FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

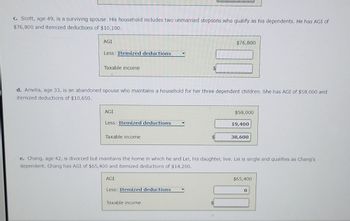

Transcribed Image Text:C. Scott, age 49, is a surviving spouse. His household includes two unmarried stepsons who qualify as his dependents. He has AGI of

$76,800 and itemized deductions of $10,100.

AGI

Less: Itemized deductions

Taxable income

d. Amelia, age 33, is an abandoned spouse who maintains a household for her three dependent children. She has AGI of $58,000 and

itemized deductions of $10,650.

AGI

Less: Itemized deductions

Taxable income

AGI

$76,800

Less: Itemized deductions

Taxable income

$58,000

e. Chang, age 42, is divorced but maintains the home in which he and Lei, his daughter, live. Lei is single and qualifies as Chang's

dependent. Chang has AGI of $65,400 and itemized deductions of $14,200.

19,400

38,600

$65,400

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Joyce is a widowed taxpayer whose husband Willard passed away on March 31, 2020. Joyce and Willard had purchased a home for $215,000 on September 12, 2004, lived in the home as their main home until Willard's death. Joyce moved in with her daughter after Willard's death, and sold the home on November 30, 2020 , for $595,000. How much of the gain on the sale can Joyce exclude from taxable income? Select one: O a. $500,000, the maximum exclusion for an unmarried surviving spouse O b. $380,000, the amount of gain on the sale of the home O C. $250,000, the maximum exclusion amount for a single taxpayer O d. $0, because she moved out before she sold the homearrow_forwardXialu is a single taxpayer who is under age 65 and in good health. For 2020, she has a salary of $25,000 and itemized deductions of $7,000. Xialu allows her mother to live with her during the winter months (3–4 months per year), but her mother provides all of her own support otherwise. Table for the standard deduction Filing Status Standard Deduction Single $12,400 Married, filing jointly 24,800 Married, filing separately 12,400 Head of household 18,650 Qualifying widow(er) 24,800 a. How much is Xialu's adjusted gross income?$fill in the blank b. In order to minimize taxable income, Xialu will _______ in the amount of $fill in the blank c. What is the amount of Xialu's taxable income?$fill in the blankarrow_forwardFrankie lives in NJ, is divorced with one child, and made $80,000 last year. He qualified for several below the line, itemizable deductions (He paid $5,600 in mortgage interest, $9,500 in property taxes, and he donated $550 worth to charity during the year). Frankie can claim one child tax credit of $2,000. His ex-spouse agreed that he can claim head of household this year. Use the Income Tax Table Reference Sheet to answer the following questions. 1. Should Frankie itemize his taxes or take the standard deduction? * A. Itemize B. Standard Please answer very soon will give rating surelyarrow_forward

- Alpesharrow_forwardAlbert and Avery, ages 66 and 64, respectively, filed a joint return for 2023. They provided all of the support for their 19-year-old son, who is blind and had no gross income. They also provided the total support of Avery's father, who is a citizen and life-long resident of Peru. What is the amount of credit for other dependents that Albert and Avery can claim?arrow_forwardSteve and Stephanie Pratt purchased a home in Spokane, Washington, for $400,000. They moved into the home on February 1 of year 1. They lived in the home as their primary residence until November 1 of year 1, when they sold the home for $500,000. The Pratts' marginal ordinary tax rate is 35 percent. (Leave no answer blank. Enter zero if applicable.) b. Assume the Pratts sell the home because Stephanie's employer transfers her to an office in Utah. How much gain will the Pratts recognize on their home sale? Recognized gainarrow_forward

- Darrell (46) is unmarried. His mother, Marlene (81), lives in a nursing home. Darrell pays the entire cost of the nursing home and more than 50% of Marlene's total support. Darrell's wages were $77,000; Marlene's income consisted of $1,800 taxable interest and $9,600 social security benefits. What is Darrell's correct and most favorable 2019 filing status?arrow_forwardSuzanna earns $4000 in her summertime job; the rest of the year she attends college fulltime. Suzanna may claim an exemption from FIT withholding if: a.she also has a taxable scholarship (used for housing) = $15,000. b.her unearned income (interest) = $1698. c.her aunt claims her as a dependent and she has no unearned income. d.her unearned income (dividends) = $1800.arrow_forwardJeremy (unmarried) earned $100,300 in salary and $6,300 in interest income during the year. Jeremy’s employer withheld $10,000 of federal income taxes from Jeremy’s paychecks during the year. Jeremy has one qualifying dependent child who lives with him. Jeremy qualifies to file as head of household and has $23,300 in itemized dedications, including $2,000 of charitable contributions to his church. -Determine Jeremy’s tax refund or taxes due. -Assume that in addition to the original facts, Jeremy had a long term capital gain of $5,050. What is Jeremy’s tax refund or tax due including the tax on the capital gain? -Assume the original facts except that Jeremy has only $7,000 in itemized deductions. Assume the charitable contribution deduction for non-itemized applies to 2022. What is Jeremy’s tax refund or tax due?arrow_forward

- Bob, age 67, and Jane, age 58, are married and have one son, Will, who lives with them. They provide over \\( 50 \\% \\) of Will's support. Will is 20 years old, and a part-time college student, with \\(\\$ 5,000 \\) of income from a part-time job. How much is Bob and Jane's total standard deduction for 2023 ?arrow_forwardDengararrow_forwardAlice, age 58, is single. She owns her home and provided all the costs of keeping up her homefor the entire year. Her only income for 2022 was $46,000 in W-2 wages. Linda, age 24, and her daughter Nancy, age 4, moved in with Linda's mother, Alice, after sheseparated from her spouse in April of 2020. Linda's only income for 2022 was $25,000 inwages. Linda provided over half of her own support. Nancy did not provide more than half ofher own support. Linda will not file a joint return with her spouse. All individuals in the household are U.S. citizens with valid Social Security numbers. No onehas a disability. They lived in the United States all year. For the purpose of determining dependency, Nancy could be the qualifying child ofOnly Alice b. Only Linda c. Either Alice or Linda d. Neither Alice nor Linda 10. Linda is not eligible to claim Nancy for the earned income credit because her filing status isMarried Filing Separate.a. Trueb. Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education