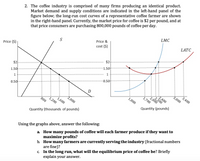

The coffee industry is comprised of many firms producing an identical product. Market demand and supply conditions are indicated in the left-hand panel of the figure below; the long-run cost

Using the graphs shown in the images find:

a. How many pounds of coffee will each farmer produce if they want to maximize profits?

b. How many farmers are currently serving the industry (fractional numbers are fine)?

c. In the long run, what will the

An industry comprised of many firms producing an identical product ia a perfect competitive industry. A firm under perfect competition is a price taker and can sell any quantity of commodity at the market determined price.

Step by stepSolved in 2 steps

- The following graph plots daily cost curves for a firm operating in the competitive market for demin overalls. Hint: Once you have positioned the rectangle on the graph, select a point to observe its coordinates. PRICE (Dollars per overalls) 50 10 10 5 0 MC 2 ATC 8 18 QUANTITY (Thousands of overallises per day) AVC 10 20 Profit or Loss In the short run, given a market price equal to $15 per overalls, the firm should produce a daily quantity of On the preceding graph, use the blue rectangle (circle symbols) to fill in the area that represents profit or loss of the firm given the market price of $15 and the quantity of production from your previous answer. Note: In the following question, enter a positive number regardless of whether the firm earns a profit or incurs a loss. The rectangular area represents a short-run thousand per day for the firm. $ overallses.arrow_forwardThe graph shows the Cost curves for a profit maximizing firm in a competitive market. If the market price is $30 and the firm produces at the profit maximum quantity, what is the amount of the total fix costarrow_forwardAt a market price of $5 your artisanal pencil business maximizes profits by producing 484 pencils per day. When you produce this quantity of pencils per day, your average cost per unit is $4. What is your total revenue per day? $ What is your total cost per day? $ What is your daily profit? $arrow_forward

- For the pizza seller whose marginal, average variable, and average total cost curves are shown in the graph below, what is the profit-maximizing level of output and how much profit will this producer earn if the price of pizza is $1.50 per slice?Instructions: In the graph below, label all three curves by clicking on the dropdown to select the appropriate label. Instructions: Enter your response as a whole number. If you are entering a negative number, be sure to include a negative sign (−). When the price is $1.50 per slice, the profit-maximizing level of output is slices per day. Instructions: Enter your response rounded to the nearest penny (two decimal places). At the profit-maximizing level of output, the producer's profit is: $ per day.arrow_forwardYou are a fleet manager for a transportation company and, as such, are interested in the changes in the gasoline market since gasoline is an input of production for your company. A hurricane in the Gulf of Mexico disrupts oil refineries. In the short-run, you predict that this hurricane will, all else equal, Select one: a. Increase the supply of gasoline, pushing down its price and increasing your company's profit. b. Decrease the demand for gasoline, pushing down its price and reducing your company's profit. c. Decrease the supply of gasoline, pushing up its price and reducing your company's profit. d. Increase the demand for gasoline, pushing up its price and increasing your company's profit.arrow_forwardThe table shows cost data for a firm that is selling in a perfectly competitive market. This firm's minimum average variable cost is $14 and has fixed costs equal to $100. Output 5 7 9 11 11 units 9 units Refer to the above cost table. If the price of the product is $26, the firm will produce Select TWO answers from the choices below; one selection is the number of units produced and the second selection is the dollar amount of the loss earned by the firm. ✔$100 $30 $28 $0 7 units 00 units 5 units ATC $34.00 30.00 30.55 33.09 $182 MC $13 26 35 48 for a loss.arrow_forward

- In competitive markets, there are many small firms with each firm unable to influence the market price. Suppose company ABX operates in the wheat market. The company produces and markets wheats at a Price = $20 per container. The firm’s total costs are given as: TC = 50 +2Q + 3Q2 What is the firm Fixed Cost? Why? Also, use a graph to support your answerarrow_forwardThe table shows cost data for a firm that is selling in a perfectly competitive market. This firm's minimum average variable cost is $14 and has fixed costs equal to $100. Output 5 7 9 11 $30 Refer to the above cost table. If the price of the product is $26, the firm will produce loss. 7 units 9 units Select TWO answers from the choices below, one selection is the number of units produced and the second selection is the dollar amount of the loss earned by the firm. $28 $100 $0 $182 11 units ATC $34.00 30.00 30.55 33.09 O units MC $13 5 units 26 35 48 for aarrow_forwardSuppose that the market for dress shirts is a competitive market. The following graph shows the daily cost curves of a firm operating in this market. 50 18, 42 45 40 35 30 ATC 25 20 15 AVC 10 MC 2 4 6 8 10 12 14 16 18 20 QUANTITY (Thousands of shirts) For each price in the following table, calculate the firm's optimal quantity of units to produce, and determine the profit or loss if it produces at that quantity, using the data from the graph to identify its total variable cost. Assume that if the firm is indifferent between producing and shutting down, it will produce. (Hint: You can select the purple points [diamond symbols] on the graph to see precise information on average variable cost.) Price Quantity Total Revenue Fixed Cost Variable Cost Profit (Dollars per shirt) (Shirts) (Dollars) (Dollars) (Dollars) (Dollars) 12.50 7,500 135,000 27.50 135,000 45.00 135,000 If the firm shuts down, it must incur its fixed costs (FC) in the short run. In this case, the firm's fixed cost is…arrow_forward

- The table below shows the weekly marginal cost (MC) and average total cost (ATC) for Buddies, a purely competitive firm that produces novelty ear buds. Assume the market for novelty ear buds is a competitive market and that the price of ear buds is $6.00 per pair. Buddies Production Costs Quantity MC ATC of Ear Buds ($) ($) 20 1.00 25 2.00 1.20 30 2.46 1.41 35 3.51 1.71 40 4.11 2.01 45 5.43 2.39 50 5.99 2.75 55 8.47 3.27 Instructions: In part a, enter your answer as the closest given whole number. In parts b-d, round your answers to two decimal places. a. If Buddies wants to maximize profits, how many pairs of ear buds should it produce each week? pairs b. At the profit-maximizing quantity, what is the total cost of producing ear buds? 2$ c. If the market price for ear buds is $6 per pair, and Buddies produces the profit-maximizing quantity of ear buds, what will Buddies profit or loss be per week? 2$arrow_forwardConsider the market for ice cream. Suppose that this market is perfectly competitive. The cost structure of the typical ice cream producer is as follows. Average total cost is equal to 50 1 1 ATC(Q) +÷Q, average variable cost is equal to AVC(Q) =;Q, and marginal cost is equal to 2 MC(Q) = Q. Now, suppose that a new scientific study comes out that shows that soil pollution from rock salt (a key input for making ice cream) is extremely hazardous to human health. In response, the government decides to impose harsh re-zoning restrictions on any land once used for making ice cream. This reduces the market rent for land used to make ice cream, which in turn lowers the opportunity cost of operating an ice cream factory. This reduction in the opportunity cost of capital causes the total fixed cost of ice cream production to fall to 32, but there is no change to variable cost. Give formulas for the typical ice cream producer's new average total cost curve ATC(Q) and marginal cost curve MC(Q).arrow_forwardExplain how the following events may affect the profit rate for a U.S. firm and industry (be sure to define your measure(s) of the profit rate) :Consider both the immediate impact and the possible long run implications: (1) across firms within an industry; (2) across industries and (3) across nations please long and mindful answers that covers all three categories. j) Removal of all subsidies to the U.S. agriculture sector k) Reduction in the federal tax rate on profit incomearrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education