FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

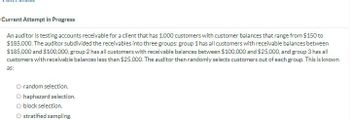

Transcribed Image Text:Current Attempt in Progress

An auditor is testing accounts receivable for a client that has 1,000 customers with customer balances that range from $150 to

$185,000. The auditor subdivided the receivables into three groups: group 1 has all customers with receivable balances between

$185,000 and $100,000, group 2 has all customers with receivable balances between $100,000 and $25,000, and group 3 has all

customers with receivable balances less than $25,000. The auditor then randomly selects customers out of each group. This is known

as:

O random selection.

O haphazard selection.

O block selection.

O stratified sampling.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- PROBLEM 2 You are revisiting the audit working paper presented to you by your audit staff in line with his audit procedures done in auditing T-ara Corporation’s accounts receivable. The following were lifted from the said working papers: Audit notes: T-ara Corporation’s accounts receivable subsidiary ledger had the following details: Customers Invoice Date Invoice Amount Balance Park Ji-yeon Inc. 12/06/22 127,000 10/29/22 84,000 211,000 Hyomin Company 12/30/22 42,000 09/27/22 30,000 08/20/22 53,520 125,520 Hahn Eunjung Inc. 12/30/22 40,000 12/08/22 80,000 11/25/22 63,600 183,600 Park So-yeon Company 11/17/22 138,840 10/09/22 132,000 08/20/22 74,400 345,240 Jeon Boram Corporation 12/10/22 250,000 250,000 Qri Incorporated 09/12/22 104,400 104,400 Total 1,219,760 The…arrow_forwardSee photoarrow_forwardQ. A staff internal auditor was assigned to audit one of the company’s wholesale distribution locations. The staff auditor returned to the office after a week and said that everything was fine. The senior auditor reviewed the staff auditor’s working papers and noted that there was a year-end adjustment in excess of US $100,000—a debit to sales and a credit to accounts receivable. “To adjust the general ledger accounts receivable account to the accounts receivable subsidiary ledger” is how the description read. The senior asked the staff auditor how an error that big could have happened. He told her the location manager said there had been some problems installing the accounting system at the new store. Initially, the senior auditor thought the adjustment was proper since the general ledger balance was now in agreement with the subsidiary ledger. However, a short time later she was reviewing the analytical procedures performed by the staff auditor and noted that the gross margin…arrow_forward

- Carl Roen had a balance of $1,700 in his checking account at First National Bank on a day when the bank received the following five checks for processing against his account. Check Number Check Amount Number Amount 3150 $135 3165 $750 3162 400 3166 1,710 3169 380 Assuming a $130 fee assessed by the bank for each bounced check, how much fee revenue would the bank generate if it processed checks (1) from largest to smallest, (2) from smallest to largest, and (3) in order of check number? Fee revenue (1) Largest to smallest $ so (2) Smallest to largest $ 30 (3) In order of check number $ 60arrow_forwardCurrent Attempt in Progress Identify whether each of the following items would be (a) added to the book balance, or (b) deducted from the book balance in a bank reconciliation. 1. 2 3. 4. 5. EFT transfer to a supplier. Bank service charge. Check printing charge. Error recording check # 214 which was written for $260 but recorded for $620. Collection of note and interest by the bank on the company's behalf.arrow_forwardThe financial records of the Movitz Company show that R. Dennis owes $4,100 on an account receivable. An independent audit is being carried out, and the auditors send a positive confirmation to R. Dennis. What is the most likely reason as to why a positive confirmation rather than a negative confirmation was used here?a. Control risk was particularly low for accounts receivable.b. Inherent risk was particularly high for accounts receivable.c. Dennis’s account was not yet due.d. Dennis’s account was not with a related party.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education