FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

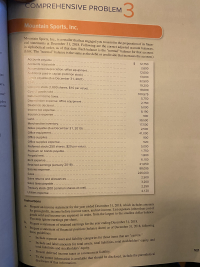

Transcribed Image Text:### Comprehensive Problem 3

#### Mountain Sports, Inc.

Mountain Sports, Inc., is a retailer that has engaged you to assist in the preparation of its financial statements at December 31, 2018. Following are the correct adjusted account balances, in alphabetical order, as of that date. Each balance is the “normal” balance for that account. (Hint: The “normal” balance is the same as the debit or credit side that increases the account.)

| Account | Amount ($) |

|---------------------------------------------------|------------|

| Accounts payable | 12,750 |

| Accounts receivable | 12,000 |

| Accumulated depreciation: office equipment | 2,600 |

| Additional paid-in capital (common stock) | 23,000 |

| Bonds payable (due December 31, 2021) | 13,000 |

| Cash | 22,550 |

| Common stock (1,800 shares, $10 par value) | 19,200 |

| Cost of goods sold | 18,000 |

| Deferred income taxes | 100,575 |

| Depreciation expense: office equipment | 5,750 |

| Dividends declared | 2,750 |

| Income tax expense | 8,190 |

| Insurance expense | 5,000 |

| Land | 39,500 |

| Merchandise inventory | 17,500 |

| Notes payable (due December 31, 2019) | 2,500 |

| Office equipment | 6,000 |

| Office supplies | 900 |

| Office supplies expense | 520 |

| Preferred stock (250 shares, $20 par value) | 5,000 |

| Premium on bonds payable | 1,750 |

| Prepaid rent | 1,800 |

| Rent expense | 6,100 |

| Retained earnings (January 2018) | 21,075 |

| Salaries expense | 88,095 |

| Sales | 226,000 |

| Sales returns and allowances | 2,500 |

| Sales taxes payable | 3,200 |

| Treasury stock (200 common shares at cost) | 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the below information to answer the following question. Sales Cost of goods sold Depreciation Income Statement For the Year Taxable income Taxes Earnings before interest $4,500 and taxes Interest paid Net income Dividends $900 Balance Sheet End-of-Year Cash Accounts receivable Inventory Total current assets Net fixed assets Total assets Accounts payable Long-term debt Common stock ($1 par value) Retained earnings O O O O Total Liab. & Equity 33 percent 40 percent 50 percent $28,400 60 percent 21,200 2,700 67 percent 850 $3,650 1,400 $2,250 $550 2,450 4,700 $7,700 What was the retention ratio? 16,900 $24,600 $ 2,700 9,800 8,000 4,100 $24,600arrow_forwardWhat is the year-over-year revenue change percent? Use the attached financial data to calculate the ratios for 2022. Round to the nearest decimal. Abercrombie & Fitch Co (ANF) Financial Data Revenues Cost of Sales Total Operating Expenses Interest Expense Income Tax Expense Diluted Weighted Shares Outstanding Cash + Equivalents Accounts Receivable Inventories Total Current Assets Total Assets Accounts Payable Total Current Liabilities Total Stockholders' Equity ANF Stock Price = $10.30 Select one O A. 5.3% B. 14.4% C. -1.4% O D. -3.5% 2022 $3,659.3 $1,545.9 $2,026.9 $28.5 $37.8 52.8 $257.3 $108.5 $742.0 $1,220.4 $2,694.0 $322.1 $935.5 $656.1 2021 $3,712.8 $1,400.8 $1,968.9 $34.1 $38.9 62.6 $823.1 $69.1 $525.9 $1,507.8 $2,939.5 $374.8 $1,015.2 $826.1arrow_forwardI have obtained Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019). What was Target’s accounting equation for 2018?arrow_forward

- Cullumber Inc.'s only temporary difference at the beginning and end of 2024 is caused by a $3.75 million deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable (only one-half of which is classified as a current asset) is due in equal installments in 2025 and 2026. The related deferred tax liability at the beginning of the year is $1,125,000. In the third quarter of 2024, a new tax rate of 20% is enacted into law and is scheduled to become effective for 2026. Taxable income for 2024 is $6,250,000, and taxable income is expected in all future years.arrow_forwardUse the Ulta annual report to calculate profit margin, total debt ratio, and cash ratio for the year ending in 2021.arrow_forwardSales. Costs and expenses Cost of goods sold. Operating expenses. Interest expense... Income before income taxes. Income tax expense.. Net income.. Statement of Income For the Year Ended December 31, 2020 $1,140,000 $1,700,000 364,800 37,800 1,542,600 157,400 55,090 $ 102,310 GEORGE INDUSTRIES Statement of Financial Position December 31, 2020 Total assets. Total liabilities.. Total shareholders' equity... 2020 2019 $842,110 $717,800 329,600 279,600 512,510 438,200 Calculate the Net profit margin ratio (use up to 2 decimal places and do not use a % sign)arrow_forward

