Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

infoPractice Pack

Question

thumb_up100%

infoPractice Pack

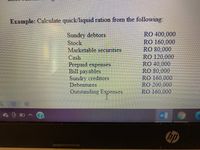

Transcribed Image Text:Example: Calculate quick/liquid ration from the following:

Sundry debtors

Stock

Marketable securities

Cash

Prepaid expenses

Bill payables

Sundry creditors

Debentures

RO 400,000

RO 160,000

RO 80,000

RO 120,000

RO 40,000

RO 80,000

RO 160,000

RO 200,000

RO 160,000

Outstanding Expenses

hp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your wayIncludes step-by-step video

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following items are reported on a company's balance sheet: $212,700 90,200 252,800 196,700 278,400 Cash Marketable securities Accounts receivable Inventory Accounts payable Determine the (a) current ratio, and (b) quick ratio. Round your answers to one decimal place. a. Current ratio b. Quick ratioarrow_forwardUse the following table: Case X Case Y Case Z Cash $ 940 $ 1,470 $ 1,940 Short-term investments 0 0 780 Receivables 0 1,690 1,360 Inventory 3,400 1,560 6,520 Prepaid expenses 2,600 1,020 1,460 Total current assets $ 6,940 $ 5,740 $ 12,060 Current liabilities $ 3,600 $ 1,800 $ 5,750 Required:Calculate the quick ratio in each of the above cases and select the case which is in the best position to meet short-term obligations most easily. (Round your answers to 2 decimal places.)arrow_forwardCalculate the horizontal analysis, vertical analysis Y3 and Y2. All need to be expressed as percentages.arrow_forward

- Calculate the dividend payout ratio.arrow_forwardAvailable Options Are: Accounts Payable - Frist Accounts Payable - Lyon Accounts Receivable - Frist Accounts Receivable - Lyon Accumulated Depreciation Additional Paid-In Capital Bond Premium Bonds Payable Building Cash Common Stock Cost of Goods Sold Depreciation Expense Discount on bonds payable Dividends Declared Finance Costs Goodwill Intrerest Expense Interest Income Intrerest Payable Interest Receivable Land Merchandise Inventory Micellaneous Expense Other Expenses Salesarrow_forwardHomework Assignment #13 Print Item There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: First Year Second Year Third Year Total Alpha Project $32,500 $23,000 $5,000 $60,500 Beta Project 7,500 24,000 28,500 60,000 (Click here to see present value and future value tables) A. If the discount rate is 10%, compute the NPV of each project. Round your present value factor to three decimal places and final answer to answer to 2 decimal places. Alpha Project $ Beta Project $ B. Which project should be recommended.arrow_forward

- All info for this question is includedarrow_forwardCalculate net debt. Cash and cash equivalents Short term borrowings Long term borrowings Commercial paper (liability) Capital / finance lease Accounts receivable Total liabilities Inventory Select one: 2,108.0 2,103.0 2,025.0 14,132.0 3,176.0 419.0 2,883.0 331.0 1,651.0 83.0 17,308.0 5.0arrow_forwardok D Int = Print Compute the annual dollar changes and percent changes for each of the following accounts. (Decreases should be indicated with a minus sign. Round percent change to one decimal place.) 0 ferences # Short-term investments Accounts receivable Notes payable Percent Change = Short-term investments Accounts receivable Notes payable Type here to search Esc fo F1 1 X F2 $ Current Year $ 378,252 100,583 @ 2 0 Horizontal Analysis - Calculation of Percent Change Numerator: 1 Current Year F3 20 #m Prior Year $ 236,897 104,503 91,702 3 378,252 $ 100,583 F4 0 S4 Prior Year $ 236,897 104,503 91,702 F5 $ % 5 Denominator: Dollar Change F6 111,355 (3,920) (91,702) DELL F7 A Percent Change 29.4 % (26.7) % (100.0) % 6 F8 & 7 0 F9 * a 8 F10 9arrow_forward

- The comparative statements of Lily Company are presented here. Net sales Lily Company Income Statements For the Years Ended December 31 Cost of goods sold Gross profit Selling and administrative expenses Income from operations Other expenses and losses Interest expense Income before income taxes Income tax expense Net income Assets Current assets Cash Debt investments (short-term) Accounts receivable (net) Inventory Total current assets Plant assets (net) Total assets Lily Company Balance Sheets December 31 Liabilities and Stockholders' Equity Current liabilities Accounts payable Stockholders' equity Common stock ($5 par) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 282,200 265,700 547,900 $971,800 $1,815,100 1,011,300 2022 803,800 517,400 286,400 2022 267,600 80,016 $ 187,584 $60,100 68,100 18,800 304,000 161,700 465,700 $852,700 116,200 123,100 367,500 604.300 $971,800 $160,300 2021 $64,600 50,200 102,900 114,500 332,200 520,500 $852,700…arrow_forwardThe following items are reported on a company's balance sheet: Cash $283,200 Marketable securities 83,400 Accounts receivable 251,600 Inventory 185,700 Accounts payable 315,200 Determine the (a) current ratio, and (b) quick ratio. Round your answers to one decimal place. a. Current ratio b. Quick ratioarrow_forwardUse the following data to create a complete balance sheet. All accounts must be correctly labeled and arranged in the proper order. Cash Accounts receivable Accounts payable Short-term notes payable Inventories Gross fixed assets Long-term debt Common stock Accumulated depreciation $150,000 54,000 72,000 20,000 80,000 2,400,000 650,000 1,200,000 500,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education