FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

All info is included in photo.

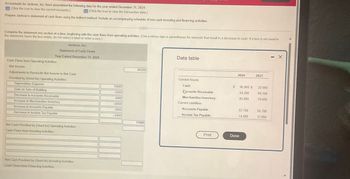

Transcribed Image Text:Accountants for Jackson, Inc. have assembled the following data for the year ended December 31, 2024

(Click the icon to view the current accounts)

(Click the icon to view the transaction data)

Prepare Jackson's statement of cash flows using the indirect method. Include an accompanying schedule of non-cash investing and financing activities.

Complete the statement one section at a time, beginning with the cash flows from operating activities (Use a minus sign or parentheses for amounts that result in a decrease in cash If a box is not used in

the statement, leave the box empty, do not select a label or enter a zero)

Jackson, Inc.

Statement of Cash Flows

Year Ended December 31, 2024

Cash Flows from Operating Activities

Net Income

Adjustments to Reconcile Net Income to Net Cash

Provided by (Used for) Operating Activities.

Depreciation Expense

Gain on Sale of Building

Decrease in Accounts Receivable

Increase in Merchandise Inventory

Increase in Accounts Payable

Decrease in Income Tax Payable

Net Cash Provided by (Used for) Operating Activities

Cash Flows from Investing Activities

Net Cash Provided by (Used for) Investing Activities

Cash Flows from Financing Activities

16000

-3500

4900

-6000

2000

-2400

66500

11000

Data table

Current Assets.

Cash

counts Receivable

Merchandise Inventory

Current Liabilities:

Accounts Payable

Income Tax Payable

Print

2024

96,900 $

64,200

85,000

57,700

14,600

Done

2023

22,000

69,100

79,000

55,700

17.000

X

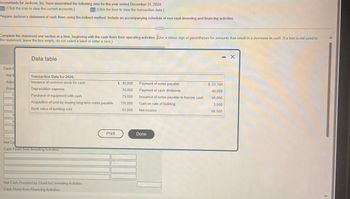

Transcribed Image Text:Accountants for Jackson, Inc. have assembled the following data for the year ended December 31, 2024:

(Click the icon to view the current accounts)

(Click the icon to view the transaction data.)

Prepare Jackson's statement of cash flows using the indirect method. Include an accompanying schedule of non-cash investing and financing activities.

Complete the statement one section at a time, beginning with the cash flows from operating activities. Use a minus sign or parentheses for amounts that result in a decrease in cash. If a box is not used in

the statement, leave the box empty, do not select a label or enter a zero.)

Cash F

Net I

Adjus

Provi

Data table

Transaction Data for 2024:

Issuance of common stock for cash

Depreciation expense

Purchase of equipment with cash

Acquisition of land by issuing long-term notes payable

Book value of building sold

Net Ca

Cash Flows from Investing Activities

Net Cash Provided by (Used for) Investing Activities

Cash Flows from Financing Activities

Print

$ 45,000

16,000

79,000

116,000

61,000

Payment of notes payable

Payment of cash dividends

Issuance of notes payable to borrow cash

Gain on sale of building

Net income

Done

$ 51,100

48,000

66,000

3,500

66,500

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education