FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

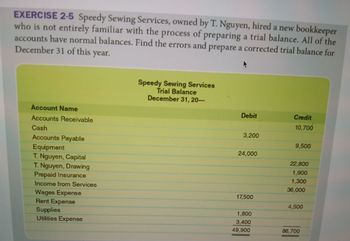

Transcribed Image Text:EXERCISE 2-5 Speedy Sewing Services, owned by T. Nguyen, hired a new bookkeeper

who is not entirely familiar with the process of preparing a trial balance. All of the

accounts have normal balances. Find the errors and prepare a corrected trial balance for

December 31 of this year.

Speedy Sewing Services

Trial Balance

December 31, 20-

Account Name

Accounts Receivable

Cash

Accounts Payable

Equipment

T. Nguyen, Capital

Debit

Credit

10,700

3,200

9,500

24,000

22,800

T. Nguyen, Drawing

1,900

Prepaid Insurance

1,300

Income from Services

36,000

Wages Expense

17,500

Rent Expense

Supplies

Utilities Expense

4,500

1,800

3,400

49,900

86,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 01 Assignment - 5. Quiz: Checking Accounts Attempt 1 of 1 ASSIGNMENTS COURSES SECTION 1 OF 1 QUESTION 6 C 1 2 3 4 6. 7 8 >> Fred Friedman writes a $45 check for groceries, but his account has only $20 in it. If an account becomes overdrawn, (not enough money to pay for the transaction), his bank charges a $20 overdraft fee. The grocer has not cashed Fred's check yet. How much is in Fred's account at the end of the day? O $20 O $40 O $45 O $65 TURN IT IN NEXT QUESTION O ASK FOR HELParrow_forwardPlease helparrow_forwardThanks!arrow_forward

- newconnect.mheducation.com 5 Homework i Saved Help BANK STATEMENT Date Checks Deposits Other Balance Dec. 1 $50,400 42,760 70,190 55,290 91,290 90,720 88,800 88,860 88,690 6 7,640 11 570 $28,000 14,900 17 23 36,000 26 570 30 20,600 19,000 NSF* $320 31 Interest earned 60 31 Service charge 170 NSF check from J. Left, a customer. Cash (A) Dec. 1 Balance 50,400 Deposits Checks written during December: Dec. 11 28,000 36,000 19,000 13,000 7,640 23 570 30 14,900 31 570 170 20,600 4,800 97,150 Dec. 31 Balance There were no deposits in transit or outstanding checks at November 30. 5. After the reconciliation journal entries are posted, what balance will be reflected in the Cash account in the ledger? 6. If the company also has $320 of petty cash on hand, which is recorded in a different account called Petty Cash on Hand, what total amount of Cash and Cash Equivalents should be reported on the December 31 balance sheet? 5. Balance in Cash Account $ 23 6. Total Amount of Cash and Cash Equivalents…arrow_forwardPlz don't copy answer without plagiarism please little different answersarrow_forwardDirect Write-Off Method Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables: Oct. 2: Received $2,060 from Ian Kearns and wrote off the remainder owed of $2,310 as uncollectible. If an amount box does not require an entry, leave it blank. Oct. 2 Dec. 20: Reinstated the account of Ian Kearns and received $2,310 cash in full payment. If an amount box does not require an entry, leave it blank. Dec. 20-Reinstate Dec. 20-Collectionarrow_forward

- Instructions (X) Chart of Accounts (X) General Journal 3a. Prepare the journal entry on June 30 to record Cowen's estimated uncollectibles, assuming the balance in Allowance for Doubtful Accounts Cowen's, a large department store located in a metropolitan area, has been prior to adjustment is $0. CHART OF ACCOUNTS experiencing difficulty in estimating its bad debts. The company has decided to prepare an aging schedule for its outstanding accounts receivable and estimate bad Cowen's General Journal Instructions debts by the due dates of its receivables. This analysis discloses the following General Ledger information: ASSETS REVENUE PAGE 1 Balance Age of Receivable Estimated Percentage Uncollectible 111 Cash 411 Sales Revenue GENERAL JOURNAL $194,000 Under 30 days 0.8% 121 Accounts DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT Receivable EXPENSES 119,000 30-60 days 2.0% 1 122 Allowance for 500 Cost of Goods 73,000 61-120 days 5.0% 2 Doubtful Accounts Sold 41,000 121-240 days 20.0% 141…arrow_forwardBANK RECONCILIATION AND RELATED JOURNAL ENTRIES The book balance in the checking account of Lyle's Salon as of Novemeber 30 is $3,282.95. The bank statement shows an ending balance of $2,127. By examining last month's bank in novemeber and noting the service charges and other debit and credit memos shown on the bank statement, the following were found: a) An ATM withdrawl of $150 on November 18 by Lyle for personal use was not recorded in the books b) A bank debit memo issued for an NSF check from a customer of $19.50 c) A bank credit memo issued for interest of $19 earned during the month d) on November 30, A deposit of 1,177 was made which is not shown on the bank statement. e) A bank debit memo issued for $17.50 for bank service charges. f) checks No. 549,561 and 562 for the amounts of $185, $21 and $9.40, respectively, were written during november but have not yet been received by the bank. g) The reconciliation from the previous month showed outstanding checks totaling $271.95…arrow_forwardDirect Write-Off Method Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables. Mar. 17: Received $2,590 from Paula Spitler and wrote off the remainder owed of $3,000 as uncollectible. If an amount box does not require an entry, leave it blank. Mar. 17 July 29: Reinstated the account of Paula Spitler and received $3,000 cash in full payment. July 29 3E July 29arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education