FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

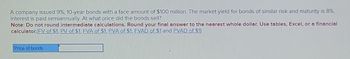

Transcribed Image Text:A company issued 9%, 10-year bonds with a face amount of $100 million. The market yield for bonds of similar risk and maturity is 8%.

Interest is paid semiannually. At what price did the bonds sell?

Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. Use tables, Excel, or a financial

calculator.(FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Price of bonds

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- On 1 July 2022 Bombo Ltd issues $2 million in six-year bonds that pay interest every six months at a coupon rate of 8 per cent. At the time of issuing the securities, the market requires a rate of return of 6 per cent. Interest expense is determined using the effective-interest method. (PV tables are available at the end of this exam). Required Determine the issue price. Provide the journal entries at the dates below by showing relevant calculations in a table form. (i) 1 July 2022arrow_forwardOn January 1 of this year, Clearwater Corporation sold bonds with a face value of $780,000 and a coupon rate of 9 percent. The bonds mature in 10 years and pay interest annually every December 31. Clearwater uses the straight-line amortization method and does not use a discount account. Assume an annual market rate of interest of 10 percent. (EY of $1. PV of $1. EVA of $1. and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Required: 1.82. Prepare the journal entry to record the issuance of the bonds and the interest payment on December 31 of this year. 3. What bonds payable amount will Clearwater report on its December 31 balance sheet? Complete this question by entering your answers in the tabs below. Required 1 and 2 Required 3 Prepare the journal entry to record the issuance of the bonds and the interest payment on December 31 of this year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.…arrow_forwardA company issued 5%, 20-year bonds with a face amount of $80 million. The market yield for bonds of similar risk and maturity is 6%. Interest is paid semiannually. At what price did the bonds sell?arrow_forward

- Determine the interest payment for the following three bonds. (Assume a $1,000 par value.) (Round your answers to 2 decimal places.) 1. 3 % percent coupon corporate bond (paid semiannually): 2. 4.25 percent coupon Treasury note (paid semiannually):arrow_forwardYou are analyzing the cost of debt for a firm. You know that the firm's 14-year maturity, 8.6 percent coupon bonds are selling at a price of $832.00. The bonds pay interest semiannually. If these bonds are the only debt outstanding, answer the following questions. Problem 13.17 a1-a2(a1) Your answer is incorrect. What is the current YTM of the bonds? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to O decimal places, e.g. 15%.) Current YTM for the bonds %arrow_forwardFind the total proceeds (in $) from the sale of 30 bonds with a coupon rate of 8.75 and a current price of 96.575. (Round your answer to the nearest cent.) The commission charge is $6.00 per bond. The date of the transaction is 145 days since the last interest payment. $2821.53 xarrow_forward

- Current Attempt in Progress × Your answer is incorrect. Marin Inc. issues $2,100,000 of 7% bonds due in 10 years with interest payable at year-end. The current market rate of interest fo bonds of similar risk is 9%. Click here to view factor tables. What amount will Marin receive when it issues the bonds? (For calculation purposes, use 5 decimal places as displayed in the factor tabl provided and final answer to O decimal places, e.g. 458,581.)arrow_forwardA company issued 9%, 15-year bonds with a face amount of $100 million. The market yield for bonds of similar risk and maturity is 8%. Interest is paid semiannually. At what price did the bonds sell?arrow_forward1. On July 1, Somerset Inc. issued $200,000 of 10%, 10-year bonds when the market rate was 12%.The bonds paid interest semi-annually. Assuming the bonds sold at 58.55, what was the selling price of thebonds? Explain why the cash received from selling this bond is different from the $200,000 face value of thebondarrow_forward

- BlueLtd. Issued a $1,164,000, 10-year bond dated January 1, 2020. The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31, and Blue followed IFRS. Using 1 factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond. Click here to view the tactor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITYOF 1 (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answers to 0 decimal places, e.g. 5,275.) Proceeds from sale of bond : on bond Prepare the journal entries for above transactions. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the…arrow_forwardSheridan Corp. has 18-year bonds outstanding. These bonds, which pay interest semiannually, have a coupon rate of 10.065 percent and a yield to maturity of 9.3 percent. Assume face value is $1,000. Problem 8.30(a) Your answer is incorrect. Compute the current price of these bonds. (Round answer to 2 decimal places, e.g. 15.25.) Current price $ eTextbook and Media Save for Later Attempts: unlimited Submit Answerarrow_forward5. Federer Corporation issued $540,000 in bonds for $498,600. The bonds had a stated rate of 12% and pay interest quarterly. Premium on Bonds Payable Interest Income Discount on Bonds Payable Interest Expense Cash Bonds Payable PLEASE NOTE: For accounts having similar accounting treatment (DR or CR), you are to record accounts in the same order as shown in the textbook. You must enter the account names exactly as written above and all dollar amounts will be rounded to whole dollars with "$" and commas as needed (i.e. $12,345). What is the journal entry to record the issuance of the bonds? DR DR/CR ? CR What is the journal entry to record the first interest payment? (Note: Do not consider the premium or discount.) DR CRarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education