FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

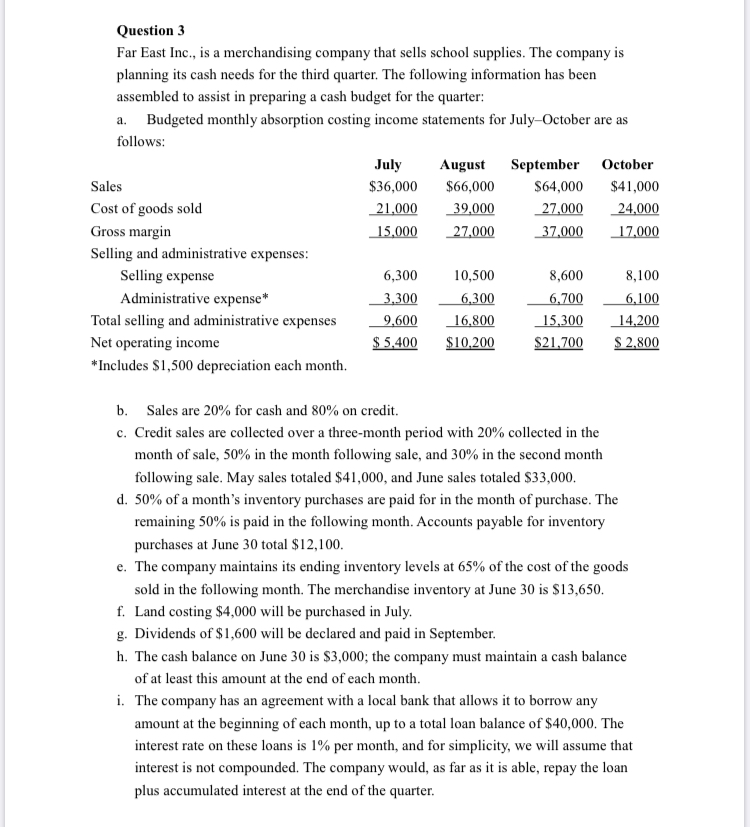

Transcribed Image Text:Far East Inc., is a merchandising company that sells school supplies. The company is

planning its cash needs for the third quarter. The following information has been

assembled to assist in preparing a cash budget for the quarter:

a. Budgeted monthly absorption costing income statements for July-October are as

follows:

July

August

September

October

Sales

$36,000

$66,000

$64,000

$41,000

Cost of goods sold

21,000

_39,000

27,000

24,000

Gross margin

15,000

27,000

37,000

17,000

Selling and administrative expenses:

Selling expense

6,300

10,500

8,600

8,100

Administrative expense"

3,300

6,300

6,700

6,100

Total selling and administrative expenses

9,600

16,800

15,300

14,200

Net operating income

$ 5,400

$10,200

$21,700

$ 2,800

*Includes $1,500 depreciation each month.

b. Sales are 20% for cash and 80% on credit.

c. Credit sales are collected over a three-month period with 20% collected in the

month of sale, 50% in the month following sale, and 30% in the second month

following sale. May sales totaled $41,000, and June sales totaled $33,000.

d. 50% of a month's inventory purchases are paid for in the month of purchase. The

remaining 50% is paid in the following month. Accounts payable for inventory

purchases at June 30 total $12,100.

e. The company maintains its ending inventory levels at 65% of the cost of the goods

sold in the following month. The merchandise inventory at June 30 is $13,650.

f. Land costing $4,000 will be purchased in July.

g. Dividends of $1,600 will be declared and paid in September.

h. The cash balance on June 30 is $3,000; the company must maintain a cash balance

of at least this amount at the end of each month.

i. The company has an agreement with a local bank that allows it to borrow any

amount at the beginning of each month, up to a total loan balance of $40,000. The

interest rate on these loans is 1% per month, and for simplicity, we will assume that

interest is not compounded. The company would, as far as it is able, repay the loan

plus accumulated interest at the end of the quarter.

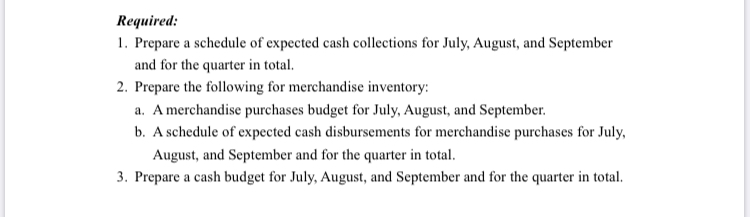

Transcribed Image Text:Required:

1. Prepare a schedule of expected cash collections for July, August, and September

and for the quarter in total.

2. Prepare the following for merchandise inventory:

a. A merchandise purchases budget for July, August, and September.

b. A schedule of expected cash disbursements for merchandise purchases for July,

August, and September and for the quarter in total.

3. Prepare a cash budget for July, August, and September and for the quarter in total.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- saarrow_forwardThe Guitar Shoppe reports the following budgeted sales: August, $130,000; and September, $210,000. For its total sales, 30% are immediately collected in cash, 55% are credit sales and collected in the month following sale, and the remaining 15% are written off as uncollectible. Prepare a schedule of cash receipts from sales for September. THE GUITAR SHOPPE Schedule of Cash Receipts from Sales September Sales $210,000 Cash receipts from: Total cash receipts $0arrow_forwardYou have been asked to prepare a December cash budget for Ashton Company, a distributor of exercise equipment. The following information is available about the company's operations: a. The cash balance on December 1 is $56,600. b. Actual sales for October and November and expected sales for December are as follows: Cash sales Sales on account October $ 71,200 $ 440,000 November $ 73,400 December $ 86,200 $ 576,000 $ 639,000 Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible. c. Purchases of inventory will total $315,000 for December. Thirty percent of a month's inventory purchases are paid during the month of purchase. The accounts payable remaining from November's inventory purchases total $181,500, all of which will be paid in December. d. Selling and administrative expenses are budgeted at $522,000…arrow_forward

