FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Portions of the financial statements for Clear Transmissions Company are provided below.

Prepare the

| Cash Flows from operating activities: | |

| Net Cash Flows from operating activities |

![Exercise 21-25 (Algo) Cash flows from operating activities (direct method)-includes sale of cash

equivalent [LO21-3]

Portions of the financial statements for Clear Transmissions Company are provided below.

CLEAR TRANSMISSIONS COMPANY

Income Statement

For the Year Ended December 31, 2021 ($ in thousands)

$2,220

Sales

Cost of goods sold

Gross margin

Salaries expense

888

1,332

$400

Depreciation expense

Amortization expense

Interest expense

255

40

100

Loss on sale of cash equivalents

21

816

Income before taxes

516

Income tax expense

258

Net Income

$

258](https://content.bartleby.com/qna-images/question/42e500ec-4da8-49e2-b3a0-97d91bc46ab8/1eb1a12d-749c-4fcc-913d-981ccad69bbd/5rcsttf_thumbnail.png)

Transcribed Image Text:Exercise 21-25 (Algo) Cash flows from operating activities (direct method)-includes sale of cash

equivalent [LO21-3]

Portions of the financial statements for Clear Transmissions Company are provided below.

CLEAR TRANSMISSIONS COMPANY

Income Statement

For the Year Ended December 31, 2021 ($ in thousands)

$2,220

Sales

Cost of goods sold

Gross margin

Salaries expense

888

1,332

$400

Depreciation expense

Amortization expense

Interest expense

255

40

100

Loss on sale of cash equivalents

21

816

Income before taxes

516

Income tax expense

258

Net Income

$

258

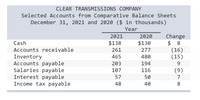

Transcribed Image Text:CLEAR TRANSMISSIONS COMPANY

Selected Accounts from Comparative Balance Sheets

December 31, 2021 and 2020 ($ in thousands)

Year

Change

$ 8

(16)

(15)

2021

2020

Cash

$138

$130

Accounts receivable

261

277

465

Inventory

Accounts payable

Salaries payable

Interest payable

Income tax payable

480

203

194

9.

107

116

(9)

57

50

7

48

40

8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Green Brands, Inc. (GBI) presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from GBI's Year 2 and Year 1 year-end balance sheets: Account Title Year 2 Year 1 $52,000 72,000 32,000 28,000 Accounts receivable $48,000 78,000 24,000 31,000 Merchandise inventory Prepaid insurance Accounts payable Salaries payable 8,200 7,800 Unearned service revenue 2,400 3,600 The Year 2 income statement is shown below: Income Statement $ 720,000 (398,000) 322,000 6,000 (36,000) (195,000) (12,000) 85,000 4,500 Sales Cost of goods sold Gross margin Service revenue Insurance expense Salaries expense Depreciation expense Operating income Gain on sale of equipment Net income 89,500 Required a. Prepare the operating activities section of the statement of cash flows using the direct method. b. Prepare the operating activities section of the statement of cash flows using the indirect method.arrow_forwardSelected data derived from the income and balance sheet of National Beverage Co. for a recent year are as follows: required: A. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method for National Beverage Co. B. Interpret your results in part (a).arrow_forwardPlease help me fill out this table. I am so lost…arrow_forward

- A company uses a spreadsheet to prepare its statement of cash flows. Indicate whether each of the followingitems would be recorded in the Debit column or Credit column of the spreadsheet’s statement of cashflows section. Net incomearrow_forwardThe following are excerpts from Hamburg Company’s statement of cash flows and other financial records. From Statement of Cash Flows: Cash flows from operating activities $282,530 Cash flows from investing activities -12,482 Cash flows from financing activities -21,014 From other records: Capital expenditure costs 23,097 Cash dividend payments 9,222 Sales revenue 478,493 Total assets 350,091 Compute cash flows to assets ratio.arrow_forwardDetermining Cash Flows from (Used for) Operating Activities Yeoman Inc. reported the following data: Net income Depreciation expense Loss on disposal of equipment Increase in accounts receivable Increase in accounts payable Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Yeoman Inc. Statement of Cash Flows (partial) Cash flows from (used for) operating activities: $481,600 75,800 31,800 12,600 12,800 Adjustments to reconcile net income to net cash flows from (used for) operating activities: Changes in current operating assets and liabilities: Net cash flows from operating activitiesarrow_forward

- Staley Inc. reported the following data: Line Item Description Amount Net income $449,900 Depreciation expense 55,600 Loss on disposal of equipment 32,900 Increase in accounts receivable 20,800 Increase in accounts payable 10,500 Prepare the "Cash flows from (used for) operating activities" section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. blankStaley Inc.Statement of Cash Flows (partial) Line Item Description Amount Amount Cash flows from (used for) operating activities: $Net income Adjustments to reconcile net income to net cash flows from (used for) operating activities: Depreciation Loss on disposal of equipment Changes in current operating assets and liabilities: Increase in accounts receivable Increase in accounts payable Net cash flows from operating activities $Net cash…arrow_forwardRavenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Cash Accounts receivable Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Total assets Accounts payable Income taxes payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity Foundational 15-11 (Algo) Net cash Ending Balance $ 85,600 69,500 93,300 248,400 249,000 83,000 166,000 $ 414,400 used in $ 54,400 42,300 102,000 119,000 96,700 $ 414,400 During the year, Ravenna paid a $10,200 cash dividend and it sold a piece of equipment for $5,100 that had originally cost $11,400 and had accumulated depreciation of $7,600. The company did not retire any bonds or repurchase any of its own common stock during the year. operating activities Beginning Balance $ 102,500 74,800 85,000 262,300 238,000…arrow_forwardPlease complete the statement of cashflows as required below: A comparative balance sheet and an income statement for Burgess Company are given below: Burgess CompanyComparative Balance Sheet(dollars in millions) Ending Balance Beginning Balance Assets Current assets: Cash and cash equivalents $ 44 $ 91 Accounts receivable 690 633 Inventory 675 630 Total current assets 1,409 1,354 Property, plant, and equipment 1,555 1,529 Less accumulated depreciation 800 666 Net property,plant, and equipment 755 863 Total assets $ 2,164 $ 2,217 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 270 $ 165 Accrued liabilities 185 165 Income taxes payable 87 77 Total current liabilities 542 407 Bonds payable 440 650 Total liabilities 982 1,057 Stockholders' equity: Common stock 170 170 Retained earnings 1,012 990 Total stockholders' equity 1,182 1,160 Total liabilities and stockholders' equity $…arrow_forward

- Please help me with show all calculation thankuarrow_forwardPlease ayúdame!arrow_forwardUsing the direct method of preparing the statement of cash flows, to determine the cash effects of operating activities, which of the following needs to be adjusted? a. Equity as reported in the balance sheet b. Long-term assets and liabilities from the balance sheet c. Net income d. Reported revenues and expensesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education