FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

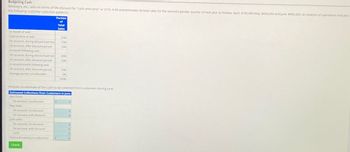

Transcribed Image Text:Budgeting Cash

Whitney's, Inc., sells on terms of 5% discount for "cash and carry" or 2/10, n/30 and estimates its total sales for the second calendar quarter of next year as follows: April, $750,000 May, $600,000 and June, $900,000. An analysis of operations indicates

the following customer collection patterns:

In month of sale:

Portion

of

Total

Sales

Cash at time of sale

25%

On account, during discount period

1596

On account, after discount period

10%

In month following sale

On account, during discount period

20%

On account, after discount period

10%

In second month following sale:

On account, after discount period

15%

Average portion uncollectible

5%

100%

Prepare an estimate of the cash to be collected from customers during June.

Estimated Collections from Customers in June

April Sales

On account, no discount

May Sales

On account, no discount

0

On account, with discount

0

June sales

On account, no discount

On account, with discount

Cash

Total estimated June collections

0

0

0

$

0

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Budgeting Cash Collections Lowell Consulting, which sells on terms 2/10, n/30, had credit sales for March and April of $90,000 and $75,000, respectively. Analysis of Lowell's operations indicates that the pattern of customers' payments on account is as follows (percentages are of total monthly credit sales) In month of sale in month of following sale Uncollectible accounts, returns, and allowances Receiving Discount Beyond Discount Period Totals 20% 60% 20% 35% 5% 100% 40% 15% Determine the estimated cash collected on customers' accounts in April.arrow_forwardNonearrow_forwardNOT GRADED Budgeting Cash CollectionsSpencer Consulting, which invoices its clients on terms 2/10, n/30, had credit sales for May and June of $175,000 and $200,000, respectively. Analysis of Spencer's operations indicates that the pattern of customers' payments on account is as follows (percentages are of total monthly credit sales): Receiving Discount Beyond Discount Period Totals In month of sale 50% 20% 70% In month of following sale 15% 10% 25% Uncollectible accounts, returns, and allowances 5% 100% Determine the estimated cash collected on customers' accounts in June. $Answerarrow_forward

- subject - accountingarrow_forwardBudgeted Selling and Administrative Expenses Salary Expense Sales Commissions 5% of Sales Insurance Expense Rent Depreciation on equipment Utilities Total Operating Expenses Schedule of Cash Payments for Selling and Administrative Expenses Salary Expense 100% of Prior Month Sales Commissions Insurance Expense October November December Multiple Choice 30,000 30,500 15,000 15,500 12,000 12,000 14,400 14,400 16,500 16,500 2,100 2,300 90,000 91, 200 ? 15,100 12,000 ? 2,200 ? 30,500 ? 12,000 ? ? ? Rent 100% of Prior Months Utilities Expense Total Payments for Selling and Administrative Expenses The amount of cash paid for Selling and Administrative expenses during the month of November is: 31,000 15,300 12,000 14,400 16,500 2,500 91,700 ? ? 12,000 14,400 ?arrow_forwardAccounting Consider the following third-quarter budget data for TAP & Brothers: TAP & Brothers Third-Quarter Budget Data July August September Credit Sales 256,167 262,962 282,872 Credit Purchases 97,465 111,565 137,292 Wages, Taxes, and Expenses 26,506 31,621 33,707 Interest 7,239 7,773 8,091 Equipment Purchases 54,832 61,271 0 The company predicts that 4% of its credit sales will never be collected, 30% of its sales will be collected in the month of the sale, and the remaining 66% will be collected in the following month. Credit purchases will be paid in the month following the purchase. In June, credit sales were $138,282, and credit purchases were $102,770 July’s beginning cash is $184,797 If TAP maintains a policy of always keeping a minimum cash balance of $75,000 as a buffer against uncertainty and forecasting errors, what is the cash surplus/deficit at the end of the quarter (i.e., end of…arrow_forward

- Budgeting for a Merchandising Firm Goldberg Company is a retail sporting goods store thatuses an accrual accounting system. Facts regarding its operations follow:∙ Sales are budgeted at $250,000 for December and $225,000 for January, terms 1/eom, n/60.∙ Collections are expected to be 50% in the month of sale and 48% in the month following the sale.Two percent of sales are expected to be uncollectible and recorded in an allowance account at theend of the month of sale. Bad debts expense is included as part of operating expenses.∙ Gross margin is 30% of gross sales.∙ All accounts receivable are from credit sales. Bad debts are written off against the allowanceaccount at the end of the month following the month of sale.∙ Goldberg desires to have 80% of the merchandise for the following month’s sales on hand at the endof each month. Payment for merchandise is made in the month following the month of purchase.∙ Other monthly operating expenses to be paid in cash total $25,000.∙ Annual…arrow_forwardSchedule of cash collections of accounts receivable OfficeMart Inc. has "cash and carry" customers and credit customers. OfficeMart estimates that 25% of monthly sales are to cash customers, while the remaining sales are to credit customers. Of the credit customers, 30% pay their accounts in the month of sale, while the remaining 70% pay their accounts in the month following the month of sale. Projected sales for the next three months are as follows: October $58,000 November 65,000 December 72,000 The Accounts Receivable balance on September 30 was $35,000. Prepare a schedule of cash collections from sales for October, November, and December. Enter all amounts as positive numbers. OfficeMart Inc. Schedule of Cash Collections from Sales For the Three Months Ending December 31 Line Item Description Receipts from cash sales: Cash sales September sales on account: Collected in October October sales on account: Collected in October Collected in November November sales on account: Collected…arrow_forwardA company makes collections on sales according to the following schedule: 50% in month of sale 45% in month following sale 5% in second month following sale The following sales have been budgeted: April May June Sales $180,000 $190,000 $180,000 Budgeted cash collections in June would be:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education