FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

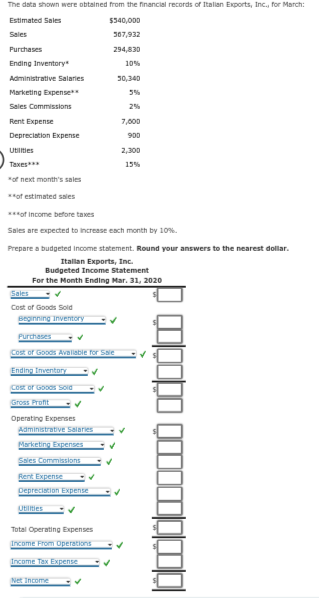

Transcribed Image Text:The data shown were obtained from the financial records of Italian Exports, Inc., for March:

Estimated Sales

Sales

Purchases

Ending Inventory*

Administrative Salaries

Marketing Expense**

Sales Commissions

Rent Expense

Depreciation Expense

Utilities

Taxes***

*of next month's sales

**of estimated sales

Sales

Cost of Goods Sold

***of income before taxes

Sales are expected to increase each month by 10%.

Prepare a budgeted Income statement. Round your answers to the nearest dollar.

Italian Exports, Inc.

Budgeted Income Statement

For the Month Ending Mar. 31, 2020

Beginning Inventory

Purchases

Cost of Goods Avaliable for Sale

Ending Inventory

Cost of Goods Sold

Gross Profit

Operating Expenses

Administrative Salaries

Marketing Expenses

Sales Commissions

Rent Expense

Depreciation Expense

$340,000

367,932

294,830

Utilities

Total Operating Expenses

Income From Operations

Income Tax Expense

Net Income

10%

30,340

5%

2%

7,000

900

2,300

15%

to ovembo

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Profit Planning and What-If Analysis As a newly hired management accountant, you have beenasked to prepare a profit plan for the company for which you work. As part of this task, you’ve beenasked to do some what-if analyses. Following is the budgeted information regarding the coming year:[LO 10-5]Number of active policyholders beginning of month 1 100,000Average monthly premium per policy $100.00Monthly midterm cancellation rate 0.50%Policy renewal rate 85.00%Selling price per unit $ 100.00Variable cost per unit 70.00Fixed costs (per year) 1,200,000Required1. What is the breakeven volume, in units and dollars, for the coming year?2. Assume that the goal of the company is to earn a pretax (operating) profit of $300,000 for thecoming year. How many units would the company have to sell to achieve this goal?3. Assume that of the $70 variable cost per unit the labor-cost component is $25. Current negotiations with the employees of the company indicate some uncertainty regarding the labor…arrow_forwardA corporation makes collections on sales according to the following schedule: 45% in month of sale 53% in month following sale 2% in the second month following sale The following sales have been budgeted: Sales April $220,000 May $150,000 June $140,000 Budgested cash collections in June would: ___________________________arrow_forwardsub : Accounting pls answer ASAP.Please type the answer. dnt CHATGPT. i ll upvote.arrow_forward

- Don't give answer in image formatarrow_forwardPrince Paper has budgeted the following amounts for its next fiscal year: Total fixed expenses $400,000 Selling price per unit Variable expenses per unit $45 $30 If Price Paper spends an additional $12,600 on advertising, sales volume should increase by 2,000 units. What effect will this have on operating income? O A. Increase of $17,400 O B. Increase of $30,000 O C. Decrease of $30,000 O D. Decrease of $17,400arrow_forward2019 Sales Cost of Goods Sold Rent Wages Insurance Utilities Auto Maintenance Advertising Other Expenses Total Expenses Net Income Jan 3,250 1,788 525 175 46 220 40 98 2,891 359 Feb 2,700 1,485 525 175 46 225 40 81 2,577 123 Mar 3,855 2,120 525 175 46 285 80 60 116 3,407 448 Tom's Business Income Statement 98 2,900 354 2019 May Jul Aug Sep Oct Nov Dec Total Apr 3,254 3,650 2,850 2,600 2010 2,200 2,250 3,755 4,890 37,264 1,790 2,008 1,106 1,210 1,238 2,065 2,690 20,495 525 525 525 525 525 525 6,300 2,100 175 175 175 175 175 175 46 46 46 46 46 46 550 227 265 210 185 220 230 2,657 40 40 40 80 640 60 147 525 175 46 200 40 110 Jun 588 * º * * * 88 * § 547 1,568 525 175 46 185 80 60 86 3,103 2,724 126 1,430 525 175 46 205 40 78 2,499 101 40 60 2217 (207) 80 60 66 2,372 (172) 68 2,276 (26) 113 3,184 3,952 571 938 240 1,118 34,100 3,164arrow_forward

- I'm working on a budgeted income statement. How do I find the income tax? And what do I do with Estimated Tax Rate:30%?arrow_forwardPrepare the operating budgetand necessary schedule for the 3rd quarter8. Selling and Administrative Expense Budgetarrow_forwardPlease answer the question thanks.arrow_forward

- bapuarrow_forwardA cash budget. by quarters, is given below for a retail company (000 omitted). The company requires a minimum cash balance of at least $5,000 to start each quarter. Quarter 2 3 Year Cash balance, beginning .. Add collections from customers $ 6 $ ? $ ? $ ? $ ? 96 323 - Total cash available Less disbursements: 71 - Purchase of inventory Selling and administrative expenses Equipment purchases Dividends . 35 45 35 30 8. 30 10 113 36 8. 2 2 2 Total disbursements 85 Excess (deficiency) of cash available over disbursements Financing: Borrowings .. Repayments (including interest) Total financing ... 15 (2) (17) (2) Cash balance, ending $ ? $ ? $ ? $ ? "interest will total $1,000 for the year. Required: Fill in the missing amounts in the above table.arrow_forwarda1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education