- F. Based on Baker’s account balances, the amount of Net Income that would be shown on Baker’s Income Statement for December 2017 would be:arrow_forwardFinancial Statements Prepare the Financial Statements for the fiscal year ended December 31, 2021 for MaBak Inc. Inc. Don't forget the statement dates and dollar signs. Complete the Horizontal and Vertical analysis. Round answers to the whole percent. Account Name Accounts Payable Accounts Receivable (net) Accrued Liabilities Administration Expense Bonds Payable Car (net) Cash Cost of Goods Sold Current Maturities of Long Term Debt Equipment (Net) Income Tax Expense Inventory Amount Account Name Investments - Long Term Land- not in use, to be sold in 5 Marketable Securities $ 42,000 30,000 3,000 30,000 Net Sales 20,000 Notes Payable - Long 32,000 Notes Receivable 50,000 20,000 Other Income Other Expense (interest) 12,250 Selling Expense 12,000 Supplies 4,400 Taxes Payable 40,000 Unearned Sales Revenue 12,000 25,000 5,000 135,000 13,000 2,000 7,600 4,000 44,000 7,500 17,750 13,000arrow_forwardExamine the following selected financial information for Best Value Corporation and Modern Stores, Inc., as of the end of their fiscal years ending in 2018: Data table (In millions) Best Value Corporation Modern Stores, Inc. 1. Total assets. . . . . . . . . . . . . . . . . . . . . . . . . . $15,256 $203,110 2. Total common stockholders' equity. . . . . $3,075 $71,460 3. Operating income. . . . . . . . . . . . . . . . . . . . $1,350 $26,820 4. Interest expense. . . . . . . . . . . . . . . . . . . . . . $88 $2,020 5. Leverage ratio. . . . . . . . . . . . . . . . . . . . . . . . 6. Total debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. Debt ratio. . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. Times interest earned. . . . . . . . . . . . . . . . . Requirements…arrow_forward

- Using the fiscal year end 2019 annual report for General Mills, Inc. and the figures from the 2017 annual report as noted below, calculate the financial ratios for 2019 and 2018 indicated using the EXCEL template provided: Gross profit percentage Return on sales Asset turnover Return on assets Return on common stockholders’ equity Current ratio Quick ratio Operating-cash-flow-to-current-liabilities ratio Accounts receivable turnover Average collection period Inventory turnover Days’ sales in inventory Debt-to-equity ratio Times-interest-earned ratio Operating-cash-flow-to-capital-expenditures ratio Earnings per share Price-earnings ratio Dividend yield Dividend payout ratio Total assets 2017 = $21,812.6 Total stockholders’ equity 2017 = $4,327.9 Total current liabilities 2017 = $5,330.8 Accounts receivable 2017 = $1,430.1 Inventory 2017 = $1,483.6 Year-end closing stock price May 2019 = $50.93 Year-end closing stock price May 2018 = $39.37 Perform a comparative analysis of the…arrow_forwardThe following income statement and balance sheets for Virtual Gaming Systems are provided. VIRTUAL GAMING SYSTEMS Income Statement For the year ended December 31, 2021 Net sales Cost of goods sold Gross profit Expenses: Operating expenses. Depreciation expense Loss on sale of land Interest expense Income tax expense Total expenses Net income Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds $852,000 27,000 7,400 12,000 42,000 $3,006,000 1,944,000 1,062,000 940, 400 $ 121,600 VIRTUAL GAMING SYSTEMS Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable. Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Balance Sheets December 31 2021 $180,000 75,000 99,000 11,400 99,000 204,000 264,000 (63,000) $869,400 $ 60,000 4,800 12,000 279,000 294,000 219,600 2020 $138,000 54,000 129,000…arrow_forwardProblem 13-2A (Algo) Ratios, common-size statements, and trend percents LO P1, P2, P3 [The following information applies to the questions displayed below] Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 2019 Sales Cost of goods sold $ 402,346 $ 308,230 242,212 $ 213,900 194,493 136,896 Gross profit 160,134 113,737 77,004 Selling expenses 57,133 42,536 28,235 Administrative expenses 36,211 27,124 17,754 Total expenses 93,344 69,660 45,989 Income before taxes Income tax expense 66,790 44,077 31,015 12,423 9,036 6,296 Net income $ 54,367 $ 35,041 $ 24,719 KORBIN COMPANY Comparative Balance Sheets December 31 Assets Current assets Long-term investments Plant assets, net Total assets Current liabilities Liabilities and Equity Common stock Other paid-in capital Retained earnings Total liabilities and equity $ 180,932 2021 $ 63,959 116,973 0 2020 $ 42,808 800 106,691 $ 180,932 $ 150,299 $…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education