Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Need help with this question solution general accounting

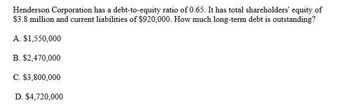

Transcribed Image Text:Henderson Corporation has a debt-to-equity ratio of 0.65. It has total shareholders' equity of

$3.8 million and current liabilities of $920,000. How much long-term debt is outstanding?

A. $1,550,000

B. $2,470,000

C. $3,800,000

D. $4,720,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How much Long term debt is outstanding ?arrow_forwardA company has total liabilitiesarrow_forward21. Kinsella Corporation's statement of financial position showed the following amounts: current liabilities, $75,000; total liabilities, $100,000; total assets, $200,000. What is the total long-term debt to total equity ratio? a.0.375 b.0.125 c.0.75 d.0.25arrow_forward

- What is the weighted average of the companys debt?arrow_forwardPlease given answerarrow_forwardThe Lawrence Company has a ratio of long term debt to long term debt plus equity of .39 and a current ratio of 1.7. Current liabilities are 950, sales are 6370, profit margin is 9.8 percent, and ROE is 20 percent. What is the amount of the firms net fixed assets?arrow_forward

- Helparrow_forwardanswer to below Questionarrow_forwardThe lawrence company has a ratio of long term debt to long term debt plus equity of .25 and a current ratio of 1.5. current liabilities are 900, sales are 6230 , profit margin is 8.1 percent what is the amount of the firms net fixt assets ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning