FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:es

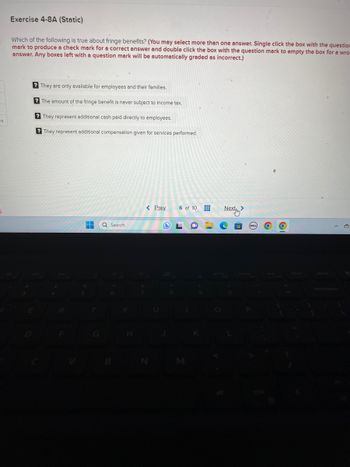

Exercise 4-8A (Static)

Which of the following is true about fringe benefits? (You may select more than one answer. Single click the box with the question

mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wro

answer. Any boxes left with a question mark will be automatically graded as incorrect.)

?They are only available for employees and their families.

? The amount of the fringe benefit is never subject to income tax.

?They represent additional cash paid directly to employees.

?They represent additional compensation given for services performed.

‒‒

Q Search

< Prev 6 of 10

N

M

Next>

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The reduction in profit arising from the actions of managers being self-serving or possible conflict of interest can best be attributed to.…........….….. • A. Agency cost • B. Tangible expense • C. Agency theory • D. Agency problemarrow_forwardStricter rules for health, environment and safety (HSE) lead to: a Reduced employment because taxes must be increased to pay for HSE measures b. Reduced employment because it becomes more expensive for companies to hire people c. Increase employment because there will be fewer accidents and thus fewer work-related injuries d. Increase employment because HSE leads to new work tasks that require extra employeesarrow_forwardWhich of the following is not a way an accounting system can generate motivation? 15 Multiple Cholce Ask The accounting system can provide Information to allocate revwards appropriately. The accounting system can help create and set goals through the bucgeting process. The accounting system can Introduce punitive measures for employees that do nột achleve goals. for example, limiting pay The accounting system can provide feedback and progress updates perlodicalyarrow_forward

- Why do you think fringe benefits are important enough to influence an employee's choice of employer and what are some specific examples of benefits that might appeal to prospective employees? Post your response and research (at least two scholarly resources) in a descriptive one-page memo or report in Microsoft Word. Your response should explain your findings in relation to why fringe benefits are important to employees.arrow_forward6arrow_forwardA ________ plan puts the onus of decision making and investment risk on the employee. A. Defined contribution B. Defined benefitsarrow_forward

- Assume that a company has decided to include "employee turnover" and "residual income" as performance measures within its balance scorecard. Which of the following choices reflects management's most likely expectations regarding how these measures should change over time? A) B) C) D) Employee turnover Increase Increase Decrease Decrease Multiple Choice. O O O O Choice A Choice B Choice C Choice D Residual Income Increase Decrease Increase Decreasearrow_forwardUESTION 33 Consider the following five situations: (I) Relative performance evaluation is used for evaluating store managers. (II) Insurabce policy holders pay deductibles before being covered by the insurance (III) The warehouse manager is not held responsible for damages and stolen goods during a riot. (IV) Individual stores are allocated (charged) for the cost of advertising done by the headquarters. (V) In performance evaluation, the actual outcome is compared witht the flexible budget, not the original budget. Which of the above would be examples that go againt the controllability principle (concept)? A. I, II, and III B. I, II, and IV C. I and III D. II and IV E. III and Varrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forward

- Which of the following statements is true of employee turnover? A) Functional turnover occurs when key individuals of an organization leave. B The turnover of poorly performing individuals is considered functional. D Organizations have little to no control over involuntary turnover. Job dissatisfaction is a common cause of involuntary turnover. Last saved 11:56:14 AM Questions Filter (10) 3 Aarrow_forwardIt says they answers are wrong from your example.arrow_forwardA-3arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education