FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

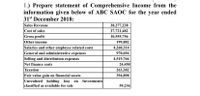

Transcribed Image Text:1.) Prepare statement of Comprehensive Income from the

information given below of ABC SAOC for the year ended

31st December 2018:

Sales Revenue

Cost of sales

Gross profit

Other income

Salaries and other employee related costs

General and administrative expenses

Selling and distribution expenses

Net finance costs

Taxation

Fair value gain on financial assets

Unrealized holding loss

classified as available for sale

38,277,238

27,721,482

10,555,756

199,882

4,260,314

970,694

4,519,766

24,450

263,382

394,898

Investments

on

59,236

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lily Company's income statement contained the following condensed Information. LILY COMPANY Income Statement For the Year Ended December 31, 2022 Service revenue Operating expenses, excluding depreciation $624,200 Depreciation expense 55,500 Loss on disposal of plant assets Income before income taxes Income tax expense Net income 2021 $75,500 $61,000 2022 Accounts receivable Accounts payable Income taxes payable 12,200 Lily's balance sheets contained the comparative data at December 31, shown below. 41.000 For Income Taxes Cash Flows from Operating Activities Cash Receipts from Customers V Less cash payments: For Operating Expenses 28,300 Accounts payable pertain to operating expenses. Prepare the operating activities section of the statement of cash flows using the direct method. (Show amounts that decrease cash flow with either a sign e.g.-15,000 or in parenthesis eg. (15,000)) 25,000 6,700 $969,000 Net Cash Provided by Operating Activities 704,700 264,300 39,700 $224,600 LILY…arrow_forwardPlease solve all questionsarrow_forwardThe return on average shareholders' equity for 2022 is 63.8%. Calculate the return on average shareholders' equity for 2023.arrow_forward

- Can you please match the correct term to the defarrow_forwardI have obtained Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019). What was Target’s accounting equation for 2018?arrow_forwardPart A. The following information is available for Entity A: Sales revenue Sales returns and allowances Sales discounts Cost of goods sold Operating expenses Interest expense Gain on sale of land Interest revenue $840,300 10,000 7,800 475,000 187,200 11,000 129,300 3,500 Instructions 1. Use the above information to prepare a multiple-step income statement for the year ended December 31, 2024. Please look at Illus. 5.12 in the text for an example. The income tax rate is 23%. Check figures: Income from operations is $160,300. Net income is $217,217. 2. Compute the profit margin and the gross profit rate. Show and label calculations. 3. Suggest at least three ways these measures might be materially improved and net income increased. Be sure to consider the relationship between net sales, cost-of- goods-sold and gross profit. 4. Last year, the profit margin was 15%. Is the increase in the profit margin this year sustainable, i.e. likely to continue? (Hint: consider what item was largely…arrow_forward

- Abhaliyaarrow_forwardThe following Information is available from the accounting records of Manahan Co. for the year ended December 31, 2019: Net cash provided by financing activities Dividends paid Loss from discontinued operations, net of tax savings of $39,700 Income tax expense Other selling expenses Net sales Advertising expense Accounts receivable Cost of goods sold General and administrative expenses Net sales Cost of goods sold Gross profit Expenses: Required: a. Calculate the operating Income for Manahan Co. for the year ended December 31, 2019. Advertising expense General and administrative expenses Operating income MANAHAN CO. Operating Income Statement For the year ended December 31, 2019 b. Calculate the company's net Income for 2019. Net income $ $119,000 18, 200 119,100 $ 27,288 11,500 646,600 47,000 59,300 368,562 141,800 0 0 0arrow_forwardRequired information [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 $ 481,724 $369,040 289,998 191,726 68,405 43,355 111,760 Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Assets Current assets Long-term investments Plant assets, net Total assets Common stock Other paid-in capital Retained earnings Total liabilities and equity Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity 79,966 14,874 52,403 10,743 $ 65,092 $ 41,660 KORBIN COMPANY Comparative Balance Sheets December 31 233,233 135,807 50,928 32,476 83,404 2021 2020 $ 56,542 0…arrow_forward

- Based on the above information, analyze the changes in the company's profitability and liquidity, in addition to the management of accounts receivable and inventory from 2022 to 2024. (Round answers to 1 decimal place, eg 13.5% or 13.5.) 2023 Sales Cost of goods sold Gross margin Other expenses Income taxes Net income Current ratio Quick ratio A/R turnover Average collection period Inventory turnover Days to sell inventory Debt to equity Return on assets 2022 Return on equity % 2022 % % 2022 :1 :1 times days times days 56 2023 % % % 2023 times days times days 2024 Based on the above information, analyze the company's use of leverage from 2022 to 2024. (Round answers to 1 decimal place, eg 15.1%) % 2024 % % % 2024arrow_forwardCompute and Compare ROE, ROA, and RNOA Graphical representations of the KLA-Tencor 2018 income statement and average balance sheet numbers (2017-2018) follow ($thousands). KLA-Tencor Average Balance Sheet 2017-2018 $1,473,464 $2.583,930 -$2,627,235.5 $1,518,371 Operating assets Nonoperating assets Operating labilities Nonoperating abis Equity + -$2,948,529 Check OS 05 KLA-Tencor Income Statement 2018 $802,265 ė $653,666- Note: Assume a statutory tax rate of 22%. a. Compute return on equity (ROE). Note: 1. Select the appropriate numerator and denominator used to compute ROE from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROE. Denominator Numerator ROE $81,263 05 Operating expenses Tax expense b. Compute return on assets (ROA). Note: 1. Select the appropriate numerator and denominator used to compute ROA from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROA. Numerator Denominator ROA -$2.499.507 +…arrow_forwardDefine each of the following terms:a. Annual report; balance sheet; income statement; statement of cash flows; statement ofstockholders’ equityb. Stockholders’ equity; retained earnings; working capital; net working capital; net operatingworking capital (NOWC); total debtc. Depreciation; amortization; operating income; EBITDA; free cash flow (FCF)d. Net operating profit after taxes (NOPAT)e. Market value added (MVA); economic value added (EVA)f. Progressive tax; marginal tax rate; average tax rateg. Tax loss carryback; carryforward; alternative minimum tax (AMT)h. Traditional IRAs; Roth IRAsi. Capital gain (loss)j. S corporationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education