Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

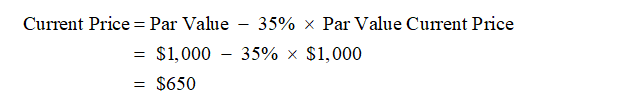

A firm specializes in buying deep discount bonds (i.e. bonds trading at well below par). The firm is eyeing a bond that pays 8% annual interest and has 17 years remaining to maturity. The bond is currently selling at 35% below par.

Required: By what percent will the price of the bonds increase between now and maturity based on semi-annual analysis?

Answer

% Intermediate calculations must be rounded to 3 decimal places (at least). Input your answer as a percent rounded to 2 decimal places (for example: 28.31%).

Expert Solution

arrow_forward

Step 1

The computations as follows:

Par Value = $1,000

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using the following information, determine the default risk premium on the 10 year AA corporate bond: Rate % inflation 0.80 T-bill 5.00 10y T-Bond 6.00 10y AAA Corporate 6.48 10y AA Corporate 7.03 note: your answer should be to 2 decimal places. So, if your answer is 3.253%, for example, then enter 3.25 without the percent sign.arrow_forwardYou are analyzing the cost of debt for a firm. You know that the firm's 14-year maturity, 8.6 percent coupon bonds are selling at a price of $832.00. The bonds pay interest semiannually. If these bonds are the only debt outstanding, answer the following questions. Problem 13.17 a1-a2(a1) Your answer is incorrect. What is the current YTM of the bonds? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to O decimal places, e.g. 15%.) Current YTM for the bonds %arrow_forwardA firm's bonds have a maturity of 14 years with a $1,000 face value, have an 8% semiannual coupon, are callable in 7 years at $1,074.21, and currently sell at a price of $1,136.52. What are their nominal yield to maturity and their nominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: % YTC: % What return should investors expect to earn on these bonds? Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC.arrow_forward

- A firm's bonds have a maturity of 14 years with a $1,000 face value, have an 8% semiannual coupon, are callable in 7 years at $1,063.91, and currently sell at a price of $1,119.63. What are their nominal yield to maturity and their nominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: YTC: % -Select- v % What return should investors expect to earn on these bonds? I. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC. II. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. III. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. IV. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC.arrow_forwardUsing the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data. Note: Input your answers as a percent rounded to 2 decimal places. 1-year T-bill at beginning of year 1 1-year T-bill at beginning of year 21 1-year T-bill at beginning of year 3 1-year T-bill at beginning of year 4 2-year security 3-year security 4-year security Expected Return % % % Interest Rate 7% 9% 10% 12%arrow_forwardThe Garland Corporation has a bond outstanding with a $70 annual interest with semiannual payment, a market price of $890, and a maturity date in 5 years. Assume the par value of the bonds is $1,000. Find the following: Use Appendix B and Appendix C. (Do not round your intermediate calculations. Round the final answers to 2 decimal places.) a. The coupon rate (nominal yield). b. The current yieldi c. The yield to maturity. d. The yield an investor would realize if coupon payments were reinvested at 8 percent (holding period return) 786arrow_forward

- A firm's bonds have a maturity of 8 years with a $1,000 face value, have an 11% semiannual coupon, are callable in 4 years at $1,144.52, and currently sell at a price of $1,264.97. What are their nominal yield to maturity and their nominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: % YTC: % What return should investors expect to earn on these bonds? Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM.arrow_forwardA firm's bonds have a maturity of 10 years with a $1,000 face value, have an 8% semiannual coupon, are callable in 5 years at $1,054.36, and currently sell at a price of $1,104.71. What are their nominal yield to maturity and their nominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: % YTC: % What return should investors expect to earn on these bonds? Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC.arrow_forwardCalculate the price of a bond originally issued six years ago that pays semiannual interest at the rate of 10 percent and matures in ten years at $3,000. The market currently requires an 8 percent return for a bond of this risk. (Use a Financial calculator to arrive at the answers. Do not round intermediate calculations. Round the final answer to 2 decimal places.) Price of a bondarrow_forward

- The Wall Street Journal reports that the current rate on 5-year Treasury bonds is 1.85 percent and on 10-year Treasury bonds is 3.35 percent. Assume that the maturity risk premium is zero. Calculate the expected rate on a 5-year Treasury bond purchased five years from today, Egrs). (Do not round intermediate calculations. Round your answer to 2 decimal places.) Expected rate- my workarrow_forwardPlease answer yield to maturity?arrow_forwardRolling Company bonds have a coupon rate of 5,00 percent, 19 years to maturity, and a current price of $1,136. What is the YTM? The current yield? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. YTM Current yieldarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education