- Garden Sales, Incorporated, sells garden supplies. Management is planning its cash needs for the second quarter. The company usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter: Budgeted monthly absorption costing income statements for April–July are: April May June July Sales $ 600,000 $ 900,000 $ 500,000 $ 400,000 Cost of goods sold 420,000 630,000 350,000 280,000 Gross margin 180,000 270,000 150,000 120,000 Selling and administrative expenses: Selling expense 79,000 120,000 62,000 51,000 Administrative expense* 45,000 52,000 41,000 38,000 Total selling and administrative expenses 124,000 172,000 103,000 89,000 Net operating income $ 56,000 $ 98,000 $ 47,000 $ 31,000 *Includes $20,000 of depreciation each month. Sales are 20% for cash and 80% on account. Sales on account are…arrow_forwardMilo Company manufactures beach umbrellas. The company is preparing detailed budgets for the third quarter and has assembled the following information to assist in the budget preparation: a. The Marketing Department has estimated sales as follows for the remander of the year (in units): July August Septemben 33,000 October 76,000 November 45,000 December 23,000 9,500 10,000 The selling price of the beach umbrellas is $15 per unit. b. All sales are on account. Based on past experience, sales are collected in the following pattern: 30% in the month of sale 65% in the month following sale 5% uncollectible Sales for June totaled $375,000. The company maintains finished goods inventories equal to 15% of the following month's sales. This requirement will be met at the end of June. Each beach umbrella requires 4 feet of Gilden, a material that is sometimes hard to acquire. Therefore, the company requires that the ending inventory of Gilden be equal to 50% of the following month's production…arrow_forwardGarden Sales, Incorporated, sells garden supplies. Management is planning its cash needs for the second quarter. The company usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter: Budgeted monthly absorption costing income statements for April–July are: April May June July Sales $ 650,000 $ 1,150,000 $ 610,000 $ 520,000 Cost of goods sold 455,000 805,000 427,000 364,000 Gross margin 195,000 345,000 183,000 156,000 Selling and administrative expenses: Selling expense 121,000 110,000 72,000 52,000 Administrative expense* 50,500 68,800 44,600 49,000 Total selling and administrative expenses 171,500 178,800 116,600 101,000 Net operating income $ 23,500 $ 166,200 $ 66,400 $ 55,000 *Includes $33,000 of depreciation each month. Sales are 20% for cash and 80% on account. Sales on account…arrow_forward

- Garden Sales, Incorporated, sells garden supplies. Management is planning its cash needs for the second quarter. The company usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter: Budgeted monthly absorption costing income statements for April–July are: April May June July Sales $ 690,000 $ 860,000 $ 570,000 $ 470,000 Cost of goods sold 483,000 602,000 399,000 329,000 Gross margin 207,000 258,000 171,000 141,000 Selling and administrative expenses: Selling expense 87,000 106,000 68,000 47,000 Administrative expense* 48,500 65,600 42,200 45,000 Total selling and administrative expenses 135,500 171,600 110,200 92,000 Net operating income $ 71,500 $ 86,400 $ 60,800 $ 49,000 *Includes $29,000 of depreciation each month. Sales are 20% for cash and 80% on account. Sales on account are…arrow_forwardMilo Company manufactures beach umbrellas. The company is preparing detailed budgets for the third quarter and has assembled the following information to assist in the budget preparation: The Marketing Department has estimated sales as follows for the remainder of the year (in units): July 41,000 October 31,000 August 92,000 November 17,500 September 61,000 December 18,000 The selling price of the beach umbrellas is $13 per unit. All sales are on account. Based on past experience, sales are collected in the following pattern: 30% in the month of sale 65% in the month following sale 5% uncollectible Sales for June totaled $533,000. The company maintains finished goods inventories equal to 15% of the following month’s sales. This requirement will be met at the end of June. Each beach umbrella requires 4 feet of Gilden, a material that is sometimes hard to acquire. Therefore, the company requires that the ending inventory of Gilden be equal to 50%…arrow_forwardi need the answer quicklyarrow_forward

- Please help me to solve this problemarrow_forwardRooney Company sells lamps and other lighting fixtures. The purchasing department manager prepared the following inventory purchases budget. Rooney's policy is to maintain an ending inventory balance equal to 10 percent of the following month's cost of goods sold. April's budgeted cost of goods sold is $77,000. Required a. Complete the inventory purchases budget by filling in the missing amounts. b. Determine the amount of cost of goods sold the company will report on its first quarter pro forma income statement. c. Determine the amount of ending inventory the company will report on its pro forma balance sheet at the end of the first quarter.arrow_forwardMilo Company manufactures beach umbrellas. The company is preparing detailed budgets for the third quarter and has assembled the following information to assist in the budget preparation: A) The Marketing Department has estimated sales as follows for the remainder of the year (in units): July 30,500 October 20,500 August 71,000 November 7,000 September 40,000 December 7,500 The selling price of the beach umbrellas is $10 per unit. B) All sales are on account. Based on past experience, sales are collected in the following pattern: 30% in the month of sale 65% in the month following sale 5% uncollectible Sales for June totaled $200,000. C) The company maintains finished goods inventories equal to 15% of the following month’s sales. This requirement will be met at the end of June. D) Each beach umbrella requires 4 feet of Gilden, a material that is sometimes hard to acquire. Therefore, the company requires that the ending inventory of Gilden be equal to 50%…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education