Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I need answer of this question general accounting

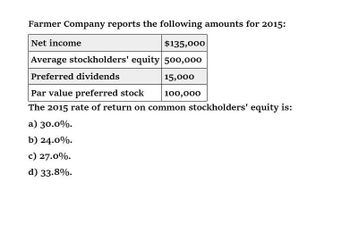

Transcribed Image Text:Farmer Company reports the following amounts for 2015:

Net income

$135,000

Average stockholders' equity 500,000

Preferred dividends

Par value preferred stock

15,000

100,000

The 2015 rate of return on common stockholders' equity is:

a) 30.0%.

b) 24.0%.

c) 27.0%.

d) 33.8%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)arrow_forward

- Ratio Analysis MJO Inc. has the following stockholders equity section of the balance sheet: On the balance sheet date, MJOs stock was selling for S25 per share. Required: Assuming MJOs dividend yield is 1%, what are the dividends per common share? Assuming MJOs dividend yield is 1% and its dividend payout is 20%, what is MJOs net income?arrow_forwardEarnings per share Financial statement data for the years ended December 31 for Black Bull Inc. follows: 2016 2015 Net income 2,485,700 1,538,000 Preferred dividends 50,000 50,000 Average number of common shares outstanding 115,000 shares 80,000 shares a. Determine the earnings per share for 2016 and 2015. b. Does the change in the earnings per share from 2015 to 2016 indicate a favorable or an unfavorable trend?arrow_forwardThe Castle Company recently reported net profits after taxes of $15.8 million. It has 2.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company’s stock currently trades at $60 per share. Compute the stock’s earnings per share (EPS). What is the stock’s P/E ratio? Determine what the stock’s dividend yield would be if it paid $1.75 per share to common stockholders.arrow_forward

- Given the following year-end information for Somerset Corporation, compute its basic earnings per share. Net income, 13,000 Preferred dividends declared, 4,000 Weighted average common shares for the year, 4,500arrow_forwardFinancial leverage Costco Wholesale Corporation (COST) and Wel-Mart Stroes Inc. (WMT)reported the following data (in milllions) for a recent year: Compute the return on stockholders equity. Round to one decimal place.arrow_forwardSuppose the following financial information is available for Walgreen Company. (in millions) 2017 2016 Average common stockholders' equity $12,990.0 $11,690.0 Dividends declared for common stockholders 545 390 Dividends declared for preferred stockholders Net income 1,895 2,195 Calculate the payout ratio and return on common stockholders' equity for 2017 and 2016. (Round answers to 1 decimal place, e.g. 12.5%.) 2017 2016 Payout ratioarrow_forward

- Selected information for Brain Corporation is as follows: December 31 2011 2012 Preference stock 180,000 P 180,000Common stock 648,000 840,000 Retained earnings 192,000 360,000 Net incomefor the year ended 144,000 240,000 What is Brain's rate of return on average stockholders' equity for 2012?a. 16.0%b. 20.0%c. 23.5%d. 26.0%arrow_forwardSuppose the following financial information is available for Walgreen Company. (in millions) 2017 2016 Average common stockholders' equity $12,880.0 $11,580.0 Dividends declared for common stockholders 490 410 Dividends declared for preferred stockholders Net income 1,840 2,140 Calculate the payout ratio and return on common stockholders' equity for 2017 and 2016. (Round answers to 1 decimal place, e.g. 12.5%.) 2017 2016arrow_forwardMorgan Company reported the following information for the year ended December 31, 2015: Net income $ 600,000 Preferred dividends declared and paid 60,000 Common dividends declared and paid 90,000 Average common shares outstanding 90,000 Ending market price per share 45 Net sales 5,100,000 What was Morgan's earnings per share for 2015? $0.15 $5.11 $6.67 $6.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning