FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Q. Calculate Flexible-

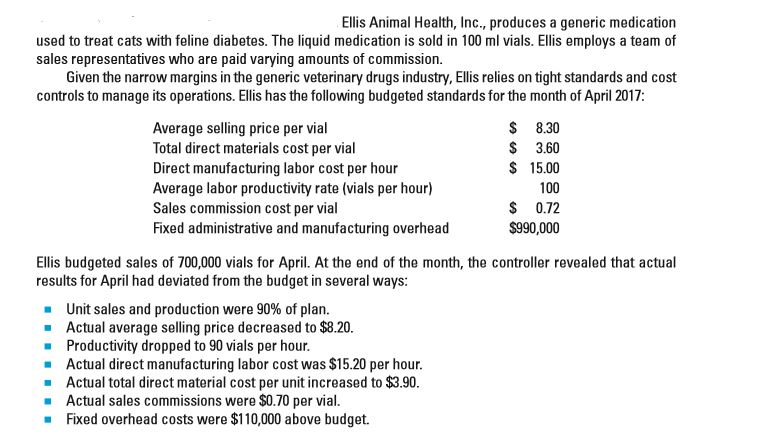

Transcribed Image Text:Ellis Animal Health, Inc., produces a generic medication

used to treat cats with feline diabetes. The liquid medication is sold in 100 ml vials. Ellis employs a team of

sales representatives who are paid varying amounts of commission.

Given the narrow margins in the generic veterinary drugs industry, Ellis relies on tight standards and cost

controls to manage its operations. Ellis has the following budgeted standards for the month of April 2017:

$ 8.30

$ 3.60

$ 15.00

100

Average selling price per vial

Total direct materials cost per vial

Direct manufacturing labor cost per hour

Average labor productivity rate (vials per hour)

Sales commission cost per vial

Fixed administrative and manufacturing overhead

$ 0.72

$990,000

Ellis budgeted sales of 700,000 vials for April. At the end of the month, the controller revealed that actual

results for April had deviated from the budget in several ways:

- Unit sales and production were 90% of plan.

- Actual average selling price decreased to $8.20.

Productivity dropped to 90 vials per hour.

- Actual direct manufacturing labor cost was $15.20 per hour.

- Actual total direct material cost per unit increased to $$3.90.

· Actual sales commissions were $0.70 per vial.

- Fixed overhead costs were $110,000 above budget.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Performance Evaluation; Ch CABILIDE 1o (Migu, riepanny envie vuugel pervane repicuri Lewis Company reports the following fixed budget and actual results for May. Prepare a flexible budget performance report showing variances between budgeted and actual results. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance.) Sales (units produced and sold) Sales (in dollars) Variable costs Fixed costs For Month Ended May 31 Sales Variable costs Contribution margin Fixed costs Income Fixed Budget 1,240 $ 500 per unit $ 200 per unit $ 131,000 LEWIS COMPANY Flexible Budget Performance Report Flexible Budget Actual Results Variances (1,440 units) (1.440 units)arrow_forwardRequired: Calculate all variances and prepare an operating statement for the month endedJune 2015 by using the following table format. Sales variances £ Favourable (F)/Adverse (A) Sales price variance: Sales volume variance: Total sales variance Direct material variances £ Favourable (F)/Adverse (A) Material price variance: Material usage variance: Total direct material variance Direct labour variances £ Favourable (F)/ Adverse (A) Labour rate variance: Labour efficiency variance: Total direct labour variance Variable overhead variances £ Favourable (F)/ Adverse (A) Variable…arrow_forwardBudget Performance Report Salisbury Bottle Company manufactures plastic two-liter bottles for the beverage industry. The cost standards per 100 two-liter bottles are as follows: Standard Cost per 100 Two-Liter Cost Category Direct labor Direct materials Factory overhead Total At the beginning of March, Salisbury's management planned to produce 500,000 bottles. The actual number of bottles produced for March was 525,000 bottles. The actual costs for March of the current year were as follows: Actual Cost for the Month Ended March 31 Cost Category Direct labor Direct materials Factory overhead Total Bottles $1.20 6.50 1.80 $9.50 Manufacturing costs: Direct labor Direct materials Factory overhead Total a. Prepare the March manufacturing standard cost budget (direct labor, direct materials, and factory overhead) for Salisbury, assuming planned production. Salisbury Bottle Company Manufacturing Cost Budget For the Month Ended March 31 $6,550 33,800 9,100 $49,450 $ Standard Cost at Planned…arrow_forward

- Antuan Company set the following standard costs per unit for its product. $ 12.00 Direct materials (3.0 pounds @ $4.00 per pound) Direct labor (1.8 hours @ $12.00 per hour) Overhead (1.8 hours @ $18.50 per hour). 21.60 33.30 Standard cost per unit $ 66.90 The standard overhead rate ($18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. Overhead Budget (75% Capacity) Variable overhead costs Indirect materials $ 15,000 Indirect labor 75,000 Power 15,000 Maintenance 30,000 135,000 Total variable overhead costs Fixed overhead costs 24,000 Depreciation-Building Depreciation-Machinery 70,000 Taxes and insurance 16,000 Supervisory salaries. 254,500 Total fixed overhead costs 364,500 Total overhead costs $ 499,500 The company incurred the following actual costs when it operated at 75% of capacity in October. Direct materials (46,000…arrow_forward4arrow_forwardComputation of Variable Cost Variances The following information pertains to the standard costs and actual activity for Repine Company for September: Standard cost per unit Direct materials Direct labor Activity for September Materials purchased Material A Material B Materials used Material A Material B Direct labor used Production output 3 units of material A x $8.00 per unit 2 units of material B x $4.00 per unit 2 hours x $15.00 per hour 7,000 units x $7.80 per unit 4,800 units x $4.50 per unit Materials price variance $ Materials quantity variance 6,430 units 3,950 units 4,100 hours x $15.50 per hour 2,000 units There were no beginning direct materials inventories. (a) Determine the materials price and quantity variances. Material A (b) Determine the labor rate and efficiency variances. Labor rate variance $ Labor efficiency variance $ ◆ → $ → Material B ◆ →arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education