FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

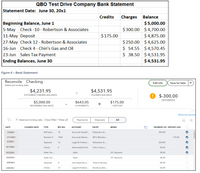

At the end of the month you are reconciling your checking account and you cannot get the reconciliation difference to come to $0. Below is a screen shot of the reconciliation and the bank statement. What is the reason for the error?

Transcribed Image Text:QBO Test Drive Company Bank Statement

Statement Date: June 30, 20x1

Credits

Charges

Balance

Beginning Balance, June 1

5-May Check -10 - Robertson & Associates

11-May Deposit

27-May Check 12 - Robertson & Associates

16-Jun Check 4 - Chin's Gas and Oil

23-Jun Sales Tax Payment

$5,000.00

$ 300.00 $ 4,700.00

$ 4,875.00

$250.00 $4,625.00

$ 54.55 $ 4,570.45

$ 38.50 $ 4,531.95

$ 4,531.95

$175.00

Ending Balances, June 30

Figure 4 – Bank Statement

Reconcile Checking

Edit info

Save for later

Statement ending date:

$4,231.95

$4,531.95

$-300.00

STATEMENT ENDING BALANCE

CLEARED BALANCE

DIFFERENCE

$5,000.00

$643.05

$175.00

+

BEGINNING BALANCE

4 PAYMENTS

1 DEPOSIT

Show me around

X Statement ending date Clear filter / View all

Payments

Deposits

All

DATE

CLEARED DATE

ΤΥΡΕ

REF NO.

ACCOUNT

PAYEE

МЕМО

PAYMENT (US DEPOSIT (USI

5/3/20x1

Bill Paym...

10

Accounts Payabl...

Robertson & ...

300.00

5/11/20x1

Receive P...

1053

Accounts Receiv...

Bill's Windsur...

175.00

5/3/20x1

Expense

Legal & Professi...

Robertson & ...

12

250.00

6/17/20x1

Check

4

Automobile:Fuel

Chin's Gas a...

54.55

6/23/20x1

Sales Tax ...

- Split -

Q1 Payment

38.50

6/23/20x1

Sales Tax ...

- Split -

Q1 Payment

38.40

6/26/20x1

Expense

Job Expenses:J...

Tania's Nursery

89.09

6/26/20x1

Check

12

Legal & Professi...

Books by Bes...

55.00

O O O O O O O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Interest on your bank balance: Suppose your bank account has a balance todayof $100. Consider the following time periods: t = 0, t = 1, t = 2, t = 12,t = 24, t = 48, and t = 60. Assume there are no deposits or withdrawalsin this account other than the interest that accumulates. (If you like, use aspreadsheet program to help you with this question.)(a) Compute your bank balance for these time periods assuming the interestrate is 1%.(b) Do the same thing for an interest rate of 6%.(c) Plot your bank balances for these two scenarios on a standard scale.(d) Do the same thing with a ratio scale.arrow_forwardWhy is it important to reconcile a company's bank statement each month? What is the difference between an outstanding check and a cancelled check? Explain the only times the Petty Cash account should be debited or credited.arrow_forwardYou are trying to explain debit and credit memos that appear on bank statements and whether these will increase or decrease your company's bank account balance. Complete the following table to help your new staff understand. Debit or Credit Increases or Decreases the Company's Item Memo Bank Account Balance EFT payment Bank correction of an error due to posting another customer's check to your account Service charge Note and interest collected for our company NSF check Bank correction of an error recording a $250 deposit as $520 EFT depositarrow_forward

- Your company writes a check for $123 but records it as $132. To adjust for this in a bank reconciliation, you would: reduce the book balance by $9 O reduce the bank balance by $9 O increase the bank balance by $9 O increase the book balance by $9arrow_forwardIn a bank reconciliation, to adjust for an incorrect deposit of $1,000 from another company in your account requires: O reducing the bank balance by the amount of the deposit O increasing the bank balance by the amount of the deposit O reducing the book balance by the amount of the deposit O increasing the book balance by the amount of the depositarrow_forwardPlease do not give solution in image format thankuarrow_forward

- explain why it is important for a business to do a bank reconciliation monthly.arrow_forwardReview and study the following journal entries and determine which entries have errors. All transactions are regular daily transactions (no adjusting entries). When looking for errors ask yourself does that transaction make sense? Once you discover an error, state how you would correct it.arrow_forwardA check that has a future date instead of the actual date; it should not be deposited until the date on the check, is known as ____________. Electric Funds Transfer (EFT) Check 21 Bank card Post dated checkarrow_forward

- multiple choice quetion a.When preparing a bank reconciliation statement and the closing bank statement balance is an overdraft, we begin with the balance in the bank statement and then: add unpresented cheques and deduct outstanding receipts. add outstanding receipts and deduct unpresented cheques. add all receipts and deduct all payments. 4.add all payments and deduct all receiptsarrow_forward6. After comparing your bank statement, canceled checks, and checkbook register, complete the reconciliation statement shown below. What are the new and adjusted balances? Reconciliation Statement Check Register Balance Service Charge NEW BALANCE> 285.14 -8.10 Reconciliation statement Provided for your convenience Statement Balance Outstanding Checks # 202 # 203 $35.92 $28.75 Total Checks > (-) Outstanding Deposits 4/8 4/16 $129.08 $30.00 Total Deposits> (+) ADJUSTED BALANCE 182.63arrow_forwardAssume you are a new hire in the accounting department of an organization. One of your responsibilities is the reconciliation of the operating account. After the end of the month you are given a copy of the bank statement and the cancelled checks, and are instructed to perform your reconciliation. You notice that there are some faint markings on a portion of the bank statement that could be alterations. What steps would you take in performing the reconciliation?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education