FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

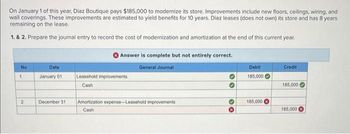

Transcribed Image Text:On January 1 of this year, Diaz Boutique pays $185,000 to modernize its store. Improvements include new floors, ceilings, wiring, and

wall coverings. These improvements are estimated to yield benefits for 10 years. Diaz leases (does not own) its store and has 8 years

remaining on the lease.

1. & 2. Prepare the journal entry to record the cost of modernization and amortization at the end of this current year.

No

1

Date

January 01

Leasehold improvements

Cash

2

December 31

Answer is complete but not entirely correct.

General Journal

Debit

185,000

Credit

185,000

Amortization expense-Leasehold improvements

Cash

30

185,000

185,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- On January 1 of this year, Diaz Boutique pays $170,000 to modernize its store. Improvements include new floors, ceilings, wiring, and wall coverings. These improvements are estimated to yield benefits for 8 years. Diaz leases (does not own) its store and has 5 years remaining on the lease. 1. & 2. Prepare the journal entry to record the cost of modernization and amortization at the end of this current year. View transaction list Journal entry worksheet 1 2 Record the cost of modernization of the store for $170,000 cash. Note: Enter debits before credits. Date January 01 General Journal Debit Creditarrow_forwardOn January 1 of this year, Diaz Boutique pays $105,000 to modernize its store. Improvements include new floors, ceilings, wiring, and wall coverings. These improvements are estimated to yield benefits for 10 years. Diaz leases (does not own) its store and has eight years remaining on the lease. Prepare the entry to record (1) the cost of modernization and (2) amortization at the end of this current year.arrow_forwardOn January 1 of this year, a company pays $165,000 cash to modernize its store with new flooring, internet wiring, and wall fixtures. These improvements are estimated to yield benefits for 10 years. The company leases (does not own) its store and has 8 years remaining on the lease. 1. & 2. Prepare the entry to record its cash payment for the leasehold improvements and the December 31 year-end entry to amortize the leasehold improvements. View transaction list Journal entry worksheet 1 2 Record the cost of modernization of the store for $165,000 cash. Note: Enter debits before credits. Date January 01 General Journal Debit Credit >arrow_forward

- 50) Crestfield leases office space. On January 3, the company incurs $15,000 to improve the leased office space. These improvements are expected to yield benefits for 10 years. Crestfield has 5 years remaining on its lease. What journal entry would be needed to record the expense for the first year related to the improvements? A) Debit Amortization Expense-Leasehold Improvements $1,500; credit Accumulated Amortization Leasehold Improvements $1,500. B) Debit Depletion Expense $3,000; credit Accumulated Depletion $3,000. C) Debit Depreciation Expense $1,500; credit Accumulated Depreciation $1,500. D) Debit Depletion Expense $15,000; credit Accumulated Depletion $15,000. E) Debit Amortization Expense-Leasehold Improvements $3,000; credit Accumulated Amortization Leasehold Improvements $3,000.arrow_forwardNEW Co. leased an office and paid $20,000 for leasehold improvements in January of this year. This cost included drywall, new carpets, and all new lighting fixtures. The term of the lease is 2 years plus an option to renew for 2 more years. Required: Calculate the maximum CCA that NEW Co. will be allowed to deduct this year. (Show calculations and the process of arriving at your answer.)arrow_forwardCrestfield leases office space. On January 3, the company incurs $15,000 to improve the leased office space. These improvements are expected to yield benefits for 4 years. Crestfield has 2 years remaining on its lease. What journal entry would be needed to record the expense for the first year related to the improvements? Multiple Choice O Debit Amortization Expense-Leasehold Improvements $7,500; credit Accumulated Amortization-Leasehold Improvements $7,500. Debit Depletion Expense $15,000; credit Accumulated Depletion $15,000. Debit Depreciation Expense $3,750; credit Accumulated Depreciation $3,750. Debit Amortization Expense-Leasehold Improvements $3,750; credit Accumulated Amortization-Leasehold Improvements $3,750. Debit Depletion Expense $7,500; credit Accumulated Depletion $7,500.arrow_forward

- On December 1, 2023, Oriole Corp. leased office space for 10 years at a monthly rental of $43000, under an operating lease. On that date Oriole paid the landlord the following amounts: Rent deposit $43000 First month's rent 43000 Last month's rent 43000 Installation of new walls and offices 157200 $286200 Oriole debited the entire $286200 payment to Prepaid Rent. How much should Oriole Corp recognize as rent expense for the year ended December 31, 2023? ○ $28620 ○ $44310 ○ $161500 ○ $43000arrow_forwardPlease answer the following question: Beaver Construction purchases new equipment for $45,360 cash on April 1, 2024. At the time of purchase, the equipment is expected to be used in operations for seven years (84 months) and have no resale or scrap value at the end. Beaver depreciates equipment evenly over the 84 months ($540/month). Required: 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the year-end adjusted balances of Accumulated Depreciation and Depreciation Expense (assuming the balance of Accumulated Depreciation at the beginning of 2024 is $0).arrow_forwardOn January 1, 2018, Yancey, Inc. signs a 10 year concancelable lease agreement to lease a storage building from Holt Warehouse company. Lease payments is predictable and no important uncertainties surround the amount of costs to be incurred by the lessor: Following information: 1. equal rental payments at beginning of each year 2. Fair value of building is $6,000,000, book value is $4,950,000 3. Building has a life of 10 years with no residual value. Yancey uses straight line method 4. At end of lease, ownership transfer to the lessee. 5. Yancey's borrowing rate is 11%. Holt set the annual rental to insure a 10% rate of return. 6. The yearly rental payment includes $15,000 of executory costs. What is the amount of the total annual lease payment?arrow_forward

- Crestfield leases office space. On January 3, the company incurs $26,000 to improve the leased office space. These improvements are expected to yield benefits for 10 years. Crestfield has 5 years remaining on its lease. What journal entry would be needed to record the expense for the first year related to the improvements?arrow_forwardMaynard Printers (MP) manufactures printers. Assume that MP recently paid $450,000 for a patent on a new laser printer. Although it gives legal protection for 20 years, the patent is expected to provide a competitive advantage for only eight years. Read the requirements Requirement 1. Assuming the straight-line method of amortization, make journal entries to record (a) the purchase of the patent and (b) amortization for the first full year. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) (a) Record the purchase of the patent. Date Accounts and Explanation Debit Credit (b) Record the amortization for the first full year. Date Accounts and Explanation Debit Credit Requirement 2. After using the patent for four years, MP learns at an industry trade show that another company is designing a more efficient printer. On the basis of this new information, MP decides, starting with Year 5, to amortize the remaining cost of the patent over…arrow_forwardMiriam Corp. began leasing retail space at Oberlin Village in Raleigh, NC, on December 1, 2022. Before opening its new store, Miriam spent $7,000 on special lighting for the store. The lease term is ten (10) years, and the special lighting has an economic life of five (5) years. Which statement shows the correct accounting treatment for the new lighting in 2022? Miriam should debit its “Leasehold Improvements” account for $7,000 and depreciate the lighting over the lease term of ten (10) years. Miriam should debit its “Repairs and Maintenance Expense” account by $7,000. Miriam should debit its “Cost of Goods Sold” account by $7,000. Miriam should debit its “Leasehold Improvements” account for $7,000 but should not depreciate the lighting. Miriam should debit its “Leasehold Improvements” account for $7,000 and depreciate the lighting over its economic life of five (5) years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education