Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

None

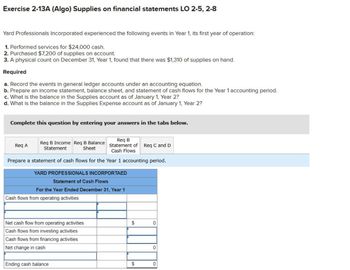

Transcribed Image Text:Exercise 2-13A (Algo) Supplies on financial statements LO 2-5, 2-8

Yard Professionals Incorporated experienced the following events in Year 1, its first year of operation:

1. Performed services for $24,000 cash.

2. Purchased $7,200 of supplies on account.

3. A physical count on December 31, Year 1, found that there was $1,310 of supplies on hand.

Required

a. Record the events in general ledger accounts under an accounting equation.

b. Prepare an income statement, balance sheet, and statement of cash flows for the Year 1 accounting period.

c. What is the balance in the Supplies account as of January 1, Year 2?

d. What is the balance in the Supplies Expense account as of January 1, Year 2?

Complete this question by entering your answers in the tabs below.

Req A

Req B Income Req B Balance

Statement

Sheet

Req B

Statement of Req C and D

Cash Flows

Prepare a statement of cash flows for the Year 1 accounting period.

YARD PROFESSIONALS INCORPORTAED

Statement of Cash Flows

For the Year Ended December 31, Year 1

Cash flows from operating activities

Net cash flow from operating activities

Cash flows from investing activities

Cash flows from financing activities

Net change in cash

Ending cash balance

$

0

0

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Notes Receivable Crowne Cleaning provides cleaning services for Amber Inc., a business with four buildings. Crowne assigned different cleaning charges for each building based on the amount of square feet to be cleaned. The charges for the four buildings are $87,600, $82,200, $102,000, and $62,400. Amber secured this amount by signing a note bearing 10% interest on June 1. Required: Question Content Area 1. Prepare the journal entry to record the sale on June 1. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - Question Content Area 2. Determine how much interest Crowne will receive if the note is repaid on December 1.$fill in the blank 59d6dd028fbe01b_1 Question Content Area 3. Prepare Crowne’s journal entry to record the cash received to pay off the note and interest on December 1. If an amount box does not require an entry, leave it blank. blank - Select - - Select…arrow_forwardAnalyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.arrow_forwardDinesh bhaiarrow_forward

- Need Ans general Accounting questionarrow_forwardAccounts Payable Subsidiary Ledger The cash payments and purchases journal for Outdoor Artisan Landscaping follow. The accounts payable control account has a June 1, 20Y1, balance of $4,820, consisting of an amount owed to Augusta Sod Co. CASH PAYMENTS JOURNAL Page 31 Date Ck. No. Account Debited Post Ref. Other Accounts Dr. Accounts Payable Dr. Cash Cr. 20Y1 June 4 203 Augusta Sod Co. √ 4,820 4,820 5 204 Utilities Expense 54 630 630 15 205 Home Centers Lumber Co. √ 7,900 7,900 24 206 Nu Lawn Fertilizer √ 1,400 1,400 30 630 14,120 14,750 (√) (21) (11) PURCHASES JOURNAL Page 22 Date Account Credited Post Ref. Accounts Payable Cr. Landscaping Supplies Dr. Other Accounts Dr. Post Ref. Amount 20Y1 June 3 Home Centers Lumber Co. √ 7,900 7,900 7 Concrete Equipment Co. √ 3,660 Equipment 18 3,660 14 Nu Lawn Fertilizer √ 1,400 1,400 24 Augusta Sod Co.…arrow_forwardSolve with explanation accounting questionsarrow_forward

- Searth Summer 19/201 Sport Direct, a sport stuff shop. At the beginning of the current season, the ledger of Sport Direct shop showed cash $2,200, Inventory $1,800, and Share capital - Ordinary $4,000. The following transactions were completed during April NOTE: Answer questions from 1 - 25 by using these information. April 1) Purchased Truck costing $9,600 by signing $9,600, 12%, 6-month notes payable. April 4) Purchased racquets and balls from Jay-Mac Co. for $760, FOB Shipping point, terms 2/10,n/30. April 5) Purchased Building for $48,000 cash, April 6) Paid Freight on purchase from Jay-Mac Co. for $40 cash. April 7) Purchased Supplies for $2,500 cash. April 8) Sold Merchandise to members for $1,150 on account terms n/30. The merchandise sold had a cost of $790 April 9) Paid office rent $1,500 cash. April 10) Returned merchandise for Jay-Mac Co. for $60, for a racquets that were defective, April 11) Purchased tennis shoes from u Sports for $420 cash. April 13) Paid Jay-Mac Co. in…arrow_forwardHello tutor solve this general accounting questionarrow_forward48arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning