Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

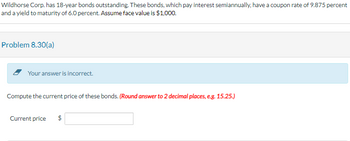

Transcribed Image Text:Wildhorse Corp. has 18-year bonds outstanding. These bonds, which pay interest semiannually, have a coupon rate of 9.875 percent

and a yield to maturity of 6.0 percent. Assume face value is $1,000.

Problem 8.30(a)

Your answer is incorrect.

Compute the current price of these bonds. (Round answer to 2 decimal places, e.g. 15.25.)

Current price $

EA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 9 images

Knowledge Booster

Similar questions

- Ashburn Corporation issued 15-year bonds two years ago at a coupon rate of 8.2 percent. The bonds make semiannual payments. If these bonds currently sell for 103 percent of par value, what is the YTM? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardDufner Co. issued 17-year bonds one year ago at a coupon rate of 6.8 percent. The bonds make semiannual payments. If the YTM on these bonds is 5.4 percent, what is the current dollar price assuming a par value of $1,000? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current bond pricearrow_forwardYou are analyzing the cost of debt for a firm. You know that the firm's 14-year maturity, 8.6 percent coupon bonds are selling at a price of $832.00. The bonds pay interest semiannually. If these bonds are the only debt outstanding, answer the following questions. Problem 13.17 a1-a2(a1) Your answer is incorrect. What is the current YTM of the bonds? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to O decimal places, e.g. 15%.) Current YTM for the bonds %arrow_forward

- Peterson Amalgamated recently issued 4-year semiannual coupon bonds. These bonds sell for $933.25 and have a yield-to-maturity of 8.9 percent. What is the bonds' coupon rate? Don't round steps, 2 decimal answer. _%arrow_forwardParkway Void Co. issued 16-year bonds two years ago at a coupon rate of 9.5 percent. The bonds make semiannual payments. If these bonds currently sell for 104 percent of par value, what is the YTM? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardKk.173.arrow_forward

- Westco Company issued 15-year bonds a year ago at a coupon rate of 8.1 percent. The bonds make semiannual payments and have a par value of $1,000. If the YTM on these bonds is 6.4 percent, what is the current bond price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current bond pricearrow_forwardBell Canada issues a 20 year bond with 3% coupon rate (paid semi-annually.) Other similar Bell Canada bonds a yield of 3.4%. (These bonds are quoted on a "bond equivalent yield" basis, i.e. compounded semi-annually.) The bond has a face value of $1000. What is the fair market value of the bond? (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) Numeric Response 942.30arrow_forwardParkway Void Co. issued 14-year bonds two years ago at a coupon rate of 9.2 percent. The bonds make semiannual payments. If these bonds currently sell for 107 percent of par value, what is the YTM? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Yield to maturity %arrow_forward

- Dufner Co. issued 17-year bonds one year ago at a coupon rate of 73 percent. The bonds make semiannual payments. If the YTM on these bonds is 5.3 percent, what is the current dollar price assuming a pe value of $1,000? (Do not round intermediate calculations and round your answer to decimal places, e.g., 32.16.) Parkway Void Co. issued 13-year bonds two years ago at a coupon rate of 9.3 percent. The bonds make semiannual payments. If these bonds currently sell for 106 percent of par value, what is the YTM? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardgot 7.78 and wasnt rightarrow_forwardneed help on both questions, thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education