FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:--/1

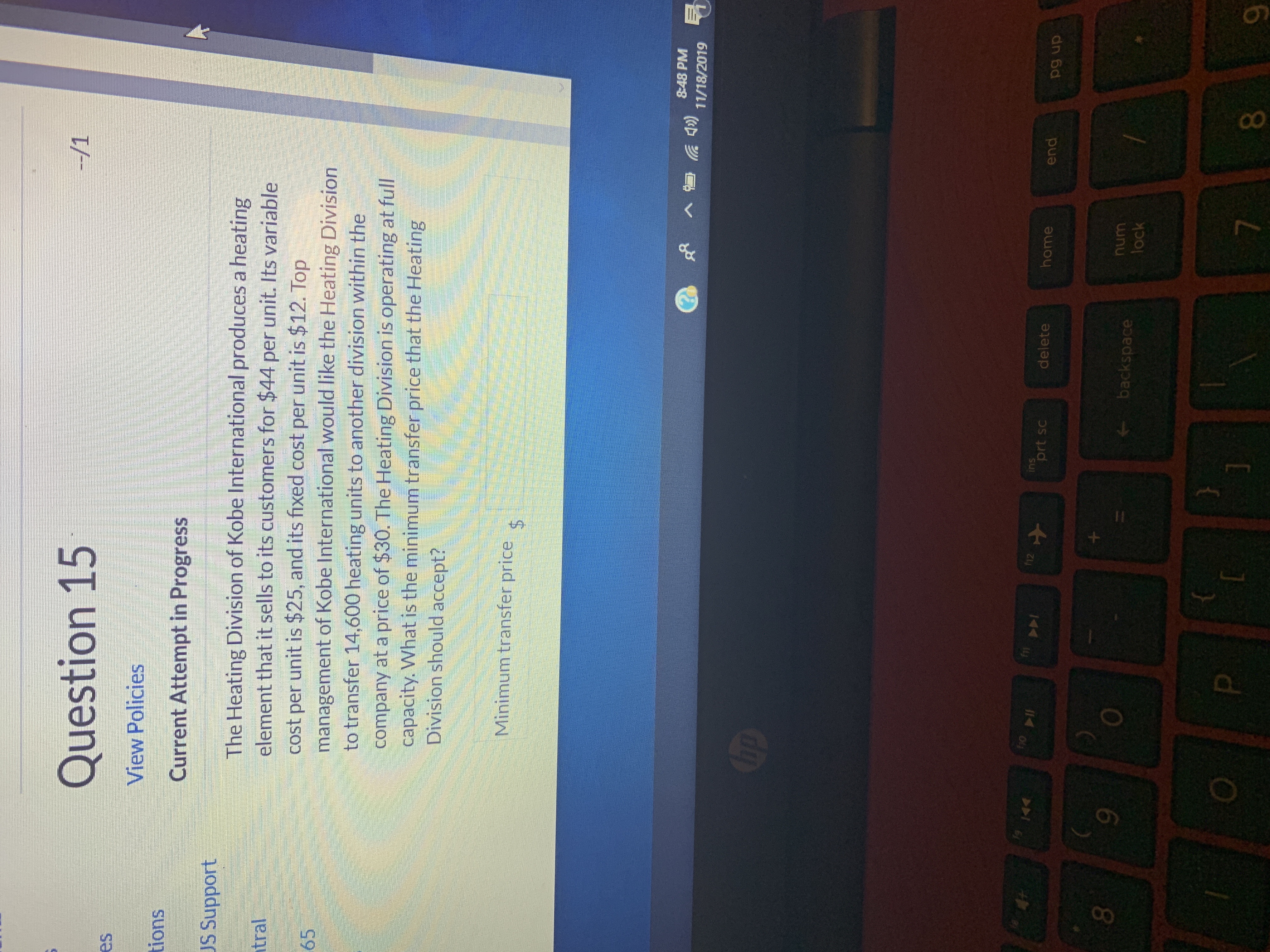

Question 15

es

View Policies

tions

Current Attempt in Progress

US Support

The Heating Division of Kobe International produces a heating

element that it sells to its customers for $44 per unit. Its variable

cost per unit is $25, and its fixed cost per unit is $12. Top

management of Kobe International would like the Heating Division

to transfer 14,600 heating units to another division within the

company at a price of $30. The Heating Division is operating at full

capacity. What is the minimum transfer price that the Heating

Division should accept?

