FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Selected data derived from the income and

required:

A. Prepare the

B. Interpret your results in part (a).

Transcribed Image Text:Instructions

Amount Descriptions.

Statement of Cash Flows-Operating Activities

Instructions

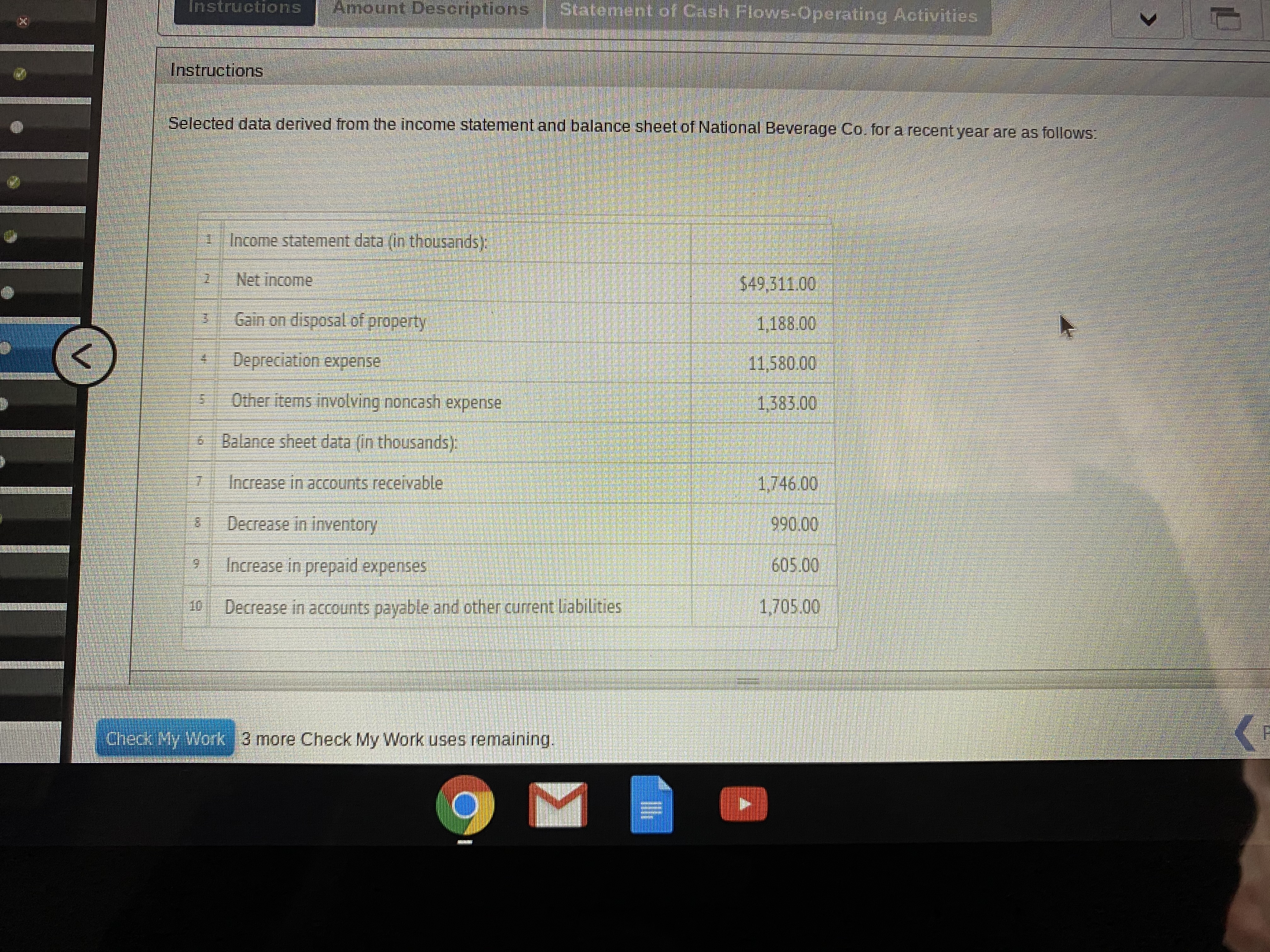

Selected data derived from the income statement.and balance sheet of National Beverage Co for a recent year are as follows

Income statement data (in thousands

Net income

$49,311.00

Gain on disposal of property

1188.00

Depreciation expense

11,580.00

Other items involving noncash expense

1.383.00

Balance sheet data (in thousands);

Increase in accounts receivable

1,746.00

Decrease in inventory

00060

605.00

Increase in prepaid expenses

Decrease in accounts payable and other current liabilities

1,705.00

Check My Work 3 more Check My Work uses remaining.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please help me to check the answersarrow_forwardHought Office Machines, Inc.'s accountants assembled the following selected data for the year ended December 31, 2018: E (Click the icon to view the current accounts.) E (Click the icon to view the transaction data.) Requirement 1. Prepare Hought Office Machines, Inc.'s statement of cash flows using the indirect method to report operating activities. List noncash investing and financing activities on an accompanying schedule. Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use parentheses or a minus sign for numbers to be subtracted.) Hought Office Machines, Inc. Data Table Statement of Cash Flows Year Ended December 31, 2018 Cash flows from operating activities: Transaction Data for 2018: Net income Net income..... $ 60,000 Adjustments to reconcile net income to net cash Purchase of treasury stock. 14,300 provided by (used for) operating activities: Issuance of common stock for cash. 36,600 Loss on sale of equipment. 6,000…arrow_forwardXYZ Corp. is selling furniture. The comparative balance sheet and income statement are summarized below. You are also given the following additional information:(see detail as attachements) Requirement: Prepare the statement of cash flows using the indirect method for the year ended December 31, current year. Prepare the Cash Flow from Operating Activities (CFO) using the direct method. Based on the cash flow statement, write a short paragraph explaining the major sources and uses of cash by XYZ Corp during the current year.arrow_forward

- The cash flows from operating activities are reported by the direct method on the statement of cash flows. Determine the following: a. If sales for the current year were $375,000 and accounts receivable increased by $29,000 during the year, what was the amount of cash received from customers?$fill in the blank 1 b. If income tax expense for the current year was $39,000 and income tax payable decreased by $21,000 during the year, what was the amount of cash payments for income tax?$fill in the blank 2arrow_forwardWhich of the following activities caused the greatest change in cash during the year? HINTS: You can find the breakdown of these activities on the Statements of Cash Flows. Multiple Choice O Operating activities Investing activities Financing activitiesarrow_forwardVery important please be correct thank youarrow_forward

- Baird Incorporated presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from the company's Year 2 and Year 1 year-end balance sheets. Account Title Accounts receivable Year 2 $15,000 Accounts payable $ 8,400 Year 1. $19,500 $10, 150 The Year 2 income statement showed net income of $28,700. Required a. Prepare the operating activities section of the statement of cash flows. (Amounts to be deducted should be indicated with minus sign.) Cash flows from operating activities Net cash flow from operating activities $ 0arrow_forwardPrepare a complete statement of cash flows using the direct method. Note: Amounts to be deducted should be indicated with a minus sign.arrow_forwardHamburger Heaven's income statement for the current year and selected balance sheet data for the current and prior years ended December 31 are presented below. Income Statement Sales Revenue $1,860 Expenses: Cost of Goods Sold 850 Depreciation Expense Salaries and Wages Expense Rent Expense 150 450 200 Insurance Expense 75 Interest Expense Utilities Expense 45 Net Income 35 Selected Balance Sheet Accounts Current Year Prior Year 72 Inventory Accounts Receivable 55 355 400 Accounts Payable Salaries/Wages Payable Utilities Payable Prepaid Rent Prepaid Insurance 225 260 39 25 25 10 14 TIP: Prepaid Rent decreased because the amount taken out of Prepaid Rent (and subtracted from net income as Rent Expense) was more than the amount paid for rent in cash during the current year. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)arrow_forward

- Using the Exhibit below, assume that the balance of Accounts Payable was $60,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Payable is $65,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts payable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on disposal of…arrow_forwardPrepare a complete statement of cash flows using the indirect method for the current year. Note: Amounts to be deducted should be indicated with a minus sign. Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. GOLDEN CORPORATION Comparative Balance Sheets December 31 Current Year Prior Year Assets Cash $ 178,000 $ 122,400 Accounts receivable 104,000 85,000 Inventory 622,000 540,000 Total current assets 904,000 747,400 Equipment 372,700 313,000 Accumulated depreciation—Equipment (165,000) (111,000) Total assets $ 1,111,700 $ 949,400 Liabilities and Equity…arrow_forwardUsing the Exhibit below, assume that the balance of Accounts Payable was $50,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Payable is $35,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts payable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on disposal of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education