Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

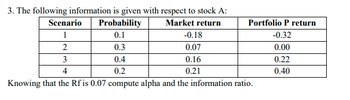

Transcribed Image Text:3. The following information is given with respect to stock A:

Scenario

Probability

Market return

1

0.1

-0.18

2

0.3

0.07

3

0.4

0.16

4

0.2

0.21

Knowing that the Rfis 0.07 compute alpha and the information ratio.

Portfolio P return

-0.32

0.00

0.22

0.40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Portfolio X Y Z Market Risk-free Rp 14.0% 13.0 .8.5 12.0 7.2 Ор 39.00% 34.00 24.00 29.00 0 Bp 1.50 1.15 0.90 1.00 0 Assume that the correlation of returns on Portfolio Y to returns on the market is 0.90. What percentage of Portfolio Y's return is driven by the market? Note: Enter your answer as a decimal not a percentage. Round your answer to 4 decimal places. R-squaredarrow_forwardProblem 1 You are given the following information about stock X and the market portfolio, M: Riskless Asset (f) Stock X Market Portfolio (M) E(r) 0.04 (4%) ? 0.10 σ 0.00 0.30 0.20 You are not given the expected return of stock X. The correlation of the returns on the stock X and the market portfolio is equal to 0.4. a) What is the beta (6) of stock X? b) Assuming the CAPM holds, what is the expected return on stock X? c) You have $1,000 to invest in some combination of the risk-free asset, stock X, and the market portfolio. You are thinking of investing $300 in the risk free asset, $400 in stock X, and $300 in the market portfolio. What is the overall expected return, standard deviation and beta of this portfolio?arrow_forwardThe index model has been estimated using historical excess return data for stocks A, B, and C, with the following results: RA = 0.02 + 0.9RM + eA RB = 0.04 + 1.2RM + eB RC = 0.10 + 1.ORM + eC OM oM = 0.22 o(eA) = 0.21 o(eB ) = 0.11 o(eC ) = 0.23 a. What are the standard deviations of stocks A, B, and C? b. Break down the variances of stocks A, B, and C into their systematic and firm-specific components. c. What is the covariance between the returns on each pair of stocks? d. What is the covariance between each stock and the market index?arrow_forward

- You are given the following information concerning three portfolios, the market portfolio, and the risk- free asset: Portfolio X Y Z Market Risk-free Rp 14.5% R-squared 13.5 9.1 10.7 5.4 op 36% 31 21 26 0 6p 1.60 1.30 .80 1.00 0 Assume that the correlation of returns on Portfolio Y to returns on the market is 72. What percentage of Portfolio Y's return is driven by the market? (Enter your answer as a decimal not a percentage. Round your answer to 4 decimal places.)arrow_forwardb) Suppose that you observe the following information in Table 2 for stocks A and B: Table 2 Expected Return (%) 11% Stock Beta A 0.8 В 14% 1.5 The risk-free rate of return is 6% and the expected rate of return on the market index is 12%. Using the Single-Index Model, calculate the alpha of both stocks. Show your calculations. Explain what the alpha of the single-factor model represents and interpret your results.arrow_forwardWhich of the following statement(s) is(are) true? 1) The real rate of interest is determined by the supply and demand for funds. II) The real rate of interest is determined by the expected rate of inflation. III) The real rate of interest is unaffected by actions of the Fed. IV) The real rate of interest is equal to the nominal interest rate plus the expected rate of inflation. III and IV only. I only. OII and III only. O, II, III, and IV only. OI and III only.arrow_forward

- You have estimated the following probability distributions of expected future returns for Stocks X and Y: Stock X Stock Y Probability Return Probability Return 0.1 -12 % 0.2 4 % 0.1 11 0.2 7 0.3 14 0.3 11 0.3 30 0.2 17 0.2 40 0.1 30 What is the expected rate of return for Stock X? Stock Y? Round your answers to one decimal place.Stock X: % Stock Y: % What is the standard deviation of expected returns for Stock X? For Stock Y? Round your answers to two decimal places.Stock X: % Stock Y: % Which stock would you consider to be riskier? is riskier because it has a standard deviation of returns.arrow_forwardA stock portfolio has the following returns under the market conditions listed below. Market Condition Probability Return Bull 0.4 $ 200 Stable 0.3 $100 Bear 0.3 - $100 Referring to Scenario 20-4, what is the EMV?arrow_forwardb. Consider the following information about three stocks: Probability of State of i. ii. iii. iv. State of Economy V. Boom Recession Economy 0.40 0.60 From the information given, you are required to answer the following questions. Compute the Standard Deviation for each stock. Compute the Coefficient Variation for each stock. Based on your computation in part (i) and (ii), which stock is riskier? Explain your answer. Rate of Return if State Occurs Stock Hang Stock Hang Jebat 7% 13% Tuah 28% (5%) Stock Hang Kasturi 15% 3% Assume that you have RM14,000 invested in Stock Hang Jebat whose beta is 1.5, RM19,000 invested in Stock Hang Kasturi whose beta is 2.5 and RM17,000 invested in Stock Hang Tuah whose beta is 1.6. Determine what is the beta of this portfolio. Based on your answer in part (iv), compute the required rate of return for this portfolio, given that the market rate of return is 13% and risk-free rate is 5%.arrow_forward

- Consider the following probability distribution for stocks A and B: State Probability Return on Stock A Return on Stock B 1 0.10 10% 8% 2 0.20 13% 7% 3 0.20 12% 6% 4 0.30 14% 9% 5 0.20 15% 8% The coefficient of correlation between A and B is:arrow_forwardBaghibenarrow_forwardThe following expected return and the standard deviation of current returns are known: Security (i) Expected Return Standard Deviation βi A 0.20 0.12 1.1 B 0.12 0.10 0.8 T-Bills 0.05 0 0 Market Portfolio 0.20 0.15 1 Required: Determine which of A or B is over-valued or undervalued.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education