Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is

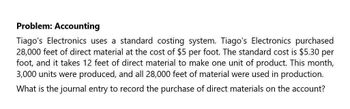

Transcribed Image Text:Problem: Accounting

Tiago's Electronics uses a standard costing system. Tiago's Electronics purchased

28,000 feet of direct material at the cost of $5 per foot. The standard cost is $5.30 per

foot, and it takes 12 feet of direct material to make one unit of product. This month,

3,000 units were produced, and all 28,000 feet of material were used in production.

What is the journal entry to record the purchase of direct materials on the account?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- SmokeCity, Inc., manufactures barbeque smokers. Based on past experience, SmokeCity has found that its total annual overhead costs can be represented by the following formula: Overhead cost = 543,000 + 1.34X, where X equals number of smokers. Last year, SmokeCity produced 20,000 smokers. Actual overhead costs for the year were as expected. Required: 1. What is the driver for the overhead activity? 2. What is the total overhead cost incurred by SmokeCity last year? 3. What is the total fixed overhead cost incurred by SmokeCity last year? 4. What is the total variable overhead cost incurred by SmokeCity last year? 5. What is the overhead cost per unit produced? 6. What is the fixed overhead cost per unit? 7. What is the variable overhead cost per unit? 8. Recalculate Requirements 5, 6, and 7 for the following levels of production: (a) 19,500 units and (b) 21,600 units. (Round your answers to the nearest cent.) Explain this outcome.arrow_forwardPattison Products, Inc., began operations in October and manufactured 40,000 units during the month with the following unit costs: Fixed overhead per unit = 280,000/40,000 units produced = 7. Total fixed factory overhead is 280,000 per month. During October, 38,400 units were sold at a price of 24, and fixed marketing and administrative expenses were 130,500. Required: 1. Calculate the cost of each unit using absorption costing. 2. How many units remain in ending inventory? What is the cost of ending inventory using absorption costing? 3. Prepare an absorption-costing income statement for Pattison Products, Inc., for the month of October. 4. What if November production was 40,000 units, costs were stable, and sales were 41,000 units? What is the cost of ending inventory? What is operating income for November?arrow_forwardDuring the week of May 10, Hyrum Manufacturing produced and shipped 16,000 units of its aluminum wheels: 4,000 units of Model A and 12,000 units of Model B. The cycle time for Model A is 1.09 hours and for Model B is 0.47 hour. The following costs and production hours were incurred: Required: 1. Assume that the value-stream costs and total units shipped apply only to one model (a single-product value stream). Calculate the unit cost, and comment on its accuracy. 2. Assume that Model A is responsible for 40% of the materials cost. Calculate the unit cost for Models A and B, and comment on its accuracy. Explain the rationale for using units shipped instead of units produced in the calculation. 3. Calculate the unit cost for the two models, using DBC. Explain when and why this cost is more accurate than the unit cost calculated in Requirement 2.arrow_forward

- Wyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of 1,312,000 and had selling and administrative expenses of 204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year.arrow_forward

- Preparation of Income Statement: Manufacturing Firm Laworld Inc. manufactures small camping tents. Last year, 200,000 tents were made and sold for 60 each. Each tent includes the following costs: The only selling expenses were a commission of 2 per unit sold and advertising totaling 100,000. Administrative expenses, all fixed, equaled 300,000. There were no beginning or ending finished goods inventories. There were no beginning or ending work-in-process inventories. Required: 1. Calculate the product cost for one tent. Calculate the total product cost for last year. 2. CONCEPTUAL CONNECTION Prepare an income statement for external users. Did you need to prepare a supporting statement of cost of goods manufactured? Explain. 3. CONCEPTUAL CONNECTION Suppose 200,000 tents were produced (and 200,000 sold) but that the company had a beginning finished goods inventory of 10,000 tents produced in the prior year at 40 per unit. The company follows a first-in, first-out policy for its inventory (meaning that the units produced first are sold first for purposes of cost flow). What effect does this have on the income statement? Show the new statement.arrow_forwardPant Risers manufactures bands for self-dressing assistive devices for mobility-impaired individuals. Manufacturing is a one-step process where the bands are cut and sewn. This is the information related to this years production: Â Ending inventory was 100% complete as to materials and 70% complete as to conversion, and the total materials cost is $57,540 and the total conversion cost is $36,036. Using the weighted-average method, what are the unit costs if the company transferred out 17,000 units? What is the value of the inventory transferred out and the value of the ending WIP inventory?arrow_forwardDuring the week of June 12, Harrison Manufacturing produced and shipped 15,000 units of its aluminum wheels: 3,000 units of Model A and 12,000 units of Model B. The following costs were incurred: Required: 1. Assume initially that the value-stream costs and total units shipped apply only to one model (a single-product value stream). Calculate the unit cost, and comment on its accuracy. 2. Calculate the unit cost for Models A and B, and comment on its accuracy. Explain the rationale for using units shipped instead of units produced in the calculation. 3. What if Model A is responsible for 40 percent of the materials cost? Show how the unit cost would be adjusted for this condition.arrow_forward

- Fresno Industries Inc. manufactures and sells high-quality camping tents. The company began operations on January 1 and operated at 100% of capacity (150,000 units) during the first month, creating an ending inventory of 20,000 units. During February, the company produced 130,000 units during the month but sold 150,000 units at 500 per unit. The February manufacturing costs and selling and administrative expenses were as follows: a. Prepare an income statement according to the absorption costing concept for the month ending February 28. b. Prepare an income statement according to the variable costing concept for for the month ending February 28. c. What is the reason for the difference in the amount of operating income reported in (a) and (b)?arrow_forwardHaversham Corporation produces dress shirts. The company uses a standard costing system and has set the following standards for direct materials and direct labor (for one shirt): During the year, Haversham produced 9,800 shirts. The actual fabric purchased was 14,600 yards at 2.74 per yard. There were no beginning or ending inventories of fabric. Actual direct labor was 10,900 hours at 19.60 per hour. Required: 1. Compute the costs of fabric and direct labor that should have been incurred for the production of 9,800 shirts. 2. Compute the total budget variances for direct materials and direct labor. 3. Break down the total budget variance for direct materials into a price variance and a usage variance. Prepare the journal entries associated with these variances. 4. Break down the total budget variance for direct labor into a rate variance and an efficiency variance. Prepare the journal entries associated with these variances.arrow_forwardKildeer Company makes easels for artists. During the last calendar year, a total of 30,000 easels were made, and 31,000 were sold for 52 each. The actual unit cost is as follows: The selling expenses consisted of a commission of 1.30 per unit sold and advertising copayments totaling 95,000. Administrative expenses, all fixed, equaled 183,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 132,600 for 3,400 easels. Required: 1. Calculate the number and the dollar value of easels in ending finished goods inventory. 2. Prepare a cost of goods sold statement. 3. Prepare an absorption-costing income statement. Add a column for percentage of sales.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,