FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

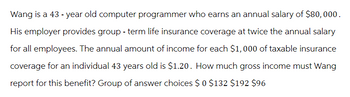

Transcribed Image Text:Wang is a 43 - year old computer programmer who earns an annual salary of $80,000.

His employer provides group - term life insurance coverage at twice the annual salary

for all employees. The annual amount of income for each $1,000 of taxable insurance

coverage for an individual 43 years old is $1.20. How much gross income must Wang

report for this benefit? Group of answer choices $0 $132 $192 $96

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Aa.63. Ms. Ray is age 46 and single. This year, Mr. Ray's retirement savings included a $2,630 employer contribution to a qualified profit-sharing plan account, and a contribution by Ms. Ray to a traditional IRA. Mr. Ray contributed the maximum allowed. Required: Compute Ms. Ray's IRA deduction if current year income includes $71,320 salary.arrow_forwardQuestion 27 of 50. Mark and Carrie are married, and they will file a joint return. They both work full-time, and their 2021 income totaled $89,000, all from wages. They have one dependent child, Aubrey (5). During the year, they spent $9,000 for Aubrey's child care. Neither Mark nor Carrie received any dependent care benefits from their employer. What amount may they use to calculate the Child and Dependent Care Credit? $0 $3,000 $8,000 $9,000 Mark for follow uparrow_forwardRiley works for a company with a 401(k) plan. The company matches at $0.50 on the dollar the first 6% of the employee's salary contributed to the 401(k). If Riley earns $90,000 and contributes 12% of her salary, how much will the employer match be in dollars for the year? $1,400 $2,700 $4,050 $5,400 $10,800arrow_forward

- The Baulding family has a basic health insurance plan that pays 80 percent of out-of-hospital expenses after a deductible of $250 per person. If three family members have doctor and prescription drug expenses of $425, $1,444, and $195, respectively, how much will the Baulding family and the insurance company each pay? How could they benefit from a flexible spending account established through Mr. Baulding's employer? What are the advantages and disadvantages of establishing such an account? The Baulding family will pay $ (Round to the nearest dollar)arrow_forwardKathy has an account balance in her employer’s money purchase pension plan of $1,000. The plan has a 2-6 graded vesting policy. She has been a participant for three and a half years and has worked for the company for five years. Assuming the plan permits loans, what is the maximum loan that Kathy could take from the plan? $20,000 $30,000 $40,000 $50,000arrow_forwardMark Mark for follow up Question 34 of 50. During the year, Brenda (70), a single taxpayer, received $18,000 in social security benefits. Her only other income consisted of $6,000 in wages from a part-time job and a pension distribution of $8,500. How much of Brenda's social security benefits are taxable? None of her benefits are taxable. 50%. 85%. 100%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education