FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

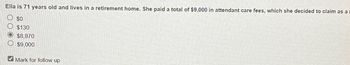

Transcribed Image Text:Ella is 71 years old and lives in a retirement home. She paid a total of $9,000 in attendant care fees, which she decided to claim as a

$0

$130

O $8,870

$9,000

Mark for follow up

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Ursula is employed by USA Corporation. USA Corporation provides medical and health, disability, and group term life insurance coverage for its employees. Premiums attributable to Ursula were as follows: (Click the icon to view the premiums attributable to Ursula.) During the year, Ursula suffered a heart attack and subsequently died. Before her death, Ursula collected $14,000 as a reimbursement for medical expenses and $5,000 of disability income. Upon her death, Ursula's husband collected the $40,000 face value of the life insurance policy. Read the requirements. C Requirement a. What amount can USA Corporation deduct for premiums attributable to Ursula? (Enter a "0" if none of the premiums are deductible.) The premiums attributable to Ursula that USA Corporation can deduct is Requirement b. How much must Ursula include in income relative to the premiums paid? (Enter a "0" if none of the premiums paid should be included in income.) The amount that Ursula must include in income…arrow_forwardWang is a 43 - year old computer programmer who earns an annual salary of $80,000. His employer provides group - term life insurance coverage at twice the annual salary for all employees. The annual amount of income for each $1,000 of taxable insurance coverage for an individual 43 years old is $1.20. How much gross income must Wang report for this benefit? Group of answer choices $0 $132 $192 $96arrow_forwardJenny, single, age 42, earns $50,000 working in 2022. She has no other income. Her medical expenses for the year total $5,000. During the year, she suffered a nonbusiness casualty loss of $7,500 when her apartment is damaged by flood waters (part of a Federally declared disaster area). Jenny contributed $10,000 to her church. She is trying to decide whether to contribute $1,000 to a traditional IRA. Fill in the table below to see if the IRA contribution reduces taxable income. Don't forget to apply the floors to the medical expenses. The deductible casualty loss has been calculated for you. We will look at personal (nonbusiness) casualty losses in another chapter; note that the nonbusiness casualty loss calculation involves 2 floors. 1. Complete the table to show the effect the IRA contribution would have on Jenny's itemized deductions. Without IRA Contribution Gross Income Contribution to IRA AGI Itemized Deductions Charitable contribution Medical expense deduction Casualty loss…arrow_forward

- Walter owns a whole-life insurance policy worth $55,800 that directs the insurance company to pay the beneficiary $251,000 on Walter's death. Walter pays the annual premiums and has the power to designate the beneficiary of the policy (it is currently his son, James). Required: What value of the policy, if any, will be included in Walter's estate upon his death? Value of policyarrow_forwardMr. Bowser is a TERMINALLY ILL patient. During the current year, he received accelerated life insurance proceeds of $10,000. His qualified long-term care expenses for the year were $13,000, of which $7,000 was reimbursed by insurance. What amount of the accelerated life insurance must Mr. Bowser include in gross income? $6,000 $7,000 $10,000 $0arrow_forwardces Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: Insurance $580 545 Advertising expense Mortgage interest Property taxes 4,550 960 Repairs & maintenance Utilities 1,160 Depreciation 720 9,700 During the year, Tamar rented out the condo for 81 days, receiving $23,500 of gross income. She personally used the condo for 57 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume 365 days in the current year. Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount. Required: a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo (assuming she itemizes deductions before considering deductions…arrow_forward

- Alexa owns a condominium near Cocoa Beach in Florida. In 2022, she incurs the following expenses inconnection with her condo:Insurance $ 2,000Mortgage interest 6,500Property taxes 2,000Repairs & maintenance 1,400Utilities 2,500Depreciation 14,500 During the year, Alexa rented out the condo for 100 days. She did not use the condo at all for personalpurposes during the year. Alexa's AGI from all sources other than the rental property is $200,000. Unlessotherwise specified, Alexa has no sources of passive income.Assume Alexa receives $30,000 in gross rental receipts. a. What effect do the expenses associated with the property have on her AGI?b. What effect do the expenses associated with the property have on her itemized deductions?arrow_forwardLinda Smith paid $25,000 in premiums on a 20-year endowment policy on her life. The policy has a face value of $40,000. At age 60, Linda decides to collect the face value of the policy. In the year of collection, how much will Linda include in her taxable income?arrow_forwardNancy, who is 59 years old, is the beneficiary of a $235,000 life insurance policy. What amount of the insurance proceeds is taxable under each of the following scenarios? Note: Do not round any intermediate division. Round your final answer to the nearest whole dollar amount. a. She receives the $235,000 proceeds as a lump-sum payment. b. She receives the proceeds at the rate of $4,525 a month for five years. c. She receives the proceeds in monthly payments of $1,370 over her remaining life expectancy (assume she will live 25 years). d. Use the information from (c). If Nancy lives beyond her 25-year life expectancy, what amount of each monthly payment will be taxable in the 26th year? a. Taxable insurance proceeds b. Taxable insurance proceeds per month c. Taxable insurance proceeds per month d. Taxable insurance proceeds per month $arrow_forward

- Ashvinnarrow_forwardLO.2Barbara incurred the following expenses during 2020: $840 dues at a health club she joined at the suggestion of her physician to improve her general physical condition, $240 for multiple vitamins and antioxidant vitamins, $3,500 for a smoking cessation program, $250 for nonprescription nicotine gum, $2,600 for insulin, and $7,200 for funeral expenses for her mother who passed away in June. Barbara's AGI for 2020 is $54,000. What is Barbara's medical expense deduction for 2020? 1arrow_forwardBob, age 67, and Jane, age 58, are married and have one son, Will, who lives with them. They provide over \\( 50 \\% \\) of Will's support. Will is 20 years old, and a part-time college student, with \\(\\$ 5,000 \\) of income from a part-time job. How much is Bob and Jane's total standard deduction for 2023 ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education