Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

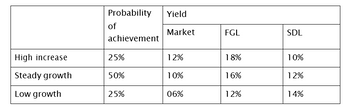

Exercice 5 ( Answer question 4 to 6)

The expected return on treasury bills E(RF)= 4%

- Calculate the expected return E(.) for the market portfolio, the FGL security and the SDL

- Calculate the variance and standard deviation for the market portfolio, FGL security and SDL

- Calculate the covariance between the market portfolio and the FGL security, and the covariance between the market portfolio and the SDL

- Calculate the correlation coefficient between the market portfolio and the FGL security, and the correlation coefficient between the market portfolio and the SDL security.

- Calculate the beta of FGL stock relative to the market portfolio with two different methods.

- Calculate the beta of the SDL stock relative to the market portfolio with two different

- Calculate the expected return of the Pfl portfolio composed of 70% FGL stock and 30% SDL stock, what is the beta of this portfolio?

- Using

CAPM assess the performance of FGL and SDL securities, Are they overvalued or undervalued? - Which of these two securities would you recommend selling if held, and which would you recommend buying?

Transcribed Image Text:High increase

Steady growth

Low growth

Probability Yield

of

achievement

25%

50%

25%

Market

12%

10%

06%

FGL

18%

16%

12%

SDL

10%

12%

14%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Baghibenarrow_forwardYou are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Op 1.45 1.20 0.75 1.00 Portfolio: X Y Z Market Risk-free Rp 11.00% 10.00 8.10 10.40 5.20 Information ratio Op 33.00% 28.00 18.00 23.00 0 Assume that the tracking error of Portfolio X is 9.10 percent. What is the information ratio for Portfolio X? Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 4 decimal places. 02148 0arrow_forwardPortfolio Suppose rA ~ N (0.05, 0.01), rB ~ N (0.1, 0.04) with pA,B = 0.2 where rA and rB are CCR’s. a) Suppose you construct a portfolio with 50% for A and 50% for B. Find the variance of the portfolio CCR. b) Find the portfolio expected gross return. c) Find the expected portfolio CCR.arrow_forward

- Given the following probability distribution, what are the expected return and the standard deviation of returns for Security J? State Pi ri 1 0.5 11% 2 0.3 8% 3 0.2 5% O 9.40%; 2.04% O 8.90%; 2.34% O 7.40%; 2.94% O 8.40%; 2.64% O 7.90%; 1.74%arrow_forwardThe following expected return and the standard deviation of current returns are known: Security (i) Expected Return Standard Deviation βi A 0.20 0.12 1.1 B 0.12 0.10 0.8 T-Bills 0.05 0 0 Market Portfolio 0.20 0.15 1 Required: Determine which of A or B is over-valued or undervalued.arrow_forwardAssume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be halfof the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratioof betaof A(A) tobeta of B(B). Thank you for your help.arrow_forward

- Q1: Suppose there are (N) securities in the market and it is Expected return for each security = 10%. It was a contrast For any security = 0.0144 and the deviation was The common (covariance) between any two cards = 0.0064 Required: 1-Determine the expected return and variance of a portfolio consisting of... (N) paper, note that the relative weight of all papers equal = 1-N? 2- Explain what happens to the variance of this portfolio as it increases value(N)?arrow_forwardPortfolio theory with two assets E(R1)=0.15 E(01)= 0.10 W1=0.5 E(R2)=0.20 E(02) = 0.20 W2=0.5 Calculate the expected return and the standard deviation of the two portfolios if r1,2 = 0.4 and -0.60 respectively.arrow_forward2. The following table gives information on the return and variance of assets A and B, whose covariance is 0.0003: A B 0} 0,0009 0,0012 E (R₂) 0,05 0,06 a. Does the portfolio (1/3 of A and 2/3 of B) dominate the portfolio (2/3 of A and 1/3 of B)? b. Does the portfolio (1/2, 1/2) belong to the efficient frontier? c. If there were the possibility of lending and borrowing at 2%, would the portfolio (1/2, 1/2) belong to the new efficient frontier?arrow_forward

- Consider the following two assets: Asset Expected return Standard deviation of returns 1 18% 30% 2 8% 10% The returns on the two assets are perfectly negatively correlated (i.e. coefficient of -1). Calculate the proportions of assets 1 and 2 that generate a portfolio with a standard deviation of zero. What is the expected return of that portfolio?arrow_forwarda. Using the data in the table below and calculate the following performance measuresarrow_forward1. The return over the risk free rate of 3.4% A. Real return B. Average return C. Risk premium D. Required return E. Inflation premiumarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education