tral

65

Minimum transfer price

$

8:48 PM

49)

11/18/2019

Chp

fo

fn

ins

prt sc

f12

4

home

delete

end

pg up

9

num

backspace

lock

7

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Answer letter d onlyarrow_forwardQuestion 9.4 East Meets West Ltd. is a Canadian company with a fully owned subsidiary in the UK. The UK subsidiary produces a component for off shore gas compressors that are sold in Canada. The components have a variable cost of 1,700 Euros and a full cost of 2,100 Euros. The 2,000 components required can be purchased in Canada for $3,500. Assume the minimum transfer price allowed by the Canadian tax authorities is the variable cost and the maximum is the market value. Also assume operating income in each country is equal to taxable income. One Euro is worth $1.45 Canadian. The marginal tax rate in Canada is 25% and in Ireland 12.5%. Required: What transfer price should be set for East Meets West Ltd. to minimize its total income taxes? Show your calculations. If East Meets West Ltd. desires to minimize its total income taxes, calculate the amount of tax liability in each country in Canadian dollars.arrow_forwardQ25arrow_forward

- Question 45 Assume a division of HP Inc currently makes 50,000 circuit boards per year used in producing diagnostic electronic instruments at the cost of 150 per board, considering of variable costs per unit of $35 and feed costs per unit of $15. Further, assume Sarmina Corporation offers to sell HP the 50.000 circuit boards for $50 each if HP accepts this offer the facilities currently used to make the boards could be rented to one of HP's suppliers for $75,000 per year. In addition, $8 per unit of the fixed overhead applied to the circuit boards would be totally eliminated. Should HP outsource this component from Sanmina Corporation Support your answer with relevant cost calculations. Make-or-Buy) Decision.arrow_forward6arrow_forwardReturn to question Lost Mine has offered to buy 3,100 of the US umbrellas at a price of $32 each. Mohave currently has the excess capacity necessary to accept the offer. The following information is related to the production of the US umbrella: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost $13.00 7.00 9.00 2.50 $31.50 $40.00 Regular. sales price Required: 1. Compute the incremental profit (or loss) from accepting the special order. 2. Should Mohave accept the special order? 3. Suppose that the special order had been to purchase 3,600 umbrellas får $28.00 each. Recompute the incremental profit (or loss) from accepting the special order under this scenario. 4. Assume that Mohave is operating at full capacity. Calculate the special-order price per unit at which Mohave would be indifferent between accepting or rejecting the special order. X Answer is complete but not entirely correct. Complete this question by entering your answers in…arrow_forward

- Problem 17.049: Calculate the after-tax AW of two alternatives A European candy manufacturing plant manager must select a new irradiation system to ensure the safety of specific ingredients, while being economical. The two alternatives available have the following estimates: System First Cost, $ CFBT, $ per Year Life, Years A -115,000 60,000 3 B -70,000 20,000 5 The company is in the 35% tax bracket and assumes classical straight line depreciation for alternative comparisons performed at an after-tax minimum acceptable rate of return (MARR) of 7% per year. A salvage value of zero is used when depreciation is calculated; however, system B can be sold after 5 years for an estimated 20% of its first cost. System A has no anticipated salvage value. Determine which is more economical using an annual worth (AW) analysis worked by hand. The annual worth analysis for system A is determined to be $ 8590.16 The annual worth analysis for system B is determined to be $ -4284.96 System A is…arrow_forwardQuestion 2 In Bradford Ltd, there are two divisions: Transportation and Refining Divisions. The below is relevant information: 1. Transportation Division: The purchase price of crude oil from fields under a long-term contract is £13 per barrel, and Transportation Division purchases crude oil in the North Sea and also transports the crude oil to London. Other costs: Variable costs per barrel of crude oil £2 Fixed costs per barrel of crude oil £3 Total £5 The pipeline from the North Sea to London can carry 35,000 barrels of crude oil per day. 2. Refining Division: The external purchase price of crude oil from outside suppliers is £23 per barrel. The Refining Division is buying 20,000 barrels a day from the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education