FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

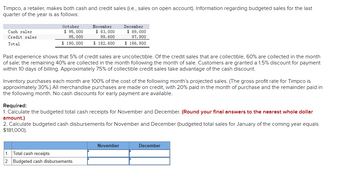

Transcribed Image Text:Timpco, a retailer, makes both cash and credit sales (i.e., sales on open account). Information regarding budgeted sales for the last

quarter of the year is as follows:

Cash sales

Credit sales

Total

October

$ 95,000

95,000

November

$ 83,000

99,600

December

$ 89,000

97, 900

$ 190,000

$ 182,600

$ 186,900

Past experience shows that 5% of credit sales are uncollectible. Of the credit sales that are collectible, 60% are collected in the month

of sale; the remaining 40% are collected in the month following the month of sale. Customers are granted a 1.5% discount for payment

within 10 days of billing. Approximately 75% of collectible credit sales take advantage of the cash discount.

Inventory purchases each month are 100% of the cost of the following month's projected sales. (The gross profit rate for Timpco is

approximately 30%.) All merchandise purchases are made on credit, with 20% paid in the month of purchase and the remainder paid in

the following month. No cash discounts for early payment are available.

Required:

1. Calculate the budgeted total cash receipts for November and December. (Round your final answers to the nearest whole dollar

amount.)

2. Calculate budgeted cash disbursements for November and December (budgeted total sales for January of the coming year equals

$181,000).

1. Total cash receipts

2. Budgeted cash disbursements

November

December

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Cash Receipts Budget and Accounts Receivable Aging Schedule Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the following sales: Quarter 1 $4,760,000 Quarter 2 5,620,000 Quarter 3 3,060,000 Quarter 4 7,720,000 In Shalimar's experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are $5,310,000 and for the fourth quarter of the current year are $7,350,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. Quarter Cash Sales Credit Sales 3, current year 4, current year 1, next year 2, next year 3. next vear 4, next year 2. Construct a cash receipts budget for…arrow_forward2arrow_forward3. The Uthred Company, a merchandising firm, has planned the following sales for the next four months: March $50,000 Аpril $70,000 Мay $90,000 June July $90,000 Total budgeted Sales $60,000 Sales are made 60% on account and 40% cash. From experience, the company has learned that a month's sales on account are collected according to the following pattern: Month of sale 60% • First month following month of sale . • Second month following month of sale • Uncollectible 28% 10% 2% Uthred has a building that is not used in the business operation; they rented it out and receive $10,080 rent every month. The company requires a minimum cash balance of $14,000 to start a month.arrow_forward

- Budgeted cash payments. Would I begin with Cost of Direct materiasl purchase of April-3,010, May-3,650,June-4,015, 2nd Quarter -10,675?arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardAswer correctly. Options already selected are not all correct. Revise and answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education