ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

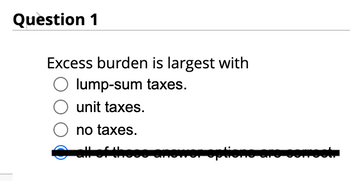

Transcribed Image Text:Question 1

Excess burden is largest with

lump-sum taxes.

unit taxes.

no taxes.

* options are correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is an example of a Tax Deduction? O Clothing Expenses O Child Dependency Expenses O Educational Expenses O Travel Expenses 1 3 4 Nextarrow_forwardê (c) (d) In 9. C. a. GE 6. Troy buys a sound system priced at $8,820.00 but paid $9,702.00 with tax. Calculate the tax rate. 1 b.arrow_forwardWith respect to the sources of state tax revenue, the corporate income tax generates approximately twice the revenue as state sales and use taxes. O True O Falsearrow_forward

- Explore the market for land and then answer the question. When the government raises the tax rate on land income, what do land owners do? Land owners O A. decrease the land they use and pay the tax OB. pay more tax and receive less after-tax income OC. sell some land and pay less tax OD. increase the rent on land and pay more tax Rent (dollars per year) 1,500 1,000 600 0 Tax rate Land supply 250 Perfectly inelastic supply Land demand 500 Land (billions of acres)arrow_forwardQuestion 44 Please refer to the description of a tax on a market, represented by the graphic .. The amount of deadweight loss as a result of the tax is represented by the area(s) Check all that apply. F C. E.arrow_forward45)arrow_forward

- There are a variety of taxes that a person pays when buying an airline ticket. One tax is called the LUST fuel tax. LUST stands for leaking underground storage tank. The LUST tax is to establish a trust fund to provide money for oversight and corrective action against owners of leaking underground storage tanks and provides money for cleanup of LUST sites where the owner or operator is unknown. Is it efficient for customer’s of airlines to beforced to pay the tax?arrow_forwardWhen a tax is collected from the buyers in a market,. a. the tax burden falls most heavily on the buyersb. the buyers bear the burden of the taxc. the sellers bear the burden of the taxd. the tax burden on the buyers and sellers is the same as an equivalent tax collected from the sellersarrow_forwardWhen firm must pay a tax proportional to the number of items it produces: fixed cost of production will [increase, decrease, remain the same] , marginal cost of production will ["", "", ""] , average cost of production will ["", "", ""] .arrow_forward

- Tax incidence refers to ? A. the average tax rate. B.how much revenue a tax generates. C.the extent to which a tax is proportional. D. who bears the burden of a tax.arrow_forwardSuppose you bought a digital camera for a total purchase price of $279.99. If state taxes were 5.4%, what was the amount of the sales tax? (Round your answer to the nearest cent.)arrow_forwardQUESTION 3 What tax per item t will maximize total tax reveue T = tq if the demand is p+q3D1000 and supply 92 +2.5q+920 30 isarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education