FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

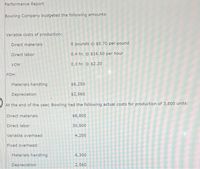

Transcribed Image Text:Performance Report

Bowling Company budgeted the following amounts:

Variable costs of production:

Direct materials

8 pounds @ $0.70 per pound

Direct labor

0.4 hr. @ $16.50 per hour

VOH

0.3 hr. @ $2.20

FOH:

Materials handling

$6,250

Depreciation

$2,560

At the end of the year, Bowling had the following actual costs for production of 3,800 units:

Direct materials

$6,800

Direct labor

30,500

Variable overhead

4,200

Fixed overhead:

Materials handling

6,300

Depreciation

2,560

Transcribed Image Text:Performance Report

Prepare a performance report using a budget based on the actual level of production. In the variance typ

and "U" for unfavorable. If the variance is zero, enter ("0") in the variance amount column and "N" for n

column.

Bowling Company

Performance Report

Actual

Budgeted Variance Variance Type (F or U or N)

Units produced

Direct materials

Direct labor

Variable overhead

Fixed overhead:

Materials handling

Depreciation

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- he following data are given for Bahia Company: Budgeted production 1,032 units Actual production 954 units Materials: Standard price per pound $1.816 Standard pounds per completed unit 10 Actual pounds purchased and used in production 9,254 Actual price paid for materials $18,971 Labor: Standard hourly labor rate $14.44 per hour Standard hours allowed per completed unit 4.3 Actual labor hours worked 4,913.1 Actual total labor costs $74,925 Overhead: Actual and budgeted fixed overhead $1,062,000 Standard variable overhead rate $25.00 per standard labor hour Actual variable overhead costs $137,567 Overhead is applied on standard labor hours. The variable factory overhead controllable variance is a.$80,267.44 unfavorable b.$80,267.44 favorable c.$35,012.00 unfavorable d.$35,012.00 favorablearrow_forwardMerlyn Company has the following budgeted variable costs per unit produced: DIRECT MATRERIALS $5.50 direct labour 2.8 Variable overhead supplies 0.65 maitenance 0.25 power 0.17 Budgeted fixed overhead costs per month include supervision of $60,000, depreciation of $71,000, and other overhead of $175,000. Required: 1. Prepare a flexible budget for all costs of production for the following levels of production: 150,000 units, and 185,000 units.arrow_forwardCalculate the total, fixed, and variable predetermined manufacturing overhead rates. (Round answers to 2 decimal places, e.g. 15.25.) Variable manufacturing overhead $ Fixed manufacturing overhead Total manufacturing overhead $ Total overhead variance Budget overhead variance Volume overhead variance Rate Calculate the total, budget, and volume overhead variances.arrow_forward

- Subject: acountingarrow_forwardDogarrow_forwardThe following data is given for the Bahia Company: Budgeted production 1,093 units Actual production 930 units Materials: Standard price per pound $1.884 Standard pounds per completed unit 11 Actual pounds purchased and used in production 9,923 Actual price paid for materials $20,342 Labor: Standard hourly labor rate $14.83 per hour Standard hours allowed per completed unit 4.7 Actual labor hours worked 4,789.5 Actual total labor costs $73,040 Overhead: Actual and budgeted fixed overhead $1,001,000 Standard variable overhead rate $26.00 per standard labor hour Actual variable overhead costs $134,106 Overhead is applied on standard labor hours. The variable factory overhead controllable variance isarrow_forward

- Answer both/allarrow_forwardThe following data are given for Stringer Company: Budgeted production 930 units Actual production 1,042 units Materials: Standard price per ounce $1.94 Standard ounces per completed unit 12 Actual ounces purchased and used in production 12,879 Actual price paid for materials $26,402 Labor: Standard hourly labor rate $14.40 per hour Standard hours allowed per completed unit 4.4 Actual labor hours worked 5,366.3 Actual total labor costs $81,836 Overhead: Actual and budgeted fixed overhead $1,110,000 Standard variable overhead rate $28.00 per standard labor hour Actual variable overhead costs $150,256 Overhead is applied on standard labor hours. The direct materials quantity variance is O a. 1,416.74 favorable Ob. 1,416.74 unfavorable Oc. 727.50 unfavorable Od. 727.50 favorablearrow_forwarddo not give solution in image formatarrow_forward

- The following data are given for Stringer Company: Line Item Description Value Budgeted production 940 units Actual production 1,045 units Materials: Standard price per ounce $1.78 Standard ounces per completed unit 11 Actual ounces purchased and used in production 11,840 Actual price paid for materials $24,272 Labor: Standard hourly labor rate $14.00 per hour Standard hours allowed per completed unit 4.4 Actual labor hours worked 5,381.75 Actual total labor costs $82,072 Overhead: Actual and budgeted fixed overhead $1,099,000 Standard variable overhead rate $24.00 per standard labor hour Actual variable overhead costs $150,689 Overhead is applied on standard labor hours. The direct materials quantity variance is a. 3,196.80 favorable b. 3,196.80 unfavorable c. 614.10 unfavorable d. 614.10 favorablearrow_forwardhharrow_forwardRoget Factory has budgeted factory overhead for the year at $15,500,000. It plans to produce 2,000,000 units of product. Budgeted direct labor hours are 1,050,000, and budgeted machine hours are 750,000. Using a single plantwide factory overhead rate based on direct labor hours, the factory overhead rate for the year is a. $20.67 b. $77.50 c. $7.75 Od. $14.76